Does a decade of underperformance by some widely followed stock value strategies mean it is time to throw in the towel? In their March 2020 paper entitled “Is (Systematic) Value Investing Dead?”, Ronen Israel, Kristoffer Laursen and Scott Richardson assess the value of (near-term, say two years) fundamental information as a driver of stock returns from both theoretical and empirical perspectives. They consider five widely used measures of value: (1) book value-to-price ratio (B/P); (2) earnings-to-price ratio (E/P); (3) forward earnings-to-price ratio (FEP); (4) sales-to-enterprise value ratio (S/EV); and, (5) cash flow-to-enterprise value ratio (CF/EV). They also investigate several recent arguments against value investing. Using data for large (small) capitalization stocks spanning 21 (25) countries with sample periods starting between 1984 and 2002 and all extending through 2019, they find that:

- Over available sample periods, based on portfolios that are long (short) the fifths of stocks with the highest (lowest) value measures, evidence is strongest for a gross value premium among small stocks and for E/P, S/EV and CF/EV measures of value.

- 24 of 30 possible global combinations (five measures of value, large and small stocks, three global regions) exhibit statistically significant gross value premiums over full sample periods. 15 of 30 premiums are highly significant.

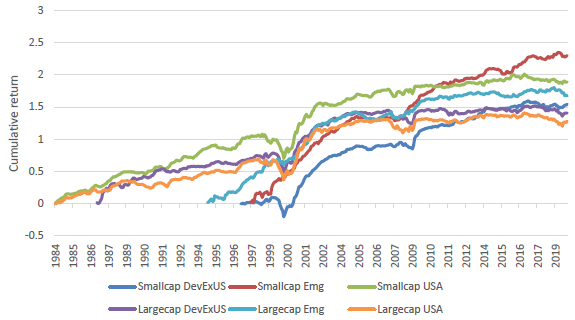

- An equal risk-weighted combination of the five value ratios that is country sector-adjusted, country rank-weighted/dollar-neutral and aggregated across countries by weighting each country by the square-root of its number of companies has done well on a gross basis over the last three decades across developed and emerging markets. However, over the last decade, large value and small U.S. value is weak (see the chart below).

- Controlling for sector or industry membership clearly improves value strategy gross Sharpe ratio. This approach essentially expands value breadth from a few sector/industry views to many stock-specific views.

- Evidence that share repurchase activity suppresses the value premium is mixed. For example, there is no evidence that B/P is a worse indicator of value for firms that repurchase the most.

- It is unlikely that growing importance of intangibles or changes in business models explains recent underperformance of value strategies.

- There is little empirical support for belief that low interest rates suppress the value premium.

- Value spreads (difference in average B/P between high-value and low-value stocks) have recently widened, making crowding an unlikely explanation for weakness of value strategies.

- There are times, such as recently, when stock prices become less connected with fundamentals and value strategies underperform.

The following chart, taken from the paper, tracks cumulative gross premiums for the combination value strategy (combining value measures) described above for large and small stocks separately for the U.S., global developed markets excluding the U.S., and global emerging markets as data become available. Premiums for large stocks and for small stocks in the U.S. are weak over the last decade.

In summary, widely used stock value strategies have not worked well in most markets over the past decade, but the overall body of evidence for value investing does not justify throwing in the towel on value investing.

Cautions regarding findings include:

- Reported performance data are gross, not net. Accounting for costs of periodic value portfolio reformation and shorting costs/constraints would reduce returns (making value even less attractive recently).

- Strategies described are beyond the reach of most investors, who pay fees for delegating to a fund manager.

- Different investors have different tolerances for when to throw in the towel.

See also the recent “Value Investing Dead?” and “Value Investing Not Dead?”.