How should investors think about alternative asset allocation strategies for risk management? In his May 2013 paper entitled “Advances in Portfolio Risk Control. Risk! Parity?”, Winfried Hallerbach offers a practitioner’s review of new and revived portfolio allocation strategies, including: Equal Weight, Maximum Diversification, Minimum Variance; Equal Risk Contribution (Risk Parity); Inverse Volatility; Maximum Sharpe Ratio; and, Volatility Targeting. He addresses their pluses and minuses and compares them to each other. He observes that the large contribution of equities to (downside) risk within portfolios that lean only moderately toward stocks provides the impetus for risk management research. Based on key studies of portfolio risk management and examples using monthly data for four U.S. asset classes (risk-free rate, stocks, aggregate Treasuries, corporate investment grade bonds, and corporate high-yield bonds) during June 2002 through May 2012, he finds that:

- Equal Weight is effectively a “buy low, sell high” strategy intended to profit from reversion of asset prices to trend, requiring no discrimination among assets based on predicted return means, volatilities and/or correlations. Equal weight portfolios may face the issue of allocating fairly large positions to illiquid assets.

- Maximum Diversification maximizes the “diversification ratio,” defined as the ratio of weighted volatilities and portfolio volatility. This approach does not have a unique solution and may produce high money and risk concentrations in some assets.

- Minimum Variance equalizes the betas of component assets relative to portfolio returns. It strongly favors low-volatility and low-beta assets and may produce very concentrated portfolios. It is very sensitive to slight changes (errors) in asset volatility and correlation predictions. Investors may need to apply constraints to limit portfolio concentration and turnover.

- Equal Risk Contribution (full Risk Parity) equalizes asset contributions to portfolio risk via inverse beta weights. It contains all assets in the universe and tends to be less concentrated than Maximum Diversification and Minimum Variance. It is less sensitive to variation in predictions than Minimum Variance. Calculations are daunting when the number of assets is large, and leverage may be needed to achieve return targets.

- Inverse Volatility (naive Risk Parity) weights component assets inversely to their standalone volatilities (normalized so that weights sum to one). For assets with high return correlations, results are similar to Equal Risk Contribution.

- Maximum Sharpe Ratio is very sensitive to slight changes (errors) in asset return (especially), volatility and correlation predictions and may produce high portfolio concentration. Investors may need to apply constraints to limit portfolio concentration and turnover.

- Volatility Targeting explicitly seeks to manage portfolio volatility over time, thereby benefiting from the generally negative correlations between expected volatilities and expected asset returns. Investors using this strategy may want to constrain allocations to assets exhibiting historically low volatilities to mitigate the risk of volatility blow-ups (price crashes).

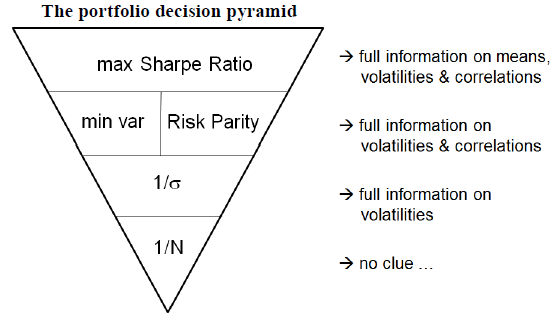

The following figure, taken from the paper, summarizes the information requirements (usefully accurate predictions) for increasing levels of portfolio allocation strategy sophistication. At the bottom of the inverted pyramid is Equal Weight (1/N), which requires no predictions. Next higher is Inverse Volatility, which requires only usefully accurate asset return volatility predictions. Next higher are Minimum Variance (min var) and Equal Risk Contribution (Risk Parity), both requiring usefully accurate predictions of asset return volatilities and correlations. At the top of the inverse pyramid is Maximum Sharpe Ratio, which requires usefully accurate predictions of asset return means, volatilities and correlations.

In summary, investors should think about implementing portfolio risk management via strategic allocation according to their beliefs in the material predictability of asset return means, volatilities and correlations.

Cautions regarding findings include:

- Some allocation strategies are complex. The associated collection of data, prediction of return statistics and computation of allocations is out of reach for many investors, and delegation of this work to a manager can be costly.

- As noted in the paper, some allocation strategies can produce seemingly unreasonable extreme allocations and generate high portfolio turnover. Assessment of net strategy performance is therefore important. The study examples consider only gross performance.

- Examples in the study employ in-sample (entire sample period) determination of asset weights to compare different strategies, to the disadvantage of equal weight. Out-of-sample (inception-to-date or rolling historical windows) may weaken performances for the prediction-sensitive strategies.

See also the similar “Overview of Risk-based Investment Allocations” and “Mean-Variance Investing Basics”.