Does adding crash protection based on global market breadth enhance the reliability of dual momentum? In their April 2016 paper entitled “Protective Asset Allocation (PAA): A Simple Momentum-Based Alternative for Term Deposits”, Wouter Keller and Jan Willem Keuning examine a multi-class, dual-momentum portfolio allocation strategy with crash protection based on multi-market breadth. Their principal goal is consistently positive returns, at least 95% (99%) of 1-year rolling returns not below 0% (-5%). Their investment universe is 13 exchange-traded funds (ETF), 12 risky (SPY, QQQ, IWM, VGK, EWJ, EEM, IYR, GSG, GLD, HYG, LQD, TLT) and one safe (IEF). Each month, they:

- Measure the momentum of each risky ETF as ratio of current price to simple moving average (SMA) of monthly prices over the past 3, 6, 9 or 12 months, minus one.

- Specify the safe ETF allocation as number of risky assets with non-positive momentum divided by 12 (low crash protection), 9 (medium crash protection) or 6 (high crash protection). For example, if 3 of 12 risky assets have zero or negative momentum, the IEF allocation for high crash protection is 3/6 = 50%.

- Allocate the balance of the portfolio to the equally weighted 1, 2, 3, 4, 5 or 6 risky assets with the highest positive momentum (reducing the number of risky assets held if not enough have positive momentum).

The interactions of four SMA measurement intervals, three crash protection levels and six risky asset groupings yield 72 combinations. They first identify the optimal combination in-sample during 1971 through 1992 and then test this combination out-of-sample since 1992. Prior to ETF inception dates, they simulate ETF prices based on underlying indexes. They assume constant one-way trading frictions 0.1%, acknowledging that this level may be too low for early years and too high for recent years. They focus on a monthly rebalanced 60% allocation to SPY and 40% allocation to IEF (60/40) as a benchmark. Using monthly simulated/actual ETF total return series during December 1969 through December 2015, they find that:

- The optimal PAA strategy in-sample (1971 through Dec 1992) employs a 12-month SMA, high crash protection and the top 6 risky assets. The annual Sharpe ratio for this combination is 1.06, compared to 0.33 for 60/40.

- Out-of-sample performance of this in-sample optimal PAA strategy is attractive, with Sharpe ratio 1.00 and maximum drawdown -8.8% (see the table and chart below).

- SHY and BIL perform nearly as well as IEF as the safe asset for this strategy. Picking either SHY or IEF based on 12-month momentum may be more resilient when rates are rising than IEF alone.

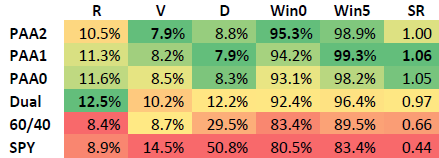

The following table, extracted from the paper compares out-of-sample (1993 through 2015) performances of six strategies based on in-sample optimal SMA measurement interval (12 months) and risky portfolio diversification (Top 6):

- PAA2: PAA with high crash protection.

- PAA1: PAA with medium crash protection.

- PAA0: PAA with low crash protection.

- Dual: Similar to PAA, but with allocation to IEF determined by number of top risky assets with negative momentum (these risky asset allocations go instead to IEF).

- 60/40: 60% allocation to SPY and 40% allocation to IEF, rebalanced monthly.

- SPY: Buy and hold SPY.

Performance statistics are compound annual growth rate (R), annual volatility (V), maximum drawdown (D), percentage of non-negative 1-year rolling returns (Win0), percentage of 1-year rolling returns not below -5% (Win5) and Sharpe ratio (SR). Results show that the in-sample optimal PAA2 is attractive based on both raw and risk-adjusted statistics.

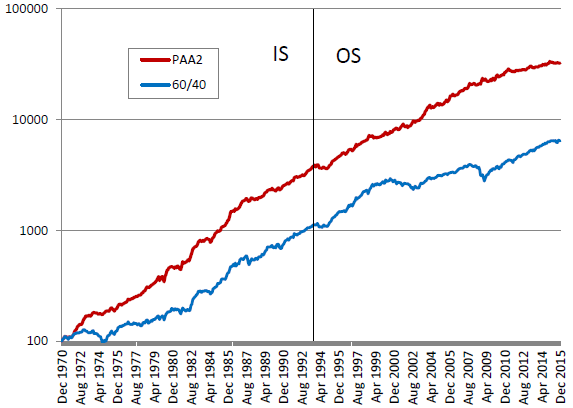

The following chart, also from the paper, tracks on a logarithmic scale cumulative values of $100 initial investments in the in-sample optimal PAA2 strategy and 60/40 over the in-sample (IS) and out-of-sample (OS) subperiods. PAA2 outperforms 60/40 both in-sample and out-of-sample essentially by replacing large drawdowns with steady positive returns.

However, it appears that PAA2 underperforms 60/40 during the 1990s and since 2008.

In summary, evidence indicates that an asset allocation strategy combining dual momentum and crash protection based on multi-market breadth may produce attractively steady investment performance.

Cautions regarding findings include:

- As noted, the assumed 0.1% level of trading frictions is much too low early in the sample period, thereby overstating expected performance.

- ETF manager costs passed along to investors would likely have been much higher early in the sample period than currently, thereby overstating simulated performance of ETFs prior to inception.

- Earlier availability of ETFs as asset class proxies may have altered investor practices and thereby affected market behaviors.

- The strategy has multiple moving parts. There may be snooping bias inherited from past studies of the out-of-sample period and/or complete in-sample/out-of-sample test iterations.

- Findings may be sensitive to the universe of assets considered.