Does the condition of S&P 500 Volatility Index (VIX) futures relative to spot VIX (contango or backwardation) predict exploitable VIX futures returns? In their June 2012 paper entitled “The VIX Futures Basis: Evidence and Trading Strategies”, David Simon and Jim Campasano investigate the predictability and exploitability of VIX futures returns based on whether VIX futures are in contango or backwardation. They focus on the two VIX futures contracts nearest to maturity, which are generally liquid with low bid-ask spreads. Their baseline trading strategy is to sell (buy) the nearest VIX futures with at least 10 trading days to maturity when in contango (backwardation) with daily roll greater than 0.10 (less than -0.10) points and hold for five trading days, hedged against changes in the level of spot VIX by (long) short positions in E-mini S&P 500 futures. Daily roll is the difference between the selected VIX futures price and spot VIX, divided by the number of trading days to maturity. Hedge ratios derive from historical regressions and are fixed for a given trade. Tests assume round-trip brokerage costs of $3 per futures contract, plus the full bid-ask spread for VIX futures and $12.50 for E-mini-S&P 500 futures (roughly $60 per complete trade). Using spot VIX levels, bid-ask data for VIX futures and prices for nearest E-mini S&P 500 futures during 2006 through 2011, they find that:

- Over the sample period, the average daily level of VIX (front and next VIX futures) is 23.70 (23.84 and 24.36), with daily standard deviation 2.24 (1.49 and 0.99).

- Bid-ask spreads at the close average 0.062 and 0.068 points for the front and next VIX futures, with cutoff for the top decile of bid-ask spreads 0.10 point.

- VIX futures exhibit a strong tendency to be in contango (backwardation) when spot VIX is low (high). For example, when VIX is less than 20 (between 40 and 50), the front and next VIX futures are in contango 78% and 91% (46% and 32%) of the time.

- Over the sample period, contango and backwardation conditions for VIX futures do not (do) have significant forecasting power for the change in spot VIX (VIX future return). Regressions indicate that a one-point contango (backwardation) relates to a 0.79 decrease (increase) in VIX futures level over the next month.

- The risk to holding VIX futures comes primarily from changes in spot VIX, which in turn relate negatively to stock market movements. A 1% increase (decrease) in E-mini S&P 500 futures relates to a 0.59% decrease (increase) in VIX futures with ten trading days to maturity.

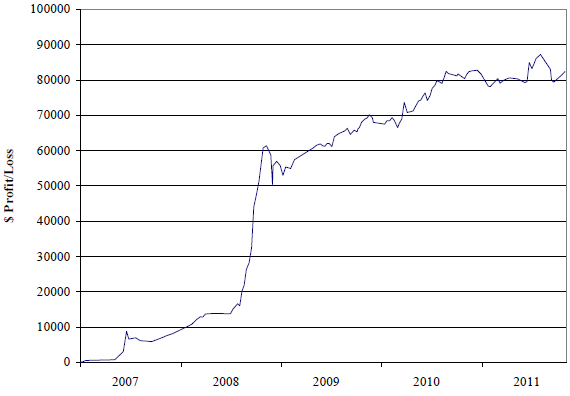

- A hedge portfolio that consists of a series of one-week trades that are short (long) VIX futures and long (short) matched E-mini S&P 500 futures when in specified contango (backwardation) conditions exhibits strong net profitability (see the chart below). Specifically:

- Short and long trades average net profits of $539 and $908 per contract, respectively, with Sortino ratios 0.75 and 0.53.

- Average net profits are greater but more volatile without E-mini S&P 500 futures hedges, resulting in lower Sortino ratios.

- The average hedge ratio is roughly one E-mini S&P 500 futures contract per VIX futures contract, ranging from about one-half to two contracts depending mostly on VIX futures time to maturity and the level of S&P 500 futures price.

- Risk-adjusted profitability of short VIX futures trades is higher when spot VIX at initiation is above rather than below 21 (Sortino ratio 1.15 versus 0.62 for hedged trading). Risk-adjusted profitability of long VIX futures trades is higher when spot VIX at initiation is below rather than above 34 (Sortino ratio 0.99 versus 0.68 for hedged trading).

- A dynamic exit strategy that closes trades when the rationale for initiating no longer holds (instead of holding for five trading days) improves the Sortino ratio for long, but not short, VIX futures trades. Stop-loss and take-gain rules adversely affect trading performance.

The following chart, taken from the paper, shows the cumulative net profit of the baseline trading strategy involving a series of one-week trades that are each short (long) one VIX futures contract and long (short) matched E-mini S&P 500 futures contracts when in specified contango (backwardation) conditions. Terminal profit is $82,000, with no severe drawdowns and very strong performance during the 2008 financial crisis. Assuming margin requirements of $6,900 for one VIX futures contract and $4,375 for one E-mini S&P 500 futures contract (the average hedge size), the annual compound return over five years is 53%. More realistically assuming equity equal to five times the minimum required margin results in an annual compound return on investment of 20%.

In summary, evidence indicates that the condition of VIX futures relative to spot VIX (contango or backwardation) reflects a strong and safely exploitable (via hedging) risk premium.

Cautions regarding findings include:

- In general, five years is a short sample period for assessing annualized returns.

- Roughly half the profit from the strategy comes during the 2008 financial crisis, an arguably rare event. Since mid-2010, by contrast, the strategy generates little or no profit.