Dollar cost averaging (DCA) is a very simple and intuitive way to buy more (less) of an asset when its price is low (high), thereby achieving some cost efficiency. Is there a simple and reliable way to enhance DCA? In their December 2011 paper entitled “Building a Better Mousetrap: Enhanced Dollar Cost Averaging”, Lee Dunham and Geoffrey Friesen examine allocation rules that retain attributes of traditional DCA but adjust to new information. Specifically, enhanced DCA (EDCA) rules adjust the amount invested in an asset according to its prior-month return. For example, one EDCA rule adds (subtracts) a fixed increment to (from) the planned monthly investment in an asset if its return for the prior month is negative (positive). Other alternatives adjust the incremental addition or reduction in monthly contribution depending on the value of the lagged monthly return. They employ both simulation and backtesting to measure the effects of EDCA. Using simulations of up to 30 years and monthly return data for six asset indexes and 100 mutual funds spanning 2000 through 2009, they find that:

- Simulations assuming that prices follow a random walk (as independent and identically distributed normal random variables) with 6% annual drift and annualized standard deviation 25% over investment horizons of 2, 5, 10 and 30 years show that fixed-increment EDCA reliably outperforms DCA based on average monthly returns over 85% of the time and on terminal wealth 62%-90% of the time (increasing with horizon).

- Average monthly return improvement for EDCA generally increases with the size of the monthly up/down increment but decreases with investment horizon.

- EDCA effectiveness increases with asset price volatility.

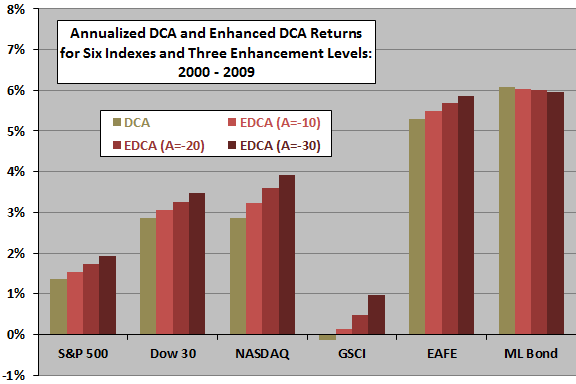

- Tests on monthly returns during 2000 – 2009 for six indexes (S&P 500, Dow Jones Industrials, NASDAQ Composite, Goldman Sachs Commodity, MSCI EAFE Index and Merrill Lynch Corporate Bond U.S. Master) with varying degrees of sensitivity to past returns suggest that EDCA beats traditional DCA for all except the corporate bond index (see the chart below), with annualized improvements ranging from about 0.2% to 1.1%.

- Tests on monthly returns during 2000 – 2009 for 100 largest mutual funds (48 equity, 49 taxable fixed income and three money market) suggest that EDCA is meaningfully effective only for equities (average annualized improvement 0.17% to 0.70%, depending on the sensitivity of cash flows to past returns). 47 of 48 equity funds show improvement with EDCA over the sample period. Only 12 of 49 fixed income funds and none of the money market funds benefit from EDCA.

The following chart, constructed from data in the paper, summarizes annualized returns for DCA and three EDCA rules applied during 2000 through 2009 to six indexes: S&P 500, Dow Jones Industrials (Dow 30), NASDAQ Composite, Goldman Sachs Commodity (GSCI), EAFE, and the Merrill Lynch Corporate Bond U.S. Master (ML Bond). The three levels of enhancement (A = -10, -20 and -30) generate increasing sensitivity to past returns. For example, the A = -10 rule adjusts the monthly investment by -10 times last-month return (+100% after a 10% monthly loss and -50% after a 5% monthly gain). Results show that:

- EDCA beats traditional DCA for all indexes except the ML Bond, but incremental gains are modest.

- EDCA effectiveness increases as rule sensitivity to past returns (magnitude of A) increases.

In summary, evidence from an array of tests suggests that investors employing dollar cost averaging to accumulate risky (volatile) assets may be able to boost performance by systematically investing more (less) after months with negative (positive) returns.

Cautions regarding findings include:

- The simulation assumption that monthly asset prices tamely follow random walks with normal distributions (zero autocorrelations and Gaussian tails) faces empirical challenges.

- Investors who use DCA may not have the flexibility to implement enhancements highly sensitive to past returns. For example, a string of large negative returns may dictate a succession of exceptionally large investment increments for which cash is unavailable.

- Data snooping bias derived from all the combinations of assets and investment increment scaling rules likely results in overstatement for the best outcomes.