Do mutual fund managers who employ technical analysis outperform those who do not? In their January 2013 paper entitled “Head and Shoulders above the Rest? The Performance of Institutional Portfolio Managers who Use Technical Analysis”, David Smith, Christophe Faugere and Ying Wang compare the aggregate investment performance of mutual funds that (self-reportedly) using technical analysis to that of funds not using technical analysis. Self-reported importance of technical analysis is on a five-level scale: “very important,” “important,” “utilized,” “not important” or “not utilized.” Using technical analysis importance levels and monthly returns for 10,452 actively managed U.S. equity, global equity, U.S. balanced and global balanced mutual funds during January 1993 through March 2012 (231 months), they find that:

- The percentage of fund managers reporting that technical analysis is very important, important or utilized ranges from 13% for U.S. balanced-funds to 32% for U.S. equity funds. Overall, only 3.3% of fund managers regard technical analysis as very important.

- Among other portfolio decision factors, technical analysis correlates most (least) with momentum (price-to-book value ratio).

- Compared to funds that do not report use of technical analysis, funds that do:

- Have slightly higher equally weighted mean and median three-factor (market, size, book-to-market) and four- factor (plus momentum) alphas.

- Higher benchmark-adjusted returns, especially during bear markets.

- Higher performance volatility.

- Elevated return skewness and kurtosis (likely advantageous, in combination).

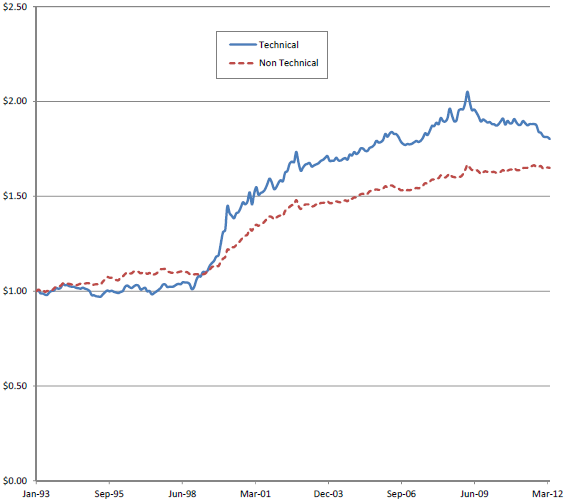

The following chart, taken from the paper, compares cumulative values of $1 initial investments at the beginning of 1993 in an equally weighted portfolio of mutual funds using technical analysis (Technical) versus an equally weighted portfolio of funds not using technical analysis (Non Technical) matched for fund type and investment style.

The Technical portfolio of funds has a higher terminal value, with most of its outperformance realized around 2000.

In summary, evidence suggests that mutual funds using technical analysis may provide a slight advantage to investors via outperformance during bad times.

Cautions regarding findings include:

- As noted, the outperformance of funds using technical analysis appears to concentrate strongly in a short window around 2000, suggesting that findings may be sample-specific.

- It may be that mutual funds utilizing technical analysis tend to allow higher allocations to cash (more market timing flexibility) than funds not utilizing technical analysis. In other words, funds that believe in technical analysis also believe in market timing and therefore adopt a policy that allows timing. Even random market timing generally beats full investment during bear markets (see “The 2000s: A Market Timer’s Decade?”).