What is the best way to bet against beta in equity markets? In their August 2012 paper entitled “Beta-Arbitrage Strategies: When Do They Work, and Why?”, Tony Berrada, Reda Jurg Messikh, Gianluca Oderda and Olivier Pictet derive and test a dynamic low-beta portfolio strategy designed to maximize excess return relative to the market portfolio. They test the strategy on a broad sample of U.S. stocks, 18 developed country stock indexes and 10 equity sector indexes by varying the emphasis on low versus high beta each month based on beta dispersion in lagged rolling 60-month intervals. Using monthly total returns for U.S. stocks during July 1925 through December 2011, for developed country stock market indexes during January 1970 through November 2010 and for sector indexes during January 1995 through November 2010, they find that:

- Portfolios that overweight low-beta stocks and underweight high-beta stocks generally outperform the value-weighted market.

- Bets against beta perform best when dispersion in betas is largest (when idiosyncratic risk is broadly elevated).

- A strategy that each month optimally overweights low-beta assets relative to high-beta assets according to lagged beta dispersion generates gross cumulative outperformance of about:

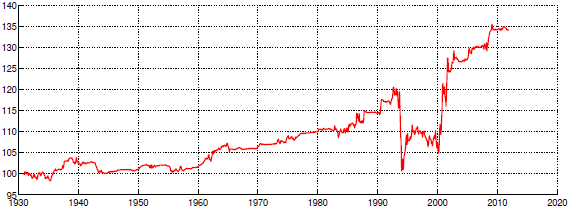

- 35% for U.S. stocks relative to the broad value-weighted U.S. stock market during July 1925 through December 2011 (see the chart below).

- 140% for developed country stock indexes relative to the value-weighted aggregate index during January 1975 through November 2010.

- 23% for equity sector indexes relative to value-weighted aggregate index during January 2000 through November 2010.

The following chart, taken from the paper, plots gross cumulative return of the optimal betting-against-beta strategy as applied to U.S. stocks relative to the broad value-weighted U.S. stock market over the available sample period. While outperformance is mostly steady, the betting-against-beta strategy breaks down during the 1990s and recovers in the 2000s.

In summary, evidence indicates that investors may be able to enhance low-beta strategies by upping bets when lagged dispersion of betas across the asset universe is relatively high.

Cautions regarding findings include:

- Return calculations are gross, not net. Including reasonable trading frictions for monthly reformation of stock and index portfolios would reduce reported outperformance and could affect findings. For example, it is doubtful that 35% gross outperformance over eight decades represents net outperformance.

- The use of country and sector indexes ignores the trading frictions and management fees involved in creating tradable assets (funds) from them.

- The data collection and processing burden for betting-against-beta optimization may be material, especially when applied to a broad sample of stocks.