How have value, quality, low-volatility and momentum equity factors, and combinations of these factors, performed in recent years. In their October 2020 paper entitled “Equity Factor Investing: Historical Perspective of Recent Performance”, Benoit Bellone, Thomas Heckel, François Soupé and Raul Leote de Carvalho review and put into context recent performances of these these factors/combinations as applied to medium-capitalization and large-capitalization World, U.S. and European stock universes. They consider both long-short and long-only factor portfolios and further investigate effects of (1) neutralizing beta and sector dependencies, (2) using multiple metrics for each factor and (3) including small stocks. Using firm accounting data and stock returns to support factor portfolio construction during 1995 through early 2020, they find that:

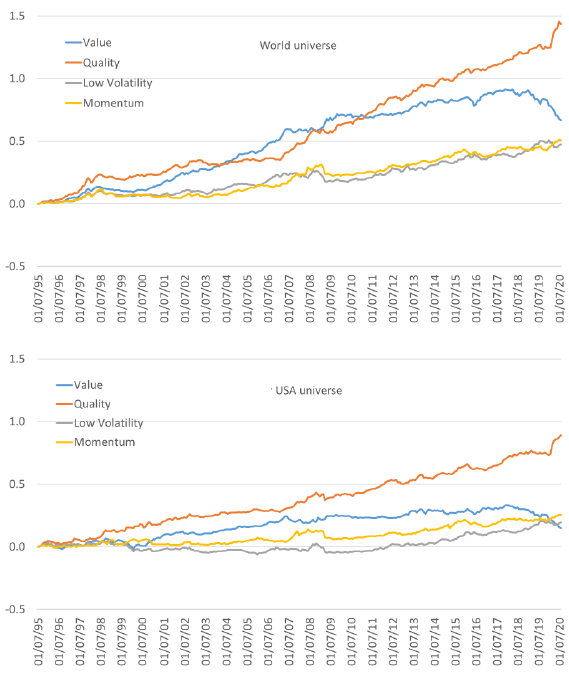

- Over the full sample period, all factors generate positive gross premiums, with quality easily winning at the end. Momentum and low-volatility are less strong than value and quality (see the charts below).

- Recently:

- Value strongly underperforms its long-term premium since about mid-2018

- Quality works well, strongly outperforming its long-term premium.

- Low-volatility and momentum perform approximately in line with their long-term premiums.

- Multi-factor strategies are unimpressive for typical implementations due to weak value performance.

- Some factor and multi-factor strategies also perform poorly during the late 1990s technology bubble and the 2008 financial crisis.

- During the full sample period, the size factor does not work for the specified stock universes, and its recent performance is exceptionally weak.

- Neutralizing beta and sector dependencies, and diversifying each factor across several definitions, materially improve factor portfolio performance.

The following charts, taken from the paper, track cumulative gross premiums for the long-short value, quality, low-volatility and momentum factor portfolios for the world (upper chart) and U.S. (lower chart) stock universes. For comparability, each factor portfolio is rebalanced monthly, beta-neutral, sector-neutral and targeted to 2.5% monthly volatility. Results show the recent exceptionally bad (good) performance of the value (quality) factor.

In summary, evidence suggests that crises perturb equity factor performance.

Cautions regarding findings include:

- Reported performance data are gross, not net. Accounting for monthly portfolio reformation frictions and ongoing shorting costs would reduce all returns. Shorting may not always be feasible as specified due to lack of shares to borrow.

- The study is retrospective only. The authors do not predict performance perturbation of any particular factor due to a crisis.

- Factor portfolio methods are generally beyond the reach of most investors, who would bear fees for delegating to a fund manager.