Is there a good short-cut for constructing a low-beta portfolio? In their March 2013 paper entitled “Country and Sector Drive Low-Volatility Investing in Global Equity Markets”, Sanne de Boer, Janet Campagna and James Norman investigate the role of country and sector effects in low-volatility investing across global stock markets. They construct country-sector capitalization-weighted sub-indexes (for example, U.S. Utilities) from stocks in the MSCI World Index. They then compare performances of a portfolio of these sub-indexes and a portfolio of individual stocks, both reformed every six months (ends of May and November) to minimize future volatility as predicted by a proprietary model (Axioma’s Global Risk Model). All portfolios are long-only with no leverage. Using monthly returns and market (free-float) capitalizations of MSCI World Index stocks during 1999 through 2012, they find that:

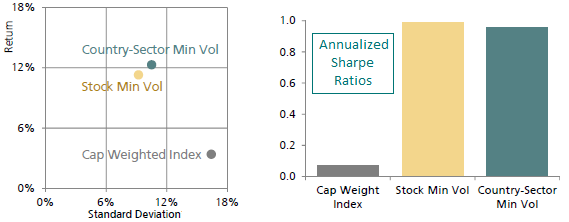

- The gross return (volatility) of the country-sector low-volatility selection strategy is slightly better (higher) than for the individual stock strategy, such that their gross risk-adjusted outcomes are similar (see the charts below). Both strongly and steadily outperform the capitalization-weighted index.

- Market-adjusted gross returns for the country-sector and individual stock strategies are highly correlated, with the few intervals of market underperformance associated with strong market rallies.

- Both the country-sector and individual stock strategies exhibit reasonably high market upside capture (about 50%) and very low market downside capture (20%), arguably because of an anti-bubble aspect of low-volatility investing.

- The country-sector strategy is more liquid than the individual stock strategy, with lower average annual turnover (94% versus 133%) and less concentrated holdings. Lower turnover indicates lower portfolio reformation costs.

The following charts, taken from the paper, compare annualized gross reward-risk relationships during 1999 through 2012 for: (1) the capitalization-weighted index of all stocks in the sample; (2) a semi-annually reformed portfolio of individual stocks selected to minimize expected volatility (Stock Min Vol); and (3) a semi-annually reformed portfolio of country-sector indexes selected to minimize expected volatility (Country-Sector Min Vol). Calculation of Sharpe ratios employs the 3-month U.S. Treasury bill yield as the risk-free rate.

The country-sector selection strategy generates a slightly better gross return with slightly higher volatility than the stock selection strategy, such that their gross Sharpe ratios are close in value. Results imply that a country-sector selection strategy captures much of the benefit of low-volatility investing in global equities.

In summary, evidence suggests that county-sector asset granularity effectively captures the benefits of low-beta investing in global equities.

Cautions regarding findings include:

- Return calculations are gross, not net. Including reasonable trading frictions for semi-annual portfolio reformation would reduce reported returns.

- The country-sector sub-indexes are not tradable assets, thereby ignoring any management/administrative costs associated with creating and maintaining fund proxies. There may be a robust enough set of funds available to support a low-beta country-sector strategy.

- The authors do not describe how the model used to predict low-volatility assets works, or exactly how they apply it. Nor do they include the costs of using the model (or paying a manager to use it) in return calculations. Simpler, publicly available methods of beta/volatility prediction may work as well as the proprietary model.

For another perspective (cited by this study), see “Layers of Low Beta”.