Is the ratio of implied volatility of implied volatility (CBOE VVIX Index), interpretable as a measure of changes in investor fear level, to CBOE VIX Index itself a useful indicator of future stock market returns? To investigate, we relate monthly VVIX/VIX and monthly change in VVIX/VIX to monthly SPDR S&P 500 (SPY) total returns. Using end-of-month levels of both VVIX and VIX and dividend-adjusted monthly SPY closes during January 2007 (limited by VVIX) through July 2021, we find that:

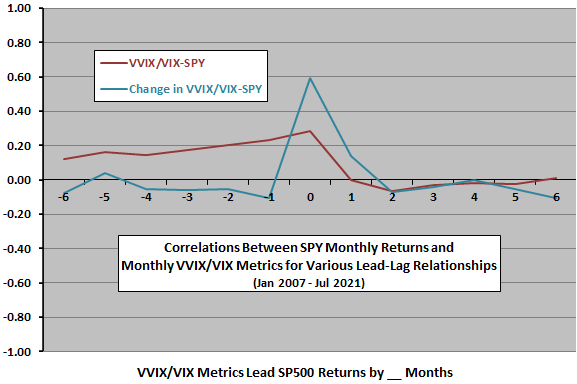

The following chart summarizes lead-lag relationships between monthly VVIX/VIX and monthly change in VVIX/VIX and monthly SPY returns, ranging from SPY leads VVIX/VIX metrics by six months (-6) to VVIX/VIX metrics lead SPY returns by six months (6). Notable points are:

- SPY returns persistently lead VVIX/VIX by up to six months. In other words, a relatively strong (weak) stock market over the past few months indicates relatively high (low) VVIX/VIX.

- There may be very weak negative relationships between VVIX/VIX and future SPY returns at two-to-five month horizons, but correlations are likely too small to exploit.

- There is a strong contemporaneous (0) positive correlation between SPY return and monthly change in VVIX/VIX.

- Monthly change in VVIX-VIX has a modest positive correlation with next-month SPY return. In other words, a large monthly jump (drop) in VVIX/VIX weakly indicates a relatively strong (weak) SPY return next month. This finding is seemingly at odds with the hypothesized relationship. Correlations at other horizons are very weak.

In case there are important non-linearities in relationships, we look at average SPY returns across ranges of VVIX/VIX metrics.

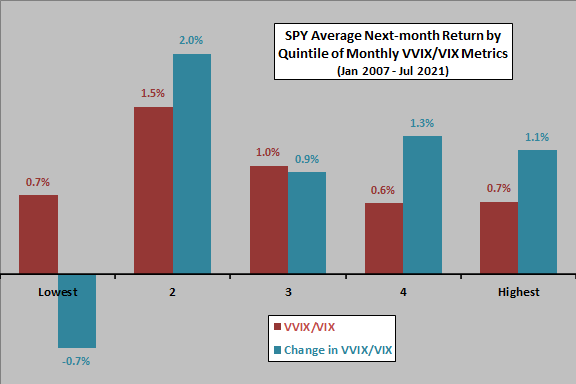

The next chart summarizes average next-month SPY returns by ranked fifth (quintile) of monthly VVIX/VIX and monthly change in VVIX/VIX. There are only 34-35 observations per quintile. Notable points are:

- Variations across quintiles are not systematic, undermining belief in reliable relationships.

- There is no range of VVIX/VIX that precedes a poor average SPY return.

- The largest monthly drops in VVIX/VIX precede a poor average SPY return, but:

- Excluding the two worst monthly SPY returns for this quintile flips average SPY return positive.

- The next-lowest quintile precedes an exceptionally high average SPY return.

In summary, evidence from simple tests on available data offers little support for belief that either VVIX/VIX or change in VVIX/VIX is useful for timing the U.S. stock market at a monthly horizon.

Cautions regarding findings include:

- The overall sample period is not long in terms of variety in market environments.

- Quintile subsamples are small.

- Testing multiple metrics on the same SPY data introduces data snooping bias, such that the better-performing strategy likely overstates expectations.

See also “VVIX as a Return Indicator?” and “Slope of VVIX Term Structure as Return Predictor”.