Has growth in futures-based exchange-traded funds (ETF) predictably affected pricing of underlying assets? In his November 2019 paper entitled “Passive Funds Actively Affect Prices: Evidence from the Largest ETF Markets”, Karamfil Todorov investigates impacts of ETF trading on pricing of futures on equity volatility (VIX) and commodities, the two asset classes most dominated by ETFs. He decomposes sources of these impacts into three rebalancing needs: (1) rolling of futures contracts as they expire; (2) inflow/outflow of investor funds; and, (3) maintenance of constant daily leverage. By modeling the fundamental value of VIX futures contracts using S&P 500 Index and VIX option prices, he quantifies non-fundamental ETF rebalancing impacts on VIX futures prices. Finally, he tests a strategy to exploit the need for daily leverage rebalancing by trading against it. Specifically, he approximates daily liquidity provision by each intraday reforming portfolios that short a pair of long and short futures-based ETFs on the same underlying asset (volatility, natural gas, gold or silver). In other words, he shorts at the open and covers at the close each day. Using daily data for selected ETFs and their underlying futures for VIX, U.S. natural gas, silver, gold and oil as available during January 2000 through December 2018, he finds that:

- The fractions of VIX futures and natural gas futures market capitalizations held by ETFs often exceed 30%.

- Introduction of futures-based ETFs increased prices and decreased realized returns of underlying futures. Specifically:

- Inceptions of ETFs based on VIX, natural gas, gold, silver and oil on average raises the price spread between spot and nearest-month futures by 82.5% and the price spread between nearest-month and second-month futures by 59.1%.

- Before introduction of VIX futures ETFs, the price difference between modeled and actual VIX futures prices is near zero. After introduction, VIX futures are on average overpriced by 18.5% per year.

- Short-term price impacts from all three types of rebalancing translate into long-term price deviations, with that needed to maintain constant daily leverage the largest.

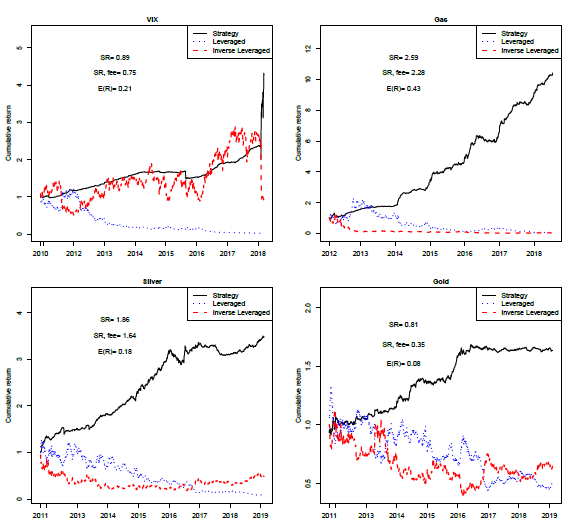

- Intraday shorting of long and short pairs of futures-based ETFs generates large returns and attractive Sharpe ratios, with returns spiking in turbulent times when liquidity evaporates and portfolio crashes rare. For example, gross annualized return and gross annualized Sharpe ratio for shorting matched pairs of (see the charts below):

- VIX futures are 21% and 0.89.

- Natural gas futures are 43% and 2.59.

- Silver futures are 18% and 1.86.

- Gold futures are 8% and 0.81.

The following charts, taken from the paper, track as solid black lines cumulative intraday returns for shorting over available sample periods matched long and short pairs of futures-based ETFs for: VIX (leverages 1 and -1); natural gas (leverages 3 and -3); gold (leverages 3 and -3); and, silver (leverages 2 and -2). E(R) is average annualized gross return, SR is annualized gross Sharpe ratio, and SR, fee is annualized gross Sharpe ratio less borrowing fees from Interactive Brokers. Dotted blue (dashed red) lines track cumulative intraday returns on the long (short) member of the ETF pair. The large spike for the VIX strategy (51% return) on February 5, 2018 is the short VIX futures ETF crash. Similar strategies for matched long and short pairs of equity, bond and currency exchange ETFs also work well (not shown).

With daily shorting and covering, investors suppress risk of large spikes in underlying assets but face high (ignored) trading frictions.

In summary, evidence indicates that investors may be able to harvest a leverage rebalancing-induced premium from futures-based ETFs by repeatedly shorting matched long and short pairs of these ETFs intraday.

Cautions regarding findings include:

- Available samples for testing the strategy of shorting matched pairs of long and short ETFs are short, with the earliest beginning about 2010. These samples may not include all market conditions.

- The paper features gross performances of this strategy. While accounting for shorting fees from one broker, results do not account for:

- Daily round-trip bid-ask spreads and transaction fees from shorting and covering two positions. Bid-ask spreads may widen considerably during market stress.

- Impact of this trading on prices. It is not obvious that the selected futures markets have the capacity to absorb large-scale trading of the strategy.

- The ETFs studied are financial instruments constructed from derivatives (not real assets), dependent on the financial health of the offeror.

See also: