What is the best way to implement futures momentum and manage its risk? In their November 2017 paper entitled “Risk Adjusted Momentum Strategies: A Comparison between Constant and Dynamic Volatility Scaling Approaches”, Minyou Fan, Youwei Li and Jiadong Liu compare performances of five futures momentum strategies and two benchmarks:

- Cross-sectional, or relative, momentum (XSMOM) – each month long (short) the equally weighted tenth of futures contract series with the highest (lowest) returns over the past six months.

- XSMOM with constant volatility scaling (CVS) – each month scales the XSMOM portfolio by the ratio of a 12% target volatility to annualized realized standard deviation of daily XSMOM portfolio returns over the past six months.

- XSMOM with dynamic volatility scaling (DVS) – each month scales the XSMOM portfolio by the the ratio of next-month expected market return (a function of realized portfolio volatility and whether MSCI return over the last 24 months is positive or negative) to realized variance of XSMOM portfolio daily returns over the past six months.

- Time-series, or intrinsic, momentum (TSMOM) – each month long (short) the equally weighted futures contract series with positive (negative) returns over the past six months.

- TSMOM with time-varying volatility scaling (TSMOM Scaled) – each month scales the TSMOM portfolio by the ratio of 22.6% (the volatility of an equally weighted portfolio of all future series) to annualized exponentially weighted variance of TSMOM returns over the past six months.

- Equally weighted, monthly rebalanced portfolio of all futures contract series (Buy-and-Hold).

- Buy-and-Hold with time-varying volatility scaling (Buy-and-Hold Scaled) – each month scales the Buy-and-Hold portfolio as for TSMOM Scaled.

They test these strategies on a multi-class universe of 55 global liquid futures contract series, starting when at least 45 series are available in November 1991. They focus on average annualized gross return, annualized volatility, annualized gross Sharpe ratio, cumulative return and maximum (peak-to-trough) drawdown (MaxDD) as comparison metrics. Using monthly prices for the 55 futures contract series (24 commodities, 13 government bonds, 9 currencies and 9 equity indexes) during June 1986 through May 2017, they find that:

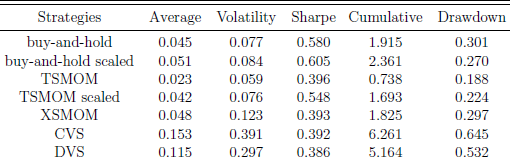

- Based on average annualized gross returns and cumulative returns CVS (15.3% average annualized) and DVS (11.5% average annualized) dominate the other five portfolios. (See the summary table below.)

- However, CVS and DVS have by far the highest annualized volatilities (39.1% and 29.7%, respectively) and therefore the lowest annualized gross Sharpe ratios (both 0.39).

- CVS and DVS also have by far the deepest MaxDDs (-64% and -53%, respectively), which would likely be intolerable for many investors.

- Based on annualized gross Sharpe ratios, the most attractive strategies are Buy-and-Hold Scaled (0.60) and Buy-and-Hold (0.58), followed by TSMOM Scaled (0.55). The other four strategies are not competitive based on this metric.

- MaxDDs for Buy-and-Hold Scaled and Buy-and-Hold are -27% and -30%, respectively.

The following table, extracted from the paper, summarizes gross performance metrics for the seven strategies specified above based on monthly outputs. Results show that CVS and DVS dominate in terms of average and cumulative returns, but are extremely volatile and therefore generate unimpressive Sharpe ratios. They also suffer deep peak-to-trough drawdowns.

In summary, evidence indicates that volatility scaled relative momentum strategies applied to a multi-class set of futures contract series do not offer attractive risk-adjusted performance.

Cautions regarding findings include:

- Performance results are gross, not net. Costs of continually rolling and rebalancing futures contracts would reduce returns.

- TSMOM appears to be at an inherent disadvantage to XSMOM. TSMOM ignores strength of momentum indications and holds all contract series (long or short). XSMOM exploits the strongest indications and holds only 20% of contract series.

- The 22.6% volatility target used to scale TSMOM and Buy-and-Hold portfolios appears to be a full-sample calculation, thereby incorporating look-ahead bias.

- Testing many strategies on the same data introduces snooping bias, such that the best-performing strategies enjoy lucky exploitation of randomness and overstate expectations.

- Strategies are beyond the reach of many investors, who would bear fees for delegating to an investment or fund manager.

See also: