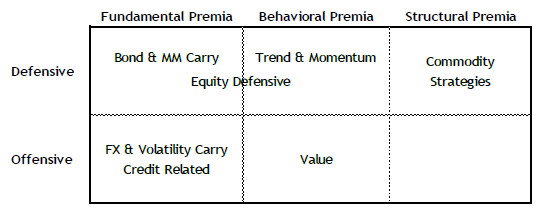

Do exposures to long-short factor (alternative risk) premiums (ARP) protect portfolios from stock and bond market crashes? In their February 2019 paper entitled “A Framework for Risk Premia Investing: Anywhere to Hide?”, Kari Vatanen and Antti Suhonen examine weekly correlations of 28 ARP composite returns with those of stocks (MSCI World Equity Market Index), bonds (Barclays Global Treasury Index) and commodities (Bloomberg Commodity Index), overall and during crashes, over an 11-year sample period. They form each ARP composite using both backtested and live data for at least three related strategies from different investment banks, weighted by inverse full-sample volatility and rebalanced weekly. They focus on ARP composite performances when stocks and bonds are weak. Based on findings, they then designate ARP composites as:

- Offensive (benefiting from high economic growth but suffering from low growth and economic turbulence) or defensive (diversifying risks of offensive strategies).

- Fundamental (based on investor risk aversion), behavioral (based on typical investor behavior) or structural (based on seasonal asset flows or on market inefficiencies and liquidity imbalances).

Using daily data as specified for long-short alternative risk premium strategies from seven global investment banks during January 2007 to the beginning of May 2018, they find that:

- For the full sample, ARP composites have:

- Generally low equity index betas, ranging from -0.09 (Commodity Trend) to 0.23 (FX Carry).

- Several statistically positive bond index betas, ranging as high as 0.75 for Fixed Income Trend and 1.03 for XA Trend.

- Low commodity index betas, ranging from -0.07 (Commodity Carry) to 0.14 (FX Carry).

- However, risk characteristics (volatilities and correlations) of most ARP composites are different for extreme equity and bond (but not commodity) market index returns. In other words, full-sample correlations represent linear dependencies mainly in the middle of equity and bond index return distributions but fail to describe tail dependencies. Specifically:

- In lowest and highest fifths (quintiles) of equity and bond index returns, most ARP composites have significantly positive betas for one of the two. Increases in betas are pronounced for the bond index.

- Very few ARP composites fully diversify distributions of both equity and bond index returns. Most promising are FX Value, Equity Value and commodity composites.

- Accounting for differences between full sample and tail correlations between ARP composite returns and equity and bond index returns argues for:

- Within the Fundamental category, distinguishing between bond-related defensive and mainly equity-related offensive strategies.

- Classification of value strategies as offensive and behavioral.

The following figure, taken from the paper, summarizes an updated ARP framework based on above findings. See the figure in “Categorization of Risk Premiums” for the prior perspective.

In summary, investors seeking to exploit the potential of alternative long-short risk premiums to diversify returns for stocks and bonds should consider both full-sample and tail diversification.

Cautions regarding findings include:

- The paper is conceptual. The authors do not speculate on optimal premium mixes or returns.

- As noted in the paper, the available sample period falls entirely within a secular decline in interest rates. Findings may differ during rising rates.

- ARP composite returns are gross, not net. Accounting for the costs of implementing the underlying strategies may affect findings.

- As noted in the paper, ARP composite returns include both backtested and live performance, with potential for selection/data snooping biases in the former.

- Weighting of ARP strategies within composites by inverse volatility over the full sample period incorporates look-ahead bias.

- Many investors do not hold portfolios large enough to diversify across many ARPs.

- Many investors do not have the capability to construct/implement portfolios exploiting some ARPs and would bear fees for delegating these tasks to an investment/fund manager.