Do market capitalization (size) and book-to-market ratio systematically affect intermediate-term momentum and long-term reversal for individual stocks? In their February 2012 paper entitled “Momentum and Reversal: Does What Goes Up Always Come Down?”, Jennifer Conrad and Deniz Yavuz examine whether size and book-to-market ratio interact with momentum portfolio performance over intervals of 0-6, 6-12, 12-24 and 24-36 months after formation. They designate a stock as a winner (loser) if its 6-month lagged return is higher (lower) than the average for all stocks, with a skip-month before portfolio formation. They weight stocks within momentum portfolios by the absolute difference between its lagged 6- month return and that of all stocks, normalizing so that winner and loser sides contribute equally. They define three hedge portfolio types to measure risk factor-momentum interaction:

- MAX portfolios are long (short) past winners that are small and/or high book-to-market (losers that are large and/or low book-to-market).

- MIN portfolios are long (short) past winners that are large and/or low book-to-market (losers that are small and/or high book-to-market).

- ZERO portfolios are long (short) past winners (losers) with similar size and book-to-market characteristics.

They sort stocks by size and book-to-market into thirds. When combining factors, they define stocks as high (low) risk group if they are in the high-risk (low-risk) third for one factor and in or above (below) the middle-risk third for the other. Using returns and factor characteristics for a broad sample of U.S. stocks during 1965 through December 2010, they find that:

- Over the entire sample of stocks, past winners earn an average monthly gross return of 1.52% over the next six months, and a hedge portfolio that is long past winners and short past losers generates an average monthly gross return of 0.50% and an average monthly gross three-factor alpha (market, size, book-to-market) of 0.65%. Average monthly gross returns are -0.11%, -0.36% and -0.16% during months 6-12, 12-24 and 24-36 after portfolio formation, respectively.

- MAX and MIN hedge portfolios exhibit very different cumulative return patterns, driven by both the winner and loser sides. For example, when combining size and book-to-market sorts:

- The MAX portfolio generates average monthly gross returns of 1.31% during months 0-6 and 0.49% during months 6- 12, with no evidence of reversal over the next 24 months.

- The MIN portfolio generates average monthly gross returns of -0.18 %, -0.66%, -0.73% and -0.33% during months 0-6, 6-12, 12-24 and 24-36, respectively.

- ZERO portfolio performance lies between those of the MAX and MIN portfolios for every interval.

- More generally, momentum portfolios whose winner (loser) stocks have high (low) expected returns based on size and book-to-market ratio generate significant momentum profits with no subsequent reversals. Momentum portfolios whose winner (loser) stocks have low (high) expected returns based on these factors generate no significant momentum profits with strong reversals.

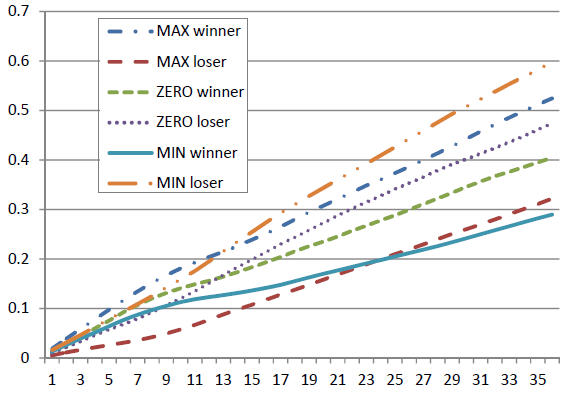

The following chart, taken from the paper, plots the cumulative gross returns of the average winner and loser sides of MAX, MIN and ZERO hedge portfolios during the 36 months after portfolio formation. This breakdown underlies the momentum and reversal behaviors of the hedge portfolios. For example:

The winner (loser) side of the MAX portfolio is very strong (weak) during the first nine months. Both sides subsequently follow trajectories with approximately equal slopes. The hedge portfolio therefore exhibits significant intermediate-term momentum with no reversal.

In contrast, the winner (loser) side of the MIN portfolio has a moderate (relatively strong) start over the first nine months, and then fades to relative weakness (maintains relative strength). The hedge portfolio therefore exhibits no intermediate-term momentum with significant reversal.

In summary, evidence indicates that investors may be able to amplify intermediate‐term momentum and long-term reversal of individual stocks by combining a momentum factor with size and book-to-market factors.

Cautions regarding findings include:

- Reported portfolio returns are gross, not net. Including reasonable trading frictions would lower these returns and, especially because small stocks tend to have higher frictions, may affect findings.

- Proliferation of portfolios introduces data snooping bias, mitigated by systematic progressions across the three portfolio types.

Compare this approach with that described in “Exploiting Momentum While Avoiding Long-term Reversal”.