Are options for volatile stocks overpriced? In the September 2010 version of their paper entitled “Cross-Section of Option Returns and Stock Volatility”, Jie Cao and Bing Han investigate the relationship between option return and price volatility of the underlying stock. The focus on delta-hedged positions in options and underlying stocks calibrated such that the combination is insensitive to stock price changes. For most analyses, they use the closing bid-ask midpoint as the option price. Using price and trading data for approximately at-the-money individual stock options about 1.5 months from expiration (filtered for reliability) on approximately 6,000 underlying U.S. stocks over the period January 1996 through October 2009 (about 200,000 observations each for puts and calls), they find that:

- Delta-hedged call and put options both have negative average and median returns to expiration. For example, delta-hedged call options lose on average 4.89% (0.48%) of the option (underlying stock) price from 1.5 months before expiration to expiration. Conversely, the average return of selling delta-hedged calls is positive.

- Delta-hedged option returns decrease systematically with underlying stock volatility and are extremely negative when stock volatility is high (driven entirely by stock idiosyncratic volatility rather than market volatility).

- Variation of return with volatility is robust to weighting approach, volatility calculation method, firm size, book-to-market ratio, past stock returns, skewness of returns and volatility risk premium. Results are consistent with market makers demanding higher premiums for options on stocks with high idiosyncratic volatility.

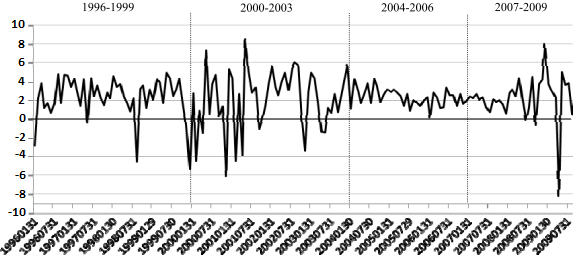

- Based on mid-points of closing option bid and ask quotes, a portfolio strategy that each month buys (sells) initially delta-hedged at-the-money call options on stocks with low (high) volatility and holds for one month generates an average return of about 2% per month. The average return decreases systematically with the market capitalization of the underlying stock. It is profitable in January, the rest of the year and four subperiods (see the chart below).

- Adding trading friction equal to 50%, 75% or 100% of the closing option bid-ask spread incrementally reduces average profitability from about 1% per month to approximately zero. In other words, only traders who can achieve relatively low trading frictions can exploit the volatility premium in option prices.

The following chart, taken from the paper, plots monthly returns (in percent) for the above hedge strategy that buys (sells) initially delta-hedged at-the-money call options on stocks with low (high) volatility about 1.5 months from expiration and holds for one month. Returns are partly gross, in that they account for part of the option bid-ask spread. The average return thus estimated is about 2% per month and fairly consistent over time, more so when market volatility is low than high.

In summary, evidence indicates that traders who can achieve low trading frictions may be able to extract a premium from the relatively high prices of options on volatile stocks.

Cautions regarding findings include:

- Most of the returns presented are more gross than net. The bid-ask spread sensitivity test does not consider option transaction fees or trading frictions for the delta hedging positions in underlying stocks.

- As indicated in the chart, it appears that efforts to extract the volatility premium from options can produce very volatile returns during bear markets.

For related studies, see “Cross Sections of Covered Call Returns” and “Are Some Covered Calls More Profitable Than Others?”.