Are popular exchange-traded products (ETP) such as VXX (iPath S&P 500 VIX Short Term Futures) and VXZ (iPath S&P 500 VIX Mid-Term Futures), designed to track specific S&P 500 VIX futures constant maturity index series, good hedges for stock portfolios? In their June 2012 paper entitled “Are VIX Futures ETPs Effective Hedges?”, Geng Deng, Craig McCann and Olivia Wang investigate whether these ETPs effectively hedge basic U.S. stock portfolios or exchange-traded funds (ETF) that leverage U.S. stock market indexes. Because the ETPs are only very recently available, they use the one-month (SPVXSP) and five-month (SPVXMP) S&P 500 VIX futures constant maturity indexes as proxies for them. They examine the hedging effectiveness of these indexes for five stock portfolios: 100% SPDR S&P 500 (SPY); 100% Vanguard Total Stock Market Index Fund (VTSMX); 80% VTSMX and 20% Vanguard Total Bond Market Index Fund (VBMFX); 60% VTSMX and 40% VBMFX; and, 40% VTSMX and 60% VBMFX. They also examine the hedging effectiveness of these indexes for three 2x-leveraged exchange-traded funds (ETF): ProShares Ultra S&P500 (SSO); ProShares Ultra QQQ (QLD); and, ProShares Ultra Dow30 (DDM). They compute optimal hedge ratios using consecutive (non-overlapping) 26-week lagged regressions of weekly total returns of each portfolio/ETF versus weekly returns of the hedging instrument. Using weekly data for all portfolio funds and VIX futures indexes since December 2005, and for leveraged ETFs since late July 2006, all through mid-April 2012, they find that:

- Over the sample period since December 2005, the correlation of weekly returns between SPY and SPVXSP (SPVXMP), tracked by VXX (VXZ), is -0.74 (-0.68). The average annual return of SPVXSP (SPVXMP) is -21.3% (6.4%).

- VIX futures indexes applied as hedges do not significantly reduce the volatility of either stock portfolios or leveraged ETFs.

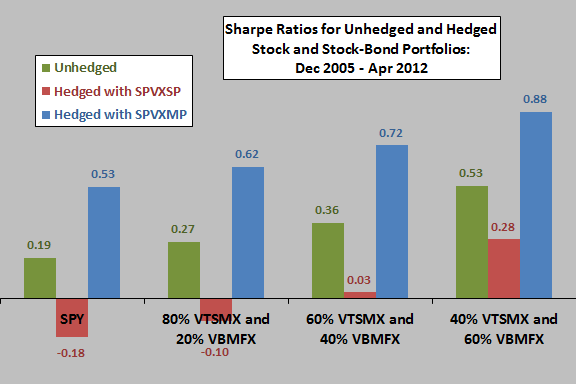

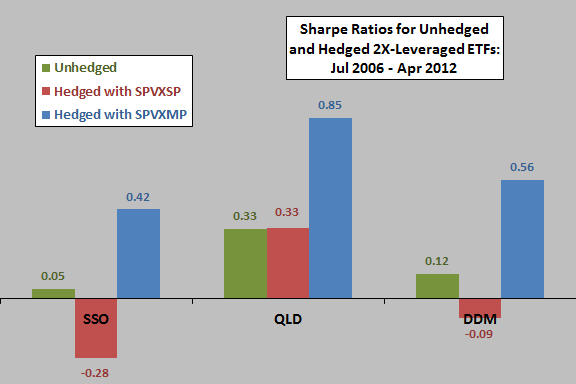

- Short-term VIX futures indexes applied as hedges substantially reduce returns and Sharpe ratios of stock portfolios and leveraged ETFs because of the usually negative roll yield incurred while maintaining constant maturity (see the charts below).

- Medium-term VIX futures indexes, with less negative roll yields, boost returns and Sharpe ratios when applied as hedges for stock portfolios and leveraged ETFs (see the charts below).

The following chart, constructed from data in the paper, summarizes Sharpe ratios for unhedged stock (SPY) and several stock-bond (VTSMX-VBMFX in different proportions) portfolios, and for these same portfolios hedged with either SPVXSP or SPVXMP, over the available sample period. Hedge ratios derive from 26-week lagged regressions of weekly portfolio returns versus hedging instrument weekly returns.

Results indicate that medium-term (short-term) VIX futures indexes are (are not) effective diversifiers for stocks portfolios over this period.

The next chart, also constructed from data in the paper, summarizes Sharpe ratios for unhedged leveraged stock ETFs, and for these same ETFs hedged with either SPVXSP or SPVXMP, over the available sample period. Hedge ratios again derive from 26-week lagged regressions of weekly portfolio returns versus hedging instrument weekly returns.

Results indicate that medium-term (short-term) VIX futures indexes are (are not) effective diversifiers for leveraged ETFs over this period.

In summary, evidence indicates that exchange-traded products that track medium-term VIX futures indexes (such as VXZ) may be effective diversifiers for stock portfolios and leveraged stock ETFs, but those that track short-term VIX futures indexes (such as VXX) are not.

Cautions regarding findings include:

- As noted in the paper, the sample periods (which involve just a few VIX regimes, including the very unusual 2008 financial crisis) may not be representative of long-term interactions between stocks and VIX futures indexes.

- Investors may not be able to achieve reported results due to roll trading frictions and fund management fees included in VXX and VXZ (plus minor frictions from adjusting hedge size every six months).

- Consideration of multiple portfolios and two hedging instruments introduces data snooping bias, such that the best-performing historical combination likely overstates future performance.

See the closely related “Diversification with VIX Futures and Related ETNs”. See also “Simple Tests of VXX as Diversifier” and “Simple Tests of VXZ as Diversifier” for context of multi-asset class portfolios.