Is there a “trick” to good results for risk parity backtests? In their April 2014 brief research paper entitled “The Risks of Risk Parity”, the Brandes Institute examines the sustainability of a critical performance driver for the risk parity asset allocation approach. This approach weights asset classes such that their expected contributions to overall portfolio risk (volatility) are equal, generally by shifting conventional portfolio weights substantially from equities to bonds. Using hypothetical portfolio performance during 1994 through 2013 and bond yield data during 1871 through 2013, they find that:

- During 1994 through 2013, a hypothetical risk parity (conventional) allocation generates a gross annualized return of 7.3% (8.3%) with annual standard deviation 6.0% (9.1%).

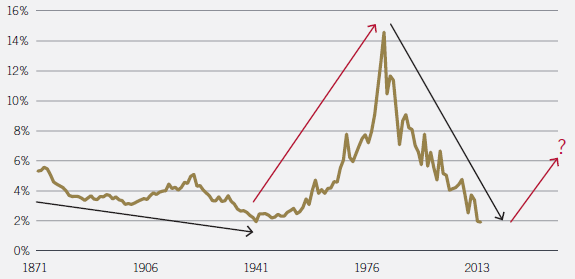

- A principal driver of risk parity risk-adjusted outperformance compared to a conventional approach is an unprecedented decline in bond yields and a commensurate rise in bond valuations. Specifically (see the chart below):

- The 10-year U.S. Treasury note yield falls from 14.6% in 1982 to 1.91% in 2013, the greatest bull market for this instrument in history.

- Since 1994, the yield falls from 5.75% to 1.91%.

- For bond-heavy (such as risk parity) portfolios to continue strong performance, bond yields must continue to fall. However, history (mean reversion) suggests that the next move in yields will be higher, creating a headwind for risk parity allocations.

The following chart, constructed by Robert Shiller and used in the paper, tracks the yield on U.S. Treasury bonds during 1871 through 2013. The long decline in yields since the early 1980s has generally boosted bond valuations and thereby asset allocation strategies that tilt toward bonds. Given this history, it seems likely that this trend is exhausted.

In summary, a reversal of the secular trend toward lower bond yields would introduce a headwind for risk parity allocation performance because of its tendency to tilt toward bonds.

A similar argument applies for simple stock market timing strategies that switch to bonds for extended intervals when out of stocks (see, for example, “Simplest Asset Class ETF Momentum Strategy?”).

Cautions regarding findings include:

- As noted in the paper, it is impossible to predict bond yields accurately. The deflationary effects of falling energy prices, low-cost global sources of manufacturing labor and currency wars might sustain downward pressure on interest rates.

- The paper does not quantify the effects of rising interest rates on risk parity portfolio performance.