Can investors exploit idiosyncratic volatility exhibited by commodity futures? In their December 2011 paper entitled “Idiosyncratic Volatility Strategies in Commodity Futures Markets”, Adrian Fernancez-Perez, Ana-Maria Fuertes and Joelle Miffre investigate the usefulness of idiosyncratic volatility as a predictor of commodity futures returns. They define idiosyncratic volatility of commodity futures as return volatility not explained by contemporaneous variation in hedging pressure. They calculate hedging pressure from CFTC Commitments of Traders reports by relating long positions to total positions across trader categories. Return calculations assume: (1) holding the first nearby contract up to one month before maturity and then rolling to the next-nearest contract; (2) trading on a fully collateralized basis, meaning that half of trading capital earns the risk-free rate (three-month Treasury bill yield); and, (3) reporting only returns in excess of the risk-free rate, which averages about 3.3% annually over the sample period. They test all combinations of commodity ranking (whether for idiosyncratic volatility, return momentum or roll return) and portfolio holding intervals of 4, 13, 26 and 52 weeks. They calculate alpha by regressing long-short commodity futures portfolio returns against the same-interval hedging pressure risk premium. Using Friday settlement prices of nearest and second-nearest contracts for 27 commodity futures and weekly hedging pressure data during September 30, 1992 through March 25, 2011, they find that:

- For a portfolio that is long (short) the equally weighted fifth of commodity futures with the lowest (highest) idiosyncratic volatility:

- Average annualized gross excess return (alpha) across ranking and holding interval combinations is 5.5% (4.6%).

- Assuming per-trade friction of 0.033% (0.066%), average annualized net alpha is 4.6% (4.5%), with breakeven per-trade friction about 2.3%.

- Shorter ranking intervals generally outperform longer ones.

- Idiosyncratic volatility strategies are materially independent of momentum and term structure (roll return) strategies in commodity futures markets.

- Triple-sort long-short portfolios combining the three anomalies yield an average annualized gross excess return (alpha) of about 7.0% (5.6%) across ranking and holding interval combinations, essentially insensitive to sorting order. Sorting criteria are coarse so that the final long and short sides of the portfolio each contain about a fifth of the 27 contracts.

- However, triple-sort portfolios underperform single-sort idiosyncratic volatility portfolios during intervals of extremely high and low market volatility.

- Assuming per-trade friction of 0.033% (0.066%), average annualized net alpha is 4.9% (4.2%) for triple-sort strategies, with breakeven per-trade friction about 0.41%.

- The profitability of idiosyncratic volatility signals survives at some level after accounting for illiquidity risk, backwardation/contango conditions and correction for data snooping bias.

- While the long-short commodity futures portfolios effectively diversify stocks and bonds, they are less effective as an inflation hedge than long-only commodity indexes.

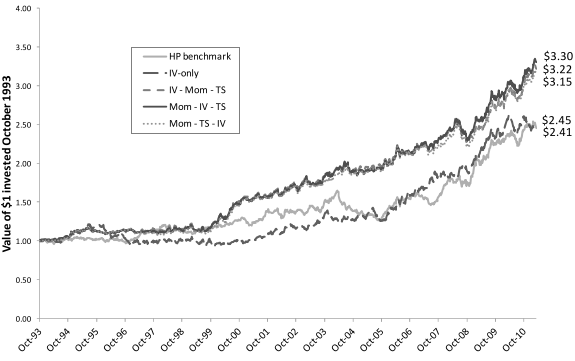

The following chart, taken from the paper, shows the cumulative gross value of $1 initial investments in five long-short commodity futures portfolios formed from sorting on: hedging pressure (HP benchmark); idiosyncratic volatility (IV-only); and, three triple sorts on idiosyncratic volatility, return momentum (Mom) and term structure/roll return (TS) in different orders.

Results show that an IV-only strategy is competitive with a hedging pressure strategy, and that combining idiosyncratic volatility with momentum and roll return enhances performance.

In summary, evidence from fairly complicated modeling and multiple tests indicates that traders may be able to exploit unexplained volatility in commodity futures contract returns via a standalone strategy or in combination with momentum and roll return.

Cautions regarding findings include:

- Data requirements, variable calculations and portfolio construction methods are complicated and likely beyond the reach of many investors (especially individuals). Access for such investors to the strategies tested would therefore entail management and administrative fees.

- Triple sorting a set of just 27 assets is problematic in terms of purifying signals while maintaining some portfolio diversification.

- Some investors (especially individuals) may not be able to achieve the benchmark levels of trading friction assumed.

- The sample period is short for the longer ranking/holding intervals.