Can commodities still be useful for portfolio diversification, despite their recent poor aggregate return, high volatility and elevated return correlations with other asset classes? In the May 2013 version of their paper entitled “Strategic Allocation to Commodity Factor Premiums”, David Blitz and Wilma de Groot examine the performance and diversification power of the commodity market portfolio and of alternative commodity momentum, carry and low-risk (low-volatility) portfolios. They define the commodity market portfolio as the S&P GSCI (production-weighted aggregation of six energy, seven metal and 11 agricultural commodities). The commodity long-only (long-short) momentum portfolio is each month long the equally weighted 30% of commodities with the highest returns over the past 12 months (and short the 30% of commodities with the lowest returns). The commodity long-only (long-short) carry portfolio is each month long the equally weighted 30% of commodities with the highest annualized ratios of nearest to next-nearest futures contract price (and short the 30% of commodities with the lowest ratios). The commodity long-only (long-short) low-risk portfolio is each month long the equally weighted 30% of commodities with the lowest daily volatilities over the past three years (and short the 30% of commodities with the highest volatilities). They also consider a combination that equally weights the commodity momentum, carry and low-risk portfolios. For comparison to U.S. stocks, they use returns of long-only, equally weighted “big-momentum” and “big-value” (comparable to commodity carry) stock portfolios from Kenneth French, and a similarly constructed “big-low-risk” stock portfolio. For comparison with bonds, they use the total return of the JP Morgan U.S. government bond index. For all return series and allocation strategies, they ignore trading frictions. Using daily and monthly futures index levels and contract prices for the 24 commodities in the S&P GSCI as available during January 1979 through June 2012, along with contemporaneous returns for a broad sample of U.S. stocks, they find that:

- Commodities have a lower average gross return, a higher volatility and a higher downside risk than U.S. stocks and U.S. government bonds over the entire sample period and the last ten years.

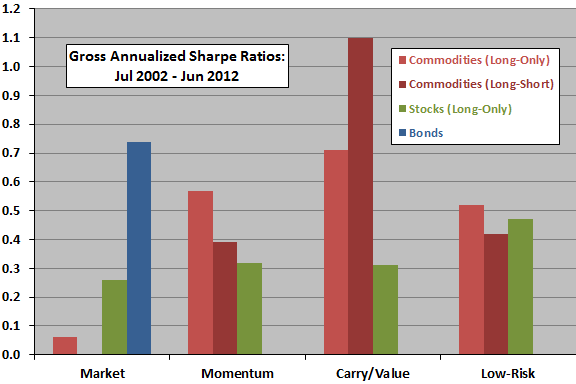

- However, commodity long-only and long-short momentum, carry and low-risk portfolios are competitive with comparable stock portfolios (see the chart below).

- Over the last ten years, an equally weighted combination of the long-only (long-short) commodity momentum, carry and low-risk portfolios generates a gross annualized Sharpe ratio of 0.70 (1.12), compared to 0.38 for an equally weighted combination of the long-only stock momentum, value and low-risk portfolios.

- Historical commodity-stock and commodity-bond return correlations are typically well below 0.50, but the commodity-stock return correlation increases sharply to about 0.75 in recent years.

- However, commodity momentum, carry and low-risk portfolio returns are largely uncorrelated with returns of their stock portfolio counterparts, indicating that these commodity portfolios remain attractive as portfolio diversifiers.

- For example, as of June 2012, the past three-year correlation between the U.S. stock market returns and those of an equally weighted combination of the long-short commodity momentum, carry and low-risk portfolios is only 0.21.

- Adding the commodity market portfolio to a traditional stocks-bonds portfolio offers little or no diversification benefit. In contrast, adding an equally weighted combination of the commodity momentum, carry and low-risk portfolios significantly boosts overall Sharpe ratio. Specifically:

- The gross Sharpe ratio for a 60%-40% stocks-bonds portfolio, rebalanced monthly, is 0.48 over both the entire sample period and the last ten years. Augmenting this portfolio with a 20% commodity market allocation, again rebalanced monthly, has little effect on the gross Sharpe ratio over the entire sample period and actually reduces it to 0.43 over the last ten years.

- However, augmenting the 60%-40% stocks-bonds portfolio with a 20% allocation to an equally weighted combination of the long-only (long-short) commodity momentum, carry and low-risk portfolios, again rebalanced monthly, boosts overall gross Sharpe ratio to 0.62 (0.81) over the entire sample period and 0.66 (0.80) over the last ten years.

- A more complex stocks-bonds portfolio that allocates 60% to an equally weighted combination of the stock momentum, value and low-risk portfolios and 40% to bonds, rebalanced monthly, generates a gross Sharpe ratio of 0.70 over the entire sample period and 0.60 over the last ten years. Augmenting this portfolio with a 20% allocation to an equally weighted combination of the long-only (long-short) commodity momentum, carry and low-risk portfolios, again rebalanced monthly, boosts overall gross Sharpe ratio to 0.81 (1.03) over the entire sample period and to 0.74 (0.89) over the last ten years.

The following chart, constructed from data in the paper, summarizes gross annualized Sharpe ratios during July 2002 through June 2012 for the commodity market (S&P GSCI), the U.S. stock market and the U.S. government bond market, and for long-only stock and both long-only and long-short commodity momentum, carry/value and low-risk portfolios as defined above.

Results show that, while overall commodity market performance is unattractive, performances of alternative commodity portfolios are generally competitive with those of comparable alternative stock portfolios.

In summary, evidence indicates that investors can continue to benefit from strategic allocation to commodities only by exploiting premiums from factors such as momentum, carry and low-risk.

Cautions regarding findings include:

- The strategies outlined involve a significant data collection/processing burden or, if delegated, administrative/management fees that would reduce performance.

- Monthly rebalancing of stock, bond and commodity portfolios/allocations would entail material trading frictions (likely highest for stocks). These frictions would reduce reported returns.

- Testing multiple strategies on the same data introduces data snooping bias, such that the best-performing alternatives likely overstate expected performance out-of-sample.