Are the relatively placid financial markets of the American Century evolving to a high-volatility regime in a more evenly competitive world? In his December 2011 paper entitled “Adaptive Markets and the New World Order”, Andrew Lo examines the implications of the Adaptive Markets Hypothesis (AMH), wherein “markets are not always efficient, but they are usually highly competitive and adaptive, varying in their degree of efficiency as the economic environment and investor population change over time.” He believes that investors can prepare for occasional failures of market efficiency by viewing financial markets and institutions from the perspective of evolutionary biology. Applying this perspective to markets since 1926, he concludes that:

- The core beliefs of traditional investing are:

- Higher risk means higher expected return.

- Asset returns are best measured linearly by alpha (excess return) and beta (riskiness) relative to a Capital Asset Pricing Model benchmark.

- Passive, long-only, highly diversified, market capitalization-weighted portfolios of equities generate reasonably good returns.

- Strategic asset allocation is the most important investment decision.

- All investors should be holding stocks for the long run.

- These beliefs implicitly assume that the relationship between risk and reward is linear, stable over time and subject to reasonably accurate estimation. They further assume that investors are rational and markets are efficient.

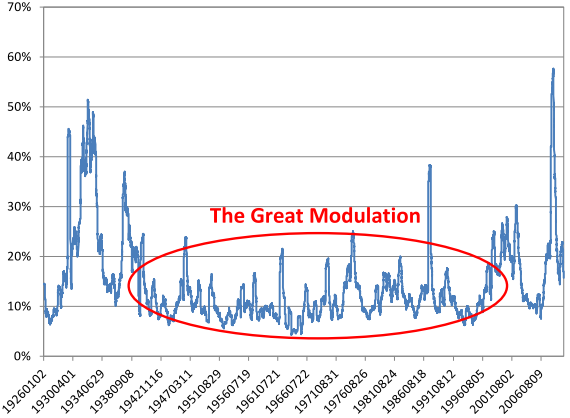

- The essential change in recent years is that U.S. no longer dominates the global economy as it did for much of the 20th century. The balance emerging among sizable competitors such as the U.S., Japan, Europe, China and India greatly changes the world economic order, thereby elevating uncertainty and volatility (see the chart below).

- AMH has several implications for investors:

- Investors should be alert to sudden increases in equity return volatility, with attendant “flight to safety” and temporarily violation of the normally positive relationship between risk and return. More generally, investors should recognize that the risk-reward trade-off is unstable, shifting between the (calm) “wisdom of crowds” and the (volatile) “madness of mobs.”

- Investors should continually measure market efficiency, the degree to which current market participants are adapted to the current economic environment.

- Investors should currently be diversifying globally according to factor exposures instead of, or in addition to, asset classes. More generally, investors should be alert to changes in the economic environment that might affect investment policy.

- Investors should recognize that competition, innovation and natural selection among investors and portfolio managers steadily transforms alpha into beta or extinguishes it.

- Investors should discard the traditional approach to strategic asset allocation and instead adapt to evolving economic environments and investor behavior. Alternative long-term allocation approaches include:

- Periodically adjust portfolio weights to maintain target risk levels, thereby decreasing exposures during high-volatility periods and inhibiting emotional overreactions. For example, an investor with a portfolio-level annualized return volatility target of 10% might maintain allocations of 5%, 3% and 1% volatility contributions from equities, bonds and commodities, respectively.

- Continually estimate all relevant parameters to maintain allocations that incorporate regime shifts, institutional changes, models of investor behavior and estimation error.

The following chart, taken from the paper, plots annualized volatility of daily returns for a broad, value-weighted index of U.S. stock over trailing 125-day windows during 1926 through 2009. The Great Modulation, lasting from about World War II through the rest of the 20th century, represents a period of relative calm bracketed by the aftermath of the 1929 stock market crash and the bursting of the technology bubble. Peak volatility occurs post-Lehman bankruptcy during the fourth quarter of 2008. The Great Modulation arguably derives from, and fades with, American economic dominance.

In summary, evidence from U.S. stock market volatility during 1926-2009 suggests the attractiveness of an adaptive, risk-based asset allocation policy.

Cautions regarding conclusions include:

- The argument is essentially retrospective, and the “New World Order” subperiod is very short for inference.

- Quantitative tools for implementing AMH are sparse and often complex.

- Empirical predictions and tests are lacking.

See also “Evolution of the Efficient Markets Hypothesis” and “Asset Allocation Strategy Horse Race”. For a different broad perspective, see “What Works Best?”.