Is shorting pairs of leveraged exchange-traded funds (ETF) reliably profitable? In their December 2017 paper entitled “Shorting Leveraged ETF Pairs”, Christopher Hessel, Jouahn Nam, Jun Wang, Xing Cunyu and Ge Zhang examine monthly returns from shorting a pair of leveraged and inverse leveraged ETFs for the same index. They first investigate what circumstances make this strategy profitable. They then test the strategy on each of the triple/inverse triple (3X/-3X) pairs associated with the following six base ETFs: Financial Select Sector SPDR (XLF: FAS/FAZ), Powershares QQQ (QQQ: TQQQ/SQQQ), iShares Russell 2000 Index (IWM: TNA/TZA), SPDR S&P 500 (SPY: UPRO/SPXU), VanEck Vectors Junior Gold Miners ETF (GDXJ: JNUG/JDST) and Energy Select Sector SPDR (XLE: ERX/ERY). Their analysis assumes rebalancing pair short positions to equal value at the end of each month and holding them to the end of the next month. Using monthly data for the selected leveraged ETFs from the end of 2007 (except the end of November 2009 for the leveraged versions of GDXJ) through the end of December 2016, they find that:

- Shorting leverage ETF pairs is a bet on mean reversion of the underlying index. If the index trends over many days, the strategy generates a loss. Mathematically, expected return is high when the average of daily autocorrelations across different lags is negative and volatility is high.

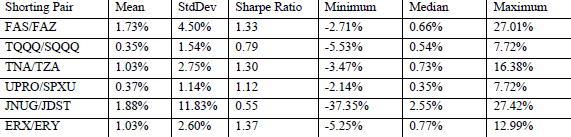

- Four of six pairs studied (FAS/FAZ, TNA/TZA, JNUG/JDST, ERX/ERY) generate average monthly returns over 1%. However, JNUG-JDST volatility is so high that it has the lowest rough annualized gross Sharpe ratio (ratio of annualized gross average monthly return to annualized standard deviation of gross monthly returns) of all six pairs.

- Monthly returns generally exhibit low correlations with those for the market, size, book-to-market and momentum factors. Most multi-factor alphas are significantly positive.

- Strategy monthly returns are higher after months with relatively high volatility of the underlying.

The following table, taken from the paper, summarizes gross means, standard deviations, rough Sharpe ratios, minimums, medians and maximums of monthly returns for shorting the six pairs of leveraged ETFs as specified above. Based on rough Sharpe ratio, the three most attractive pairs are ERX/ERY, FAS/FAZ and TNA/TZA.

In summary, evidence indicates that shorting some pairs of leveraged ETFs may be attractive.

Cautions regarding findings include:

- Given the modest sample periods available, using data beyond December 2016 may affect findings.

- Monthly return statistics are gross, not net. Costs of rebalancing the two short positions to equal size each month would reduce returns. Moreover, analyses are not indicative of a sustainable shorting strategy. Steady profitability shrinks the short positions, such that dollar values of gains decline over time. A more sustainable approach would be to reset the short positions monthly to some dollar amount while skimming excess cash (see “Leveraged ETF Pair Shorting Strategies”). Such a monthly reset would introduce more frictions.

- When conditioning the strategy on volatility, the authors use the in-sample median to delineate high and low volatilities, thereby incorporating look-ahead bias. In other words, an investor operating in real time could not know this median (again, see “Leveraged ETF Pair Shorting Strategies”).

For additional prior research, see “Shorting Leveraged ETF Pairs” and “Returns of Matched Long and Short Leveraged ETFs”.