Can diversification via allocations to volatility-related securities enhance the absolute and risk-adjusted returns of equity portfolios? In other words, can investors construct useful asset classes from equity volatility? In their early 2010 paper entitled “Volatility Exposure for Strategic Asset Allocation”, Ombretta Signori, Marie Briere and Alexandre Burgues investigate potential benefits to long-term U.S. equity investors of including two volatility-related assets: (1) a rolling dynamic long position in VIX futures that is bigger when VIX is relatively low and smaller when it is relatively high; and, (2) a rolling short position in one-month variance swap contracts to exploit the tendency of option-implied volatility to exceed realized volatility (volatility risk premium). The former lowers the downside risk of holding equities, and the latter offers returns from selling “insurance” against volatility. Because the return distributions of such volatility investments are clearly non-normal, the authors employ a risk-return optimization approach that takes distribution skewness and kurtosis into account. Using S&P 500 Index, VIX, VIX futures and S&P 500 Index variance swap contract data as available over the period February 1990 through August 2008, they find that:

- The long volatility (LV) strategy implemented by a rolling, scaled long position in VIX futures partially hedges downside equity risk. The volatility risk premium (VRP) strategy implemented by selling a series of variance swaps substantially increases returns for a given level of risk. Specifically:

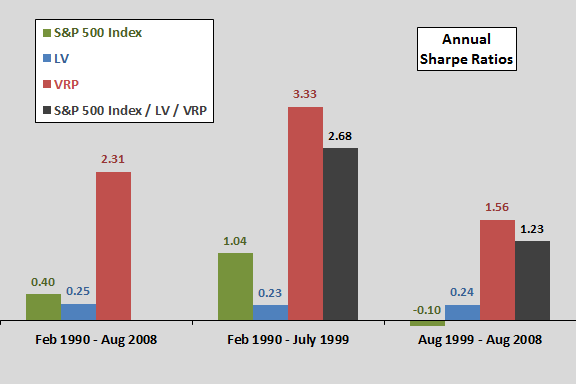

- Over the entire sample period, the long equity, LV and VRP strategies generate annualized returns of 7.9%, 7.0% and 37.1%, respectively, with Sharpe ratios 0.4, 0.2 and 2.3.

- While annualized returns for equities decrease markedly from 18.9% to 0.8% across two roughly equal subperiods, the LV strategy declines only from 8.3% to 6.7%. The VRP strategy, which is strongly profitable except during intervals with jumps in realized volatility (market crashes), generates annualized returns of 54.5% and 24.0% in the two subperiods.

- The best (worst) monthly returns for the LV and VRP strategies are 31.3% and 11.7% (-12.5% and -16.3%), respectively.

- Over the entire sample period, the correlation between monthly returns of the long equity and LV (VRP) strategies is -0.44 (0.43), indicating substantial risk hedging (risk amplification). The monthly returns of the LV and VRP strategies are mutually hedging with correlation -0.44.

- Based on in-sample calibration during the first subperiod, the optimal allocations to the equity, LV and VRP strategies are about 26%, 29% and 44%, respectively. These allocations substantially improve annualized return and decrease risk compared to 100% equity during this subperiod, with the LV strategy essentially reducing risk and the VRP strategy essentially boosting return.

- Out-of-sample results for the second subperiod using these same allocations confirm the risk-reducing capacity of the LV strategy and the return-enhancing capacity of the VRP strategy. Compared with 100% equity, the three-asset portfolio increases annualized return from 0.84% to 11.6% and Sharpe ratio from -0.10 to 1.23 (see the chart below), and reduces maximum monthly loss from -13.4% to -6.7%.

The following chart, constructed from data in the paper, summarizes annual Sharpe ratios for the equity (S&P 500 Index), LV and VRP strategies separately over the entire sample period and two roughly equal subperiods, and for the combination of the three as optimized (in-sample) during the first subperiod and implemented (out-of-sample) during the second subperiod. Note that:

- The performance of the LV strategy is fairly steady, while those of the equity and VRP strategies are sensitive to strong market declines.

- The performance of the optimal combination is almost as good as the VRP strategy alone, and the combination beats the VRP strategy on other risk metrics such as maximum monthly loss.

In summary, evidence suggests that a well–calibrated combination of a dynamic long strategy in implied stock market volatility and a volatility risk premium exploitation strategy substantially enhances the absolute and risk-adjusted returns of the broad U.S. stock market.

Note that:

- Scaling of the long VIX futures position according to the level of VIX appears to be critical to LV strategy profitability, in contrast with the findings summarized in “Feasibility of Diversifying Equities with Volatility Futures”.

- A combination of the LV and VRP strategies (with no equity position) may be interesting.

Reasons to be cautious about the findings include:

- To enable extended backtesting, this study models the VIX futures and variance swap markets prior to their actual availability, thereby introducing uncertainties derived from assumptions about how these markets would have behaved if they existed (with regard to both prices and capital requirements).

- In some ways, the sample may be very small. The performances of both the LV and VRP strategies may depend critically on the frequency and severity of market crashes (changes in VIX regimes) in the sample. The authors acknowledge that: “Although markets experienced several major crises over the period from 1990 to 2008, with significant volatility spikes, there is no assurance that, in the future, crises will not be more acute than those experienced over the testing period and that losses on variance swap positions will not be greater, thereby partly erasing the high reward associated with the volatility risk premium.” It would be interesting to know how the market crash of late 2008 through early 2009 impacts findings.

- The scaling rule for the long VIX futures position may involve data snooping, thereby biasing returns upward.

- The study appears not to include trading frictions for futures and variance swap contracts, which would dent profitability.

- Increased interest in volatility instruments may stimulate adaptive market behavior, with speed of adaptation perhaps depending on past profitability.

- Many investors may not have access to variance swap contracts.

See “Strategy Test” for results of an actual three-year test of a very simple way to exploit the volatility risk premium using equity index options.