For investors embracing the concept of portfolios based on factor premiums (rather than asset classes), what is the best factor allocation approach? In their March 2019 paper entitled “Factor-Based Allocation: Is There a Superior Strategy?”, Hubert Dichtl, Wolfgang Drobetz and Viktoria-Sophie Wendt search for the best way of combining factors in a portfolio after accounting for bias introduced from snooping many alternative allocation strategies. They consider the following 10 factors (mostly long-short) suitable for a U.S. institutional investor constrained to global equity and fixed income securities: equity, value, size, momentum, quality, low-volatility, term, real rates, credit and high-yield. They construct factors using associated published indexes denominated in U.S. dollars, with 1-month U.S. Treasury bill (T-bill) yield as the risk-free rate. They consider 17 factor allocation strategies: equal weight, minimum variance, equal risk, maximum diversification, volatility timing, reward-to-risk timing, mean-variance optimization without and with shrinkage, Black-Litterman and eight combinations of these strategies. Their test portfolio holds a 100% position in cash and a fully hedged (long-short, or zero net investment) factor portfolio, subject to 0.5% trading frictions on portfolio turnover. Using monthly data required to construct factors and T-bill yield during January 2001 though December 2018, with the first 60 months set aside to estimate strategy inputs, they find that:

- Factor-based allocations are generally profitable, even after correcting for data snooping bias. The equity premium has the highest net average return (but with highest volatility and deepest drawdown), and the value premium the lowest. The term premium has the highest net annualized Sharpe ratio (0.79), and the value premium the lowest (0.09).

- Equity and high-yield premium returns exhibit the highest correlations with returns of other factors. As in other studies, value premium returns relate negatively to momentum premium returns.

- Term, real rate, credit, high-yield, quality and low-volatility premiums are sensitive (positively or negatively) to global equity returns.

- Equity, high-yield and (to a lesser degree) credit premiums suffer in a low growth-high inflation environment. In contrast, quality and low-volatility excel in this environment, but lag in more favorable economic conditions.

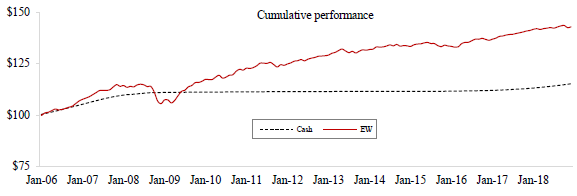

- Portfolios diversified across factors typically beat a pure cash portfolio over various market states. In general, sophisticated allocation strategies do not beat equal weight. In fact, during the January 2012 through December 2018 subperiod, only equal weight beats cash with statistical significance (see the chart below).

The following chart, taken from the paper, tracks cumulative performances of pure cash (Cash) and of an absolute return portfolio consisting of a 100% position in cash and an equal-weighted factor hedge portfolio during January 2006 to December 2018. Net annualized Sharpe ratio for the absolute return portfolio is 0.71, with maximum drawdown (during the global financial crisis) -8.2%.

In summary, evidence indicates that equal weighting of factor premiums is as good a way as any to exploit factor diversification.

Cautions regarding findings include:

- The available sample period is not long in terms of variety of financial market and economic conditions.

- Test assets are indexes. Costs of transforming these indexes into liquid funds would reduce returns and may vary by factor, thereby affecting findings.

- There may uncorrected snooping bias inherited from prior research via the choices of factors and allocation strategies considered.

- Using return on cash as a benchmark may not be acceptable to many investors.