Does market underestimation of stock price uncertainty around earnings announcements support a short-term straddle strategy (call option and put option with matched strike and expiration, profitable with large stock price moves)? In their January 2013 paper entitled “Anticipating Uncertainty: Straddles Around Earnings Announcements”, Yuhang Xing and Xiaoyan Zhang investigate the performance of short-term, near-the-money straddles during intervals around earnings announcements. Short-term means no more than 60 days to expiration. Near-the-money means moneyness in the range 0.95 to 1.05. They focus on a delta-neutral straddle constructed by appropriately weighting the call and put positions at initiation, but they also consider a simple one call-one put alternative. They examine several straddle holding periods starting at the close five, three or one trading day before scheduled earnings announcement date and ending at the close on or one day after earnings announcement date. They calculate option returns based on the mid-point of the daily closing bid and ask as a fair option price (and require it to be at least $0.125). Using daily stock returns and option prices (with data filtered to exclude implausible data), along with contemporaneous quarterly firm fundamentals, during January 1996 through December 2010, they find that:

- Based on equal weighting, the specified universe of delta-neutral straddles generates average gross daily/weekly/monthly returns of -0.19%/-2.09%/-17.1% over the sample period. Results are similar for volume weighting and open interest weighting.

- However, based on equal weighting, gross average daily returns for these delta-neutral straddles are significantly positive during the four trading days before through one trading day after earnings announcement date (0.31% to 2.30%, highest on the announcement day). Results for volume-weighted delta-neutral and for simple straddles are similar.

- On average, for a benchmark three-day holding period from the close three trading days before through earnings announcement day, gross straddle returns:

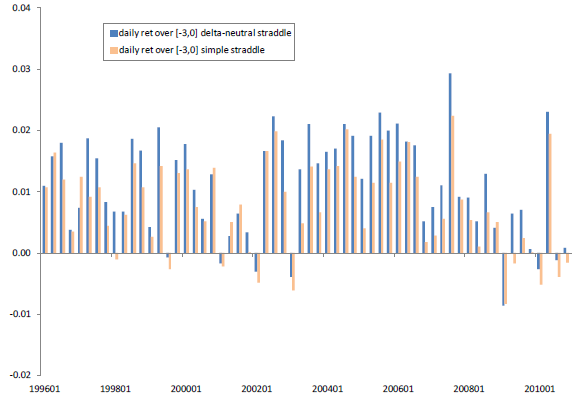

- Are mostly positive over time (see the chart below).

- Tend to be higher when lagged implied volatility of the S&P 500 Index (VIX) is relatively low.

- Tend to be higher for stocks with relatively high realized volatilities and relatively low implied volatilities (and therefore the smallest volatility risk premiums).

- Are significantly positive for 10 of 12 industries (not energy and utilities).

- Tend to be higher for small stocks and stocks with low analyst coverage, high past jump frequency, high return kurtosis and large past earnings surprises.

- Meanwhile, market makers increase bid-ask spreads around earnings announcements, thereby undermining net profitability of straddles. Investors can mitigate elevated trading friction by:

- Buying only very short-term straddles (4 to 10 days to expiration) and holding to expiration. Assuming trading friction is half the bid-ask spread, this restriction conveys an average daily net straddle return of 1.64%. However, net profitability weakens dramatically to loss as time to straddle expiration lengthens and/or trading friction approaches the bid-ask spread.

- Also limiting trades to options in the lower half of historical bid-ask spreads. Even with trading friction equal to the full bid-ask spread, the combined restrictions generate an average daily net straddle return of 1.16%.

The following chart, taken from the paper, summarizes average gross daily returns for near-the-money, short-term delta-neutral and simple straddles from the close three trading days before earnings announcement day through to the close on earnings announcement day over the 15-year sample period. Gross returns for the delta-neutral (simple) straddles are positive for 53 (50) of 60 quarters.

In summary, evidence suggests that investors may be able to exploit the underestimation of stock price uncertainty around earnings announcements via straddles implemented via near-the-money, close-to-expiration options with historically low bid-ask spreads.

Cautions regarding findings include:

- As noted in the paper, using midpoints of the bid-ask spread as fair prices for opening and closing straddle positions may not represent realistic trading. Also, assuming trading friction that is half of the bid-ask spread may be optimistic. Within the bounds of trading friction assumptions, opportunities may not accommodate large positions.

- The assumptions and restrictions necessary to achieve net profitability raise the concern of data snooping bias.

- The paper does not address the costs of acquiring and processing the considerable amount of data needed to isolate attractive trading opportunities.

- Trading opportunities may cluster because earnings announcements cluster, thereby complicating capital management due to overlapping trades.