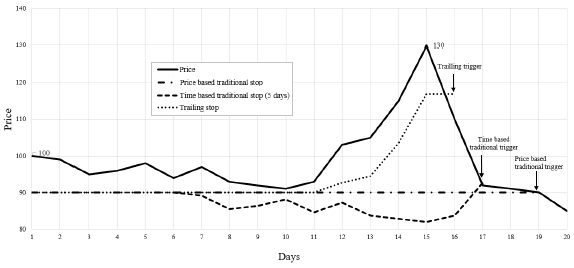

How well do trailing stop-loss rules work for U.S. stocks? In their March 2019 paper entitled “Risk Reduction Using Trailing Stop-Loss Rules”, Bochuan Dai, Ben Marshall, Nick Nguyen and Nuttawat Visaltanachoti evaluate effectiveness of trailing stop-loss rules. Traditional stop-loss rules are price-based or time-based. Trailing stop rules sell (buy back) a stock when it declines X% from a high price (rises X% above a low price). The initial trailing stop is X% below the purchase price, remaining at this level unless the stock price rises and escalates to X% below each new high. Stock sales occur at the close on the day after respective stop-loss triggers, with proceeds moved to U.S. Treasury bills (T-bills). Stock re-entries occur at the close on the day after respective buy triggers (see the figure below). They consider trailing stop thresholds of 1%, 5%, 10% and 20%. They use buy-and-hold as a benchmark. Using daily returns for 25,997 common stocks, including delisted stocks, during July 1926 through December 2016, they find that:

- Trailing stop-loss rules have lower average gross returns but also lower volatilities than buy-and-hold strategy, with mostly lower gross Sharpe ratios.

- However, they beat buy-and-hold on a gross basis for a certainty equivalents model of risk adjustment that employs typical levels of investor risk aversion, and they suppress tail risk compared to buy-and-hold as measured by either value-at-risk or expected shortfall.

- Trailing stop-loss rules are particularly effective:

- For stocks eventually delisted.

- For stocks that are relatively volatile, liquid and expensive (low book-to-market ratios).

- In declining markets.

- Trailing stop-loss rules work better in recent than early subperiods.

The following chart, taken from the paper, illustrates how different types of stop-loss rules with a 10% threshold work for potential exit of a hypothetical stock with initial price 100. The trailing stop-loss rule tracks and captures some of a price increase, but traditional rules do not.

In summary, evidence indicates that trailing stop rules work better than conventional stop-loss rules, and in some ways better than buy-and-hold, on a gross basis for individual U.S. stocks.

- As noted, results are gross, not net. Accounting for trading frictions driven by exit and re-entry signals would reduce stop-loss rule performance, such that net findings may differ from gross findings. Moreover:

- Turnover is very high for tight stops (low thresholds).

- Liquidity may diminish, and trading frictions therefore be unusually high, during stop-out conditions (especially for loose stops).

- Trailing stop-loss rules likely generate higher turnovers than comparable traditional stop-loss rules.

- Using intraday triggers may affect results and increase turnover.

- Disproportionate influence of delisted stocks is problematic because:

- It is unlikely that many investors hold such stocks.

- Identification of delisted stocks is in-sample, not predicted.

- Such stocks may be thinly traded and subject to extraordinary trading frictions.

- At a portfolio level, deep trailing stops (high thresholds) likely trigger at about the same time during market crashes, thereby moving a multi-stock portfolio mostly to cash. A simpler strategy that holds a broad equity fund with a moving average exit/re-entry rule may work similarly with far less tracking and trading.

See results of this search for related research summaries.