A subscriber asked whether forcing the Simple Asset Class ETF Momentum Strategy (SACEMS) to agree with the Simple Asset Class ETF Value Strategy (SACEVS) when the latter assigns zero weight to stocks or government bonds improves the performance of the former. Specifically, the suggested change would force to Cash in SACEMS any allocation to SPDR S&P 500 ETF Trust (SPY) or iShares 20+ Year Treasury Bond ETF (TLT) occurring when SACEVS allocates 0% to SPY or TLT, respectively. To investigate, we impose this additional condition on SACEMS and compare detailed monthly and annual performance statistics for this new version of SACEMS (New) to the original version (Base). Using monthly SACEVS allocations and monthly dividend-adjusted prices of the SACEMS universe ETFs during February 2006 through July 2020, we find that:

The SACEVS allocation to SPY is never 0% during the sample period, so the rule has no effect on SACEMS allocations to SPY.

The SACEVS allocation to TLT is 0% for 79 months during this period (46% of the time), and SACEMS Top 1/2/3 allocates to TLT 13/15/3 times (31 total times) over these 79 months.

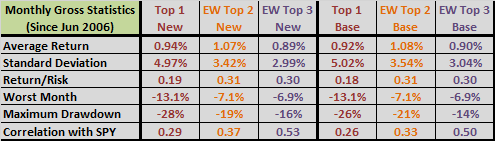

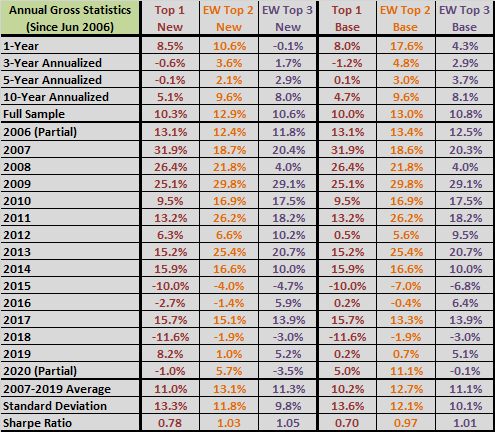

The following tables summarize gross monthly and annual SACEMS Top 1, EW Top 2 and EW Top 3 performance statistics with (New) and without (Base) replacing TLT with Cash for these 31 months. Annualized returns are compound annual growth rates (CAGR). Replacing TLT with Cash as specified:

- Modestly lowers portfolio volatilities.

- Raises portfolio monthly return correlation with SPY.

- Has mixed effects on CAGRs (a little weaker for EW Top 2 and EW Top 3) and maximum drawdowns.

- Modestly raises annual Sharpe ratios (using average monthly 3-month U.S. Treasury bill yield during a year as the risk-free rate for that year) by lowering volatilities.

Overall, findings are mixed.

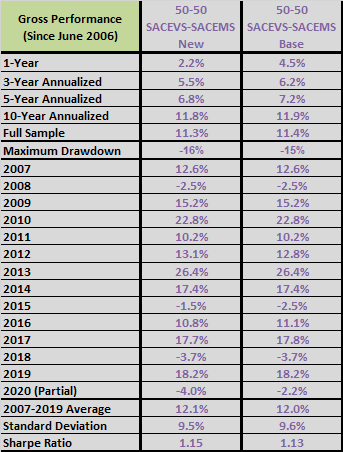

For additional perspective, we look at effects on the 50%-50% monthly rebalanced combination of SACEVS Best Value and SACEMS EW Top 3 (50-50 SACEVS-SACEMS).

The next table summarizes gross annual performance differences between 50-50 SACEVS-SACEMS with (New) and without (Base) replacing TLT with Cash in SACEMS as above. Replacing TLT with Cash as specified:

- Has a slightly negative effects on CAGRs at all horizons and on maximum drawdown.

- Has a slightly positive effect on annual Sharpe ratio.

In summary, evidence from available data offers little support for belief that forcing SACEMS to agree with SACEVS on TLT allocations improves model performance.

Cautions regarding findings include:

- Cautions for SACEMS and SACEVS apply.

- With only 31 allocation changes, differences are not statistically convincing.

- Moreover, testing an additional version of SACEMS on the same sample adds data snooping bias, effectively raising the bar for accepting model changes.