How can investors integrate global asset class diversification, pre-eminent factor premiums and crash protection? In his July 2016 paper entitled “The Trinity Portfolio: A Long-Term Investing Framework Engineered for Simplicity, Safety, and Outperformance”, Mebane Faber summarizes a portfolio combining these three principles, as follows:

- Global diversification: Include U.S. stocks, non-U.S. developed markets stocks, emerging markets stocks, corporate bonds, 30-year U.S. Treasury bonds, 10-year foreign government bonds, U.S. Treasury Inflation-Protected Securities (TIPS), commodities, gold and Real Estate Investment Trusts (REIT) .

- Value/momentum screens: For U.S. stocks, each month first rank stocks by value and momentum metrics and then pick those with the highest average ranks. For non-U.S. stocks, each month pick the cheapest overall markets. For bonds, each month pick those with the highest yields.

- Trend following for crash avoidance: For each asset each month, hold the asset (cash) if its price is above (below) its 10-month SMA at the end of the prior month.

The featured “Trinity” portfolio allocates 50% to a sub-portfolio based on principles 1 and 2 and 50% to a sub-portfolio based on principles 1, 2 and 3. Using monthly returns for the specified asset classes during 1973 through 2015, he finds that:

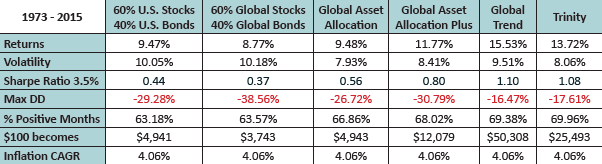

- The Trinity portfolio performs well across various market environments with reasonable risk compared to more passive conventional diversification (see the table below).

- The Trinity Portfolio, with balanced exposures to buy-and-hold and trend-following, encourages investors to hold the course when one approach underperforms the other over extended periods.

- Incautious selection of expensive funds/advisors can, for example, wipe out the gross gains from value/momentum tilts. Investors should diligently seek the lowest-cost implementation vehicles.

The following table, taken from the paper, summarizes gross performance metrics of the seven diversified portfolios considered in the paper, as follows:

- 60% U.S. Stocks-40% U.S. Bonds – monthly rebalanced blend of a capitalization-weighted U.S. stock index and U.S. Treasury bonds.

- 60% Global Stocks-40% Global Bonds – monthly rebalanced blend of a capitalization-weighted world stock index and global government bonds.

- Global Asset Allocation – monthly rebalanced blend of the 10 asset classes specified above, with allocations ranging from 1.8% for TIPS to 18% to a capitalization-weighted U.S. stock index.

- Global Asset Allocation Plus – similar to Global Asset Allocation, but with the monthly value and momentum screens specified above.

- Global Trend – each month hold the Global Asset Allocation Plus portfolio components that are: (a) in the top half of return momentum, and (b) above their 10-month SMA. For any high-momentum asset below below its 10-month SMA, substitute cash.

- Trinity – monthly rebalanced 50% allocation to Global Asset Allocation Plus and 50% allocation to Global Trend.

Gross performance metrics are annualized returns (Returns), standard deviation of annual returns (Volatility), Sharpe ratio based on an average risk-free rate of 3.5% (Sharpe Ratio 3.5%), maximum drawdown (MaxDD), percentage of months with positive portfolio return (% Positive Months), terminal value of $100 initial investment ($100 becomes) and compound annual growth rate of inflation (Inflation CAGR).

Results indicate that the Global Trend portfolio generates the strongest gross performance, but the Trinity portfolio is competitive based on gross Sharpe ratio.

In summary, evidence indicates that investors can improve the performance of very basic conventional diversification by expanding the set of assets considered globally, applying value/momentum screens to some asset classes and avoiding deep crashes via simple trend-following.

Cautions regarding findings include:

- Analyses are conceptual rather than tightly specified. Some specifications are vague or only implied. Per the author (with respect to implementing value and momentum tilts): “I don’t think that the exact factors or approaches matter greatly…”

- The paper employs indexes rather than tradable assets in backtests, ignoring costs/fees for maintaining liquid funds. Including such costs would reduce returns for all assets. The study also ignores costs of periodic rebalancing and trend signal execution. Moreover:

- These costs likely vary considerably over time, arguably affecting behaviors of asset markets during the sample period.

- Costs also vary by asset class, arguably altering optimal allocations.

- There may be data snooping bias inherited and aggregated from the cited prior studies, thereby overstating expectations.

- The 10-month SMA may not work for some asset classes as it has for the U.S. stock market. See “Do Conventional SMAs Identify Gold Market Regimes?” and “SMA Signal Effectiveness Across Stock ETFs”.

For deeper related analyses, see: