Is option-implied volatility a useful predictor of returns for commodity futures? In her March 2017 paper entitled “Commodity Option Implied Volatilities and the Expected Futures Returns”, Lin Gao tests the power of option-implied volatilities (with 12-month detrending) for commodities to predict commodity futures returns. Specifically, she each month buys (sells) the fourth of commodities with the lowest (highest) detrended implied volatilities at of the end of the preceding month. To generate continuous return series for liquid commodity futures contracts, she rolls contracts when time-to-expiration decreases to one month. She further compares the implied volatility hedge strategy to five other commodity futures hedge strategies (specified below): (1) momentum; (2) basis; (3) basis-momentum; (4) hedging pressure; and, (5) growth in open interest expressed indollars. Using options data for 25 commodities to calculate end-of-month implied volatilities and contemporaneous commodity futures price and open interest data as available during January 1990 through October 2014, she finds that:

- The detrended implied volatility hedge strategy generates annualized gross return 12.7% and annualized gross Sharpe ratio 0.69.

- But, the short side of the portfolio dominates performance (10.1% annualized), and average returns do not increase systematically across the four portfolios ranked by implied volatility.

- Performance derives mainly from spot returns, not roll returns. In other words, commodities with the cheapest (most expensive) volatility insurance tend to increase (decrease) in price next month. In fact, average gross roll return is negative (-1.8% annualized).

- The strategy performs better during economic recessions than expansions (annualized average gross return 32.9% versus 10.4%).

- Attractive performance persists for holding period up to two months.

- Neither downside nor upside volatility dominates predictive power.

- Hedge portfolios formed on raw implied volatility and realized volatility behave similarly, but with weaker predictive powers.

- Comparing the detrended implied volatility strategy to the other five commodity futures hedge strategies (see the charts below):

- The strategy has the second highest annualized average gross return and Sharpe ratio (after basis-momentum).

- This strategy is a promising diversifier for all five other strategies, with monthly return correlations ranging from -0.07 to 0.02.

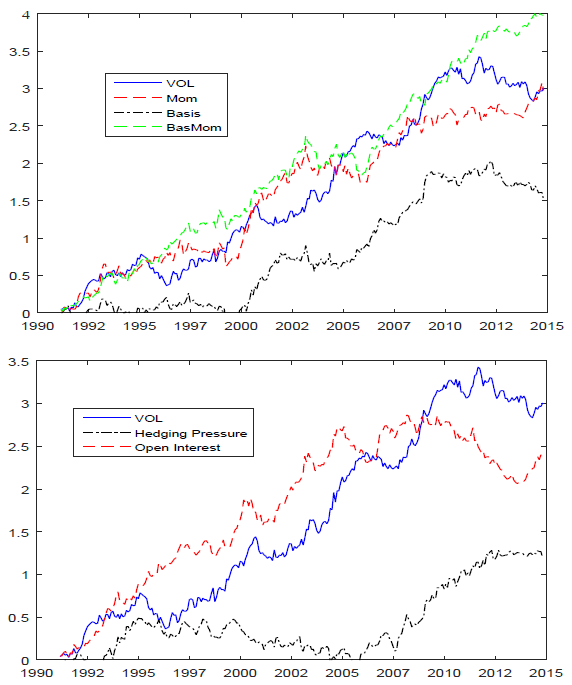

The following charts, taken from the paper, compare cumulative gross excess returns of commodity futures hedge strategies that are each month long (short) the fourth of commodity futures with the highest (lowest) expected returns. Specifically:

- Implied Volatility (VOL) is long (short) futures with the lowest (highest) prior end-of-month detrended 30-day implied volatilities.

- Momentum (Mom) is long (short) futures with the highest (lowest) returns over the last 12 months.

- Basis is long (short) futures with the lowest (highest) prior end-of-month basis.

- Basis-Momentum (BasMom) is long (short) futures with the highest (lowest) differences between nearest contract momentum and second-nearest contract momentum.

- Hedging Pressure is long (short) futures with the highest (lowest) prior end-of-month differences between short and long open interests, divided by total open interest, for commercial traders.

- Open Interest Growth (Open Interest) is long (short) futures with the highest (lowest) monthly changes in 12-month average dollar value of nearest contract open interest.

Consistent with prior research, Mom, BasMom and Open Interest deliver sizable gross excess returns, whereas those for Basis and Hedging Pressure are small. VOL performs especially well during economic recessions. The top-performing strategy overall is BasMom.

In summary, evidence indicates that hedge portfolios that are long (short) commodity futures with relatively low (high) detrended option-implied volatility may offer attractive performance.

As noted in the paper, implied volatility calculations closely track those of matched CBOE implied volatility indexes for crude oil (OVX) and SPDR gold shares (GVX).

Cautions regarding findings include:

- Returns are gross, not net. Incorporating costs of monthly contract rolls and monthly portfolio reformations would reduce returns.

- Performing end-of-month calculations and immediately reforming hedge portfolios may be problematic for some or all strategies.

- Testing multiple strategies and strategy combinations on the same data introduces snooping bias, such that the best-performing strategy overstates expectations. There may be additional snooping bias in modeling/parameters (such as 12-month detrending of implied volatilities).

- The implied volatility hedge strategy performs poorly over the last five years of the sample period.