Does the S&P 500 implied volatility index (VIX) exhibit reliable intraday and day-of-week patterns? In their December 2016 paper entitled “The Intraday Properties of the VIX and the VXO”, Adrian Fernandez-Perez, Bart Frijns, Alireza Tourani-Rad and Robert Webb investigate daily and intraday properties of VIX and its predecessor, the S&P 100 implied volatility index (VXO). VIX maintains constant 30-day maturity at a one-minute frequency, while VXO maintains a constant 30-day maturity on a daily basis. Using one-minute levels of VIX and VXO from 9:30 until 16:15 EST and of the S&P 500 Index from 9:30 to 16:00 EST during September 22, 2003 (introduction of VIX) through December 31, 2013, they find that:

- Intraday at the one-minute frequency:

- VIX drifts down an average of -0.80% from open to close, most strongly during the first 30 minutes and the last few minutes of the trading day.

- The S&P 500 Index exhibits no return pattern, but its volatility is on average U-shaped.

- The correlation between VIX and the S&P 500 Index is around -0.50, somewhat less negative during the first and last hours of trading.

- Across days of the week:

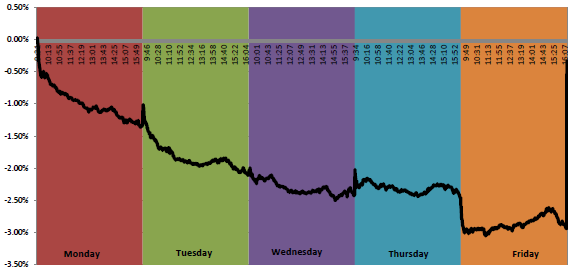

- VIX declines by an average 3% per week, falling each day except for a slight increase on Friday and then surging over the weekend (see the chart below). Average declines are largest during Monday and Tuesday and overnight Thursday.

- The S&P 500 Index exhibits a U-shaped pattern.

The following chart, taken from the paper, shows the average cumulative logarithm of change in VIX across the calendar week. VIX tends to decline strongly early in the week and early during each trading day, and then bounce back over the weekend.

In summary, evidence indicates that VIX exhibits some strong intraday and day-of-the-week tendencies.

Cautions regarding findings include:

- The authors assert: “Certain observed patterns in the VIX could point towards potential anomalies and should be of interest to (VIX) derivatives traders, as persistent patterns in the VIX could affect the pricing of these derivatives.” However, as found in “Short-term VIX Calendar Effects” and “VIX and VXX Behaviors Around Holidays”, behaviors of investable exchange-traded notes (ETN) based on VIX futures suggest that futures traders anticipate VIX patterns.

- The study does not address whether introduction of VIX ETNs affected VIX behavior.