How well does technical trading work for spot currency exchange rates? In their April 2016 paper entitled “Technical Trading: Is it Still Beating the Foreign Exchange Market?”, Po-Hsuan Hsu, Mark Taylor and Zigan Wang test the effectiveness of a broad set of quantitative technical trading rules as applied to exchange rates of 30 currencies with the U.S. dollar over extended periods. They consider 21,195 distinct technical trading rules: 2,835 filter rules; 12,870 moving average rules; 1,890 support-resistance signals; 3,000 channel breakout rules; and, 600 oscillator rules. They employ a test methodology designed to account for data snooping in identifying reliably profitable trading rules. They focus on average return and Sharpe ratio for measuring rule effectiveness. They use empirical bid-ask spread data as available to estimate costs (averaging 0.045% one way for developed markets and 0.21% one way for emerging markets). They also test whether technical trading effectiveness weakens over time. Using daily U.S. dollar spot exchange rates and associated bid-ask spreads as available for nine developed market currencies and 21 emerging market currencies during January 1971 through mid-September 2015, they find that:

- Among developed market currencies, the Swiss franc appreciates the most on average (3.25% per year), and the New Zealand dollar depreciates the most (1.25% per year). Among emerging market currencies, the Slovak koruna appreciates the most (1.35% per year), and the Turkish lira depreciates the most (28.6% per year).

- Short-term annualized interest rates for daily trading in developed (emerging) markets range from 2.8% to 10.9% (0.8% to 47.2%).

- The most (least) volatile developed market currency is the Swiss franc (Canadian dollar). The most (least) volatile emerging market currencies are the Indonesian rupiah and Russian ruble (Taiwanese dollar).

- From in-sample testing over the entire sample period:

- Based on Sharpe ratios of technical trading rules in aggregate:

- Three of nine developed market currencies are predictable with 90% confidence. Trading the Japanese yen is most profitable (annualized Sharpe ratio 0.75).

- 10 of 21 emerging market currencies are predictable with 90% confidence. Trading the Colombian peso is most profitable (annualized Sharpe ratio 1.28).

- Regarding best-performing rules:

- For developed market currencies based on Sharpe ratio, the highest performing rules for all significant results are moving averages.

- For emerging market currencies based on Sharpe ratio, four of the nine most significant rules are moving averages, and three are support-resistance.

- Choosing based on Sharpe ratio generates a slightly different list of best trading rules compared to choosing based on average excess return.

- Robustness tests suggest that the best-performing trading rules:

- Skillfully time trade entry and exit.

- Do not consistently rely on frequent trading.

- Are attractively profitable for reasonable trading frictions.

- Regarding performance across subperiods:

- Developed market currencies are most predictable in early subperiods. There are only a few reliable rules in the 1980s, and none since the 1992-1996 subperiod.

- Emerging market currencies are also most predictable in early subperiods. However, they are more predictable in recent subperiods than are developed market currencies.

- Based on Sharpe ratios of technical trading rules in aggregate:

- For out-of-sample testing during January 2012 through mid-September 2015, with currency and rule selection based on Sharpe ratio through 2011:

- Out-of-sample Sharpe ratios for the three developed market currencies selected based on pre-2012 results (German mark, Japanese yen and New Zealand dollar) are 0.03, 0.29 and 0.54, respectively.

- Out-of-sample Sharpe ratios for the nine emerging market currencies selected based on pre-2012 results range from -0.49 to 1.91, with average 0.55 (see the chart below).

- Ancillary analyses suggest that success of technical trading in currency markets derives from irrational behavior corrected by feedback over time as argued by the Adaptive Markets Hypothesis.

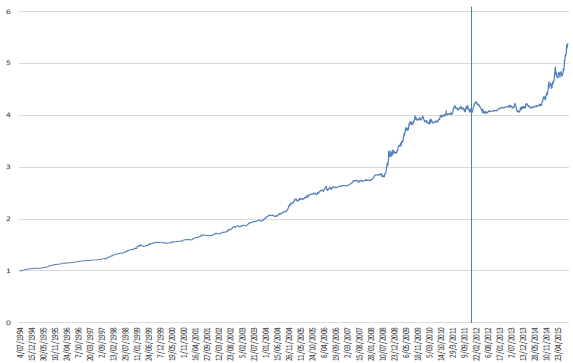

The following chart, taken from the paper, tracks cumulative value of $1 invested on July 4, 1994 (when all 21 emerging market currencies become available) in an equally-weighted portfolio of trading rules generating the highest in-sample (pre-2012) emerging market Sharpe ratios, including historical trading frictions. The vertical line marks the break between in-sample and out-of-sample subperiods. The investment grows to $4.06 by the end of 2011 and further increases to $5.36 by the end of the sample period.

In summary, evidence indicates the effectiveness of technical trading rules for spot currency exchange rates diminishes over time, but may still be attractive for emerging market currencies.

Cautions regarding findings include:

- The data collection/computational burden of searching for best-performing technical trading rules across many currencies is likely beyond the reach of most investors, who would bear fees for delegating this work to a fund manager/advisor.

- The assumed level of trading friction based solely on bid-ask spreads may not be realistic for all traders.

- The out-of-sample performance in the chart above is inconsistent, suggesting that the return distribution may be wild. The spikes in value at the end of the out-of-sample subperiod may not be representative.

See also the closely related “Comprehensive, Long-term Test of Technical Currency Trading” and “Technical Trading Thoroughly Tested on Emerging Currencies”.