A European subscriber asked about the effect of the dollar-euro exchange rate on the Simple Asset Class ETF Value Strategy (SACEVS) and the Simple Asset Class ETF Momentum Strategy (SACEMS). To investigate, we each month adjust the gross returns for these strategies for the change in the dollar-euro exchange rate that month. We consider all strategy variations: Best Value and Weighted for SACEVS; and, Top 1, equally weighted (EW) Top 2 and EW Top 3 for SACEVS. We focus on SACEVS Best Value and SACEMS EW Top 3. We consider effects on four gross performance metrics: average monthly return; standard deviation of monthly returns; compound annual growth rate (CAGR); and, maximum drawdown (MaxDD). Using monthly returns for the strategies and monthly changes in the dollar-euro exchange rate since August 2002 for SACEVS and since July 2006 for SACEMS, both through December 2020, we find that:

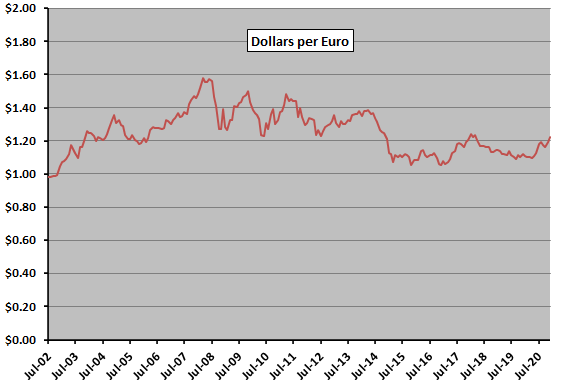

The following chart tracks dollars per euro since July 2002 based on end-of-month data, showing that the dollar sometimes appreciates versus the euro (dollars per euro falls) and sometimes depreciates (dollars per euro rises). Effects of changes in the exchange rate therefore depend on the sample period. It may be that the exchange rate is mean reverting over long periods, but not over periods of a few years.

How does this trajectory affect SACEVS and SACEMS?

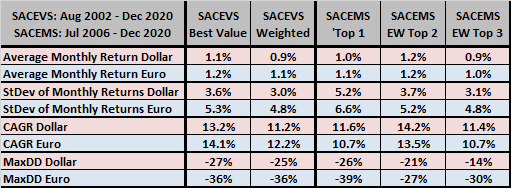

The following table compares performance metrics for all variations of SACEVS and SACEMS, unadjusted (Dollar) and adjusted for changes in the dollar-euro exchange rate (Euro) over available sample periods. Notable points are that exchange rate fluctuations:

- Do not hurt average monthly returns.

- Do make monthly returns more volatile and MaxDDs deeper.

- Increase CAGR for SACEVS and decrease CAGR for SACEMS.

The consistent volatility and MaxDD effects are likely inherent to an additional fluctuating variable in return calculations. CAGR effects are due to different sample periods. The SACEMS sample period misses a substantial dollar depreciation during 2002-2004.

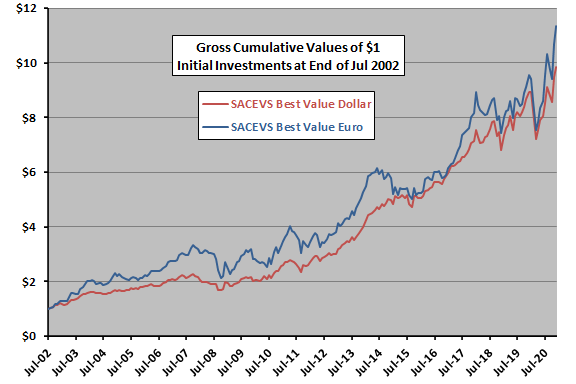

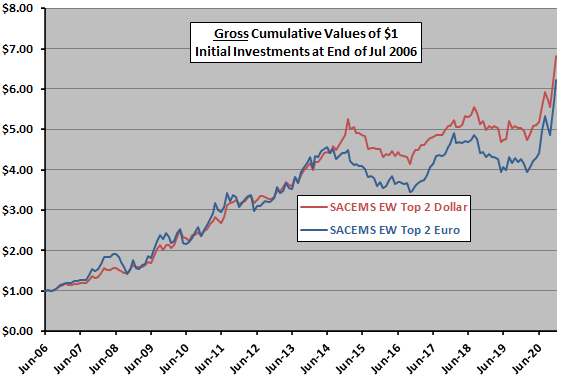

For additional perspective, we compare original and exchange rate-adjusted cumulative performances for SACEVS Best Value and SACEMS EW Top 2.

The next chart compares unadjusted SACEVS Best Value (Dollar) to exchange rate-adjusted SACEVS Best Value (Euro) over the available sample period. The latter mostly leads the former due to an extended dollar depreciation early in the sample period.

The final chart compares unadjusted SACEMS EW Top 2 (Dollar) to exchange rate-adjusted SACEMS EW Top 2 (Euro) over the available sample period. The two track closely until a year of strong dollar appreciation starting mid-2014 that drives the latter down relative to the former.

A non-U.S. investor wishing to invest in the strategies but avoid currency risk could employ a parallel currency hedge (which would involve costs) or implement the strategy in local asset class proxies (which may behave differently from U.S. counterparts).

In summary, available evidence indicates that introducing a currency exchange complication into SACEVS and SACEMS increases strategy volatilities and deepens drawdowns.

Cautions regarding findings include:

- Reported returns are gross, not net. Accounting for monthly portfolio reformation frictions as incurred would reduce these returns.

- There is latitude for parameter value snooping in each strategy. Also, testing multiple versions of a strategy on the same data introduces snooping bias.

- Results for dollar exchange rates for other currencies may differ.

- Anticipating directional effects of changes in the exchange rate would require accurate exchange rate forecasting.