Do differences in equity sector responses to stock market crashes (and associated volatility spikes) support an exploitably attractive sector rotation strategy? In the November 2020 update of his paper entitled “Actively Using Passive Sectors to Generate Alpha Using the VIX”, Michael Gayed examines a cyclical-defensive sector rotation strategy using the level of the CBOE S&P 500 Volatility Index (VIX) as trigger. Specifically, he iteratively favors defensive sectors (Utilities, Consumer Staples and Healthcare) when daily VIX is relatively low in anticipation of VIX increases and favors cyclical sectors (Technology, Industrials, Materials and Consumer Discretionary) to buy into high-VIX panics and benefit from VIX reversion. He considers:

- Three allocation schemes: (1) 100% long favored sectors and 100% short unfavored sectors; (2) 100% long favored sectors; and, (3) overweighting (underweighting) favored (unfavored) sectors by 5% to form a modified S&P 500 Index.

- Two weighting schemes for sets of defensive and cyclical sectors: (1) equal weighting, and (2) S&P 500 sector weighting.

- Two ways of applying the Nelder-Mead method to identify daily VIX levels that trigger defensive-to-cyclical and cyclical-to-defensive switches: (1) using only the first five years (1999-2004) of the full sample, and (2) using a 5-year rolling window throughout the sample period.

Using daily levels of VIX and the S&P 500 Index and daily prices of Select Sector SPDR Exchange Traded Funds (ETF) during January 1999 through October 2020, with strategy tests starting January 2005, he finds that:

- Investors tend to rotate into defensive sectors during times of relatively high VIX. Consequently, cyclical (defensive) sectors tend to outperform (underperform) over the 200 and 500 trading days after high levels of VIX.

- Over the available sample period, depending on estimation method, optimal levels of daily VIX for triggering defensive-to-cyclical (cyclical-to-defensive) switches are mostly in the 30s (low to upper teens).

- Rotating into equal-weighted cyclical sectors during times of high daily VIX and equal-weighted defensive sectors during times of low daily VIX generates higher annualized gross reward-to-risk (average return divided by standard deviation of returns) than buying and holding the S&P 500 Total Return Index (0.71 versus 0.54). However, this approach still suffers a deep maximum drawdown (-55%).

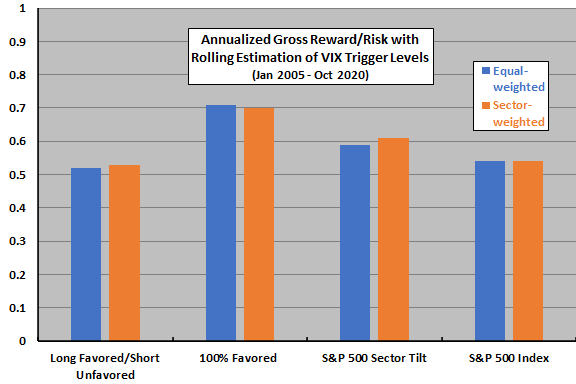

- 100% long favored sectors mostly works better than the other two allocation schemes (see the chart below).

- There is little difference in outcomes for equal versus S&P 500 sector weights for the cyclical and defensive sets of sectors.

- Rolling window optimization of VIX trigger levels generally works better than one-time estimation.

The following chart, constructed from data in the paper, compares annualized gross reward-to-risk ratios for the six of 12 sector rotation strategy alternatives based on rolling window optimization of VIX trigger levels. Results suggest that the simplest implementation (100% in either cyclical or defensive sectors) is best.

While the sector rotation strategy alternatives are competitive with or superior to the index on a gross basis, they all require daily rebalancing of sector holdings in addition to VIX-triggered switches between cyclical and defensive sectors.

In summary, evidence indicates that daily VIX level may offer useful information for timing switches between cyclical and defensive U.S. equity sectors.

Cautions regarding findings include:

- Performance results are gross, not net. Costs of daily rebalancing within sets of cyclical and defensive sectors (hundreds of trades per year), plus cost of switching between the two sets as triggered by VIX level would reduce returns. For the long-short alternative, any costs of shorting and daily rebalancing the long and short sides would further reduce returns.

- Over the test period (15.8 years), there are not many VIX triggers, suggesting that results are sensitive to the sample period used.

- As noted, the strategy alternatives with the strongest returns suffer deep maximum drawdowns.

- Testing 12 strategy alternatives on the same sample impounds data snooping bias (luck), such that the best-performing alternatives overstate expectations.

- Tracking optimal VIX trigger levels is beyond the reach of most investors, who would bear fees for delegating to an investment manager.

For other sector rotation ideas, see results of this search.