Can investors use leveraged exchange-traded funds (ETF) as building blocks for long-term portfolios? In his January 2021 presentation package entitled “One Year Later. Leveraged ETFs in Portfolio Construction and Portfolio Protection”, Mikhail Smirnov updates multi-year performance of a monthly rebalanced partially 3X-leveraged portfolio consisting of:

- 40% ProShares UltraPro QQQ (TQQQ)

- 20% Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF)

- 40% iShares 20+ Year Treasury Bond ETF (TLT)

The last three years are out-of-sample with respect to specification of this portfolio. He also looks at a more conservative portfolio of 20% TQQQ and 80% TLT, rebalanced monthly. Using pre-inception simulated and actual monthly total returns for these ETFs during January 1, 2005 through January 15, 2021, he finds that:

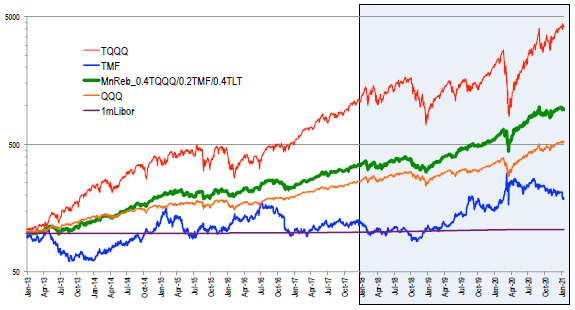

- For the 40% TQQQ/20% TMF/40% TLT portfolio (see the chart below):

- Since mid-August 2005 (with partially simulated prices), gross average annual return is 24.5%, with annual volatility 22.8% and maximum drawdown (MaxDD) -52%.

- Since the beginning of 2013, gross average annual return is 32.0%, with annual volatility 21.8% and MaxDD -33%.

- Since the beginning of 2018, gross average annual return is 39.2%, with annual volatility 27.5% and MaxDD -33%.

- For a more conservative 20% TQQQ/80% TLT portfolio, rebalanced monthly, gross average annual return is 15.1%, with annual volatility 13.1% and MaxDD -26%.

The following chart, taken from the paper, tracks on a logarithmic scale cumulative gross value of the monthly rebalanced 40% TQQQ/20% TMF/40% TLT portfolio since the beginning of 2013, with focus on recent (post-specification) performance. Overall, the portfolio performs well post-specification, but is weak in 2018 and suffers a substantial drawdown during the COVID-19 equity market crash.

In summary, a monthly rebalanced 40% TQQQ/20% TMF/40% TLT portfolio exhibits attractive risk-adjusted performance and fairly good performance persistence over the available sample period through mid-January 2021.

Cautions regarding findings include:

- The out-of-sample subperiod is very short for reliable inference.

- Performance data ignore monthly rebalancing frictions. Frictions for TQQQ and TMF may be material (wide bid-ask spreads).

- Inserting a delay between end-of-month ETF values and rebalancing actions could affect findings.

- The available test period is historically strong for both QQQ and TLT and may not be representative of their long-term performances.

- For the in-sample part of the test period, optimization of asset allocations via experimentation introduces snooping bias .

- The high returns found are arguably not sustainable due to: (1) trade crowding pushing valuations of underlying assets higher and higher; and/or, (2) increasing resistance from counterparties to act in ways that support strategy performance.

See also “Classic Stocks-Bonds Portfolios with Leveraged ETFs”, “Managing Asset Class Exposures with Leveraged ETFs” and “Simple Asset Class Leveraged ETF Momentum Strategy”.