What aspect of momentum strategy volatility is best for risk management? In his July 2017 paper entitled “Risk-Managed Momentum: The Effect of Leverage Constraints”, Federico Nucera examines stock momentum strategy risk management via different aspects of realized strategy variance with and without latitude for leverage. Specifically, he considers the following stock momentum strategy variations:

- Conventional – each month long (short) the value-weighted tenth, or decile, of stocks that are the biggest winners (losers) last month per Kenneth French’s specifications.

- Full Variance Weighting – each month weighting the conventional momentum portfolio by 1.44% (12% annual volatility) divided by the full variance of daily conventional momentum strategy returns over the past six months.

- Positive Semi-variance Weighting – each month weighting the conventional momentum portfolio by 0.68% divided by the semi-variance of positive daily conventional momentum strategy returns over the past six months.

- Negative Semi-variance Weighting – each month weighting the conventional momentum portfolio by 0.76% divided by the semi-variance of negative daily conventional momentum strategy returns over the past six months.

For each variation, he considers full weights (leverage), weights limited to 1.5X leverage and weights limited to 1.0X (no leverage). He focuses on gross annualized Sharpe ratio as the key performance metric. Using daily and monthly value-weighted momentum decile portfolio returns for a broad sample of U.S. stocks during November 1926 through December 2016, he finds that:

- Over the full sample period:

- The above variance/semi-variance risk management approaches indicate weights greater than or equal to one more than a quarter of the time.

- All the variance/semi-variance risk management approaches, with or without leverage constraint, substantially beat conventional momentum based on gross Sharpe ratio.

- Positive semi-variance weighting generally, but modestly, beats full variance and negative semi-variance approaches.

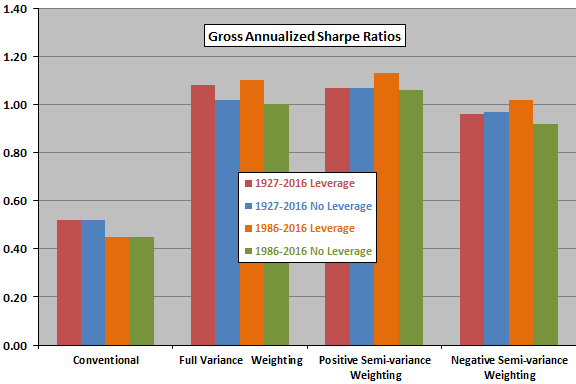

- Results hold also for a recent 1986-2016 subsample (see the chart below).

The following chart, constructed from data in the paper, compares gross annualized Sharpe ratios for eight of the stock momentum strategy variations outlined above over the full 1927-2016 sample period and over a recent 1986-2016 subperiod. Results indicate that, on a gross basis:

- All variance weighting approaches substantially beat conventional momentum.

- Positive variance weighting consistently beats negative variance weighting.

- Positive variance weighting mostly beats full variance weighting.

In summary, evidence indicates that leverage-constrained investors may prefer stock momentum strategy risk scaling based on the positive semi-variance of recent conventional momentum strategy returns.

Cautions regarding findings include:

- Reported results are gross, not net. Accounting for monthly portfolio reformation frictions, shorting costs and leverage costs would reduce returns and Sharpe ratios. Moreover:

- Lack of shares to borrow may preclude shorting some stocks as specified.

- Portfolio reformation costs may differ across strategy variations, such that net relative performance differs from gross relative performance.

- Differences in gross Sharpe ratios for the variance/semi-variance weighting approaches are small.

- The numerators of weighting factors for positive and negative semi-variances derive from full-sample proportions of positive and negative returns and therefore incorporate look-ahead bias.

- Testing many strategy variations on the same data impounds snooping bias, such that the best-performing variation overstates expectations.

See “Avoiding Momentum Strategy Crashes” for closely related research.