Do broad (capitalization-weighted) stock market indexes exhibit factor tilts that may indicate concentrations in corresponding risks? In their August 2017 paper entitled “What’s in Your Benchmark? A Factor Analysis of Major Market Indexes”, Ananth Madhavan, Aleksander Sobczyk and Andrew Ang examine past and present long-only factor exposures of several popular market capitalization indexes. Their analysis involves (1) estimating the factor characteristics of each stock in a broad index; (2) aggregating the characteristics across all stocks in the index; and (3) matching aggregated characteristics to a mimicking portfolio of five indexes representing value, size, quality, momentum and low volatility styles, adjusted for estimated expense ratios. For broad U.S. stock indexes, the five long-only style indexes are:

- Value – MSCI USA Enhanced Value Index.

- Size – MSCI USA Risk Weighted Index.

- Quality – MSCI USA Sector Neutral Quality Index.

- Momentum – MSCI USA Momentum Index.

- Low Volatility – MSCI USA Minimum Volatility Index.

For broad international indexes, they use corresponding long-only MSCI World style indexes. Using quarterly stock and index data from the end of March 2002 through the end of March 2017, they find that:

- Most broad stock indexes are materially exposed to only two or three factors, with value and momentum increasingly prevalent.

- Factor tilts of broad stock indexes have generally strengthened in recent years in terms of power of factors to explain index movements.

- Major U.S. broad stock indexes often exhibit little or no exposure to the low volatility factor, suggesting potential diversification benefits from adding such a style fund to a portfolio holding broad indexes.

- For example (see the chart below), the mimicking factor portfolio for the S&P 500 Index as of March 31, 2017:

- Is 46.6% quality, 27.2% value and 26.2% momentum.

- Has no exposure to low volatility.

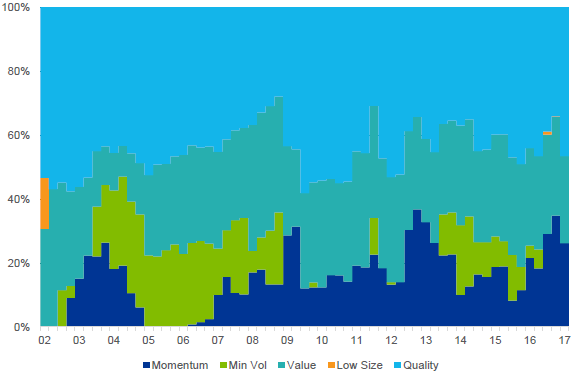

The following chart, taken from the paper, tracks composition of long-only style exposures of the S&P 500 Index over the last 15 years. Notable points are:

- The largest exposure is generally to quality, followed by value and momentum.

- There is hardly any size exposure.

- There is sometimes, as recently, no low volatility exposure.

In summary, evidence indicates that investors should regard broad indexes as factor-tilted and perhaps seek diversification via factors (style funds) not observed in these indexes.

Cautions regarding findings include:

- The authors do not quantify the hypothetical benefits of adding complementary style exposures to broad stock indexes.

- The methodology is beyond the reach of most investors, who would bear fees for delegating determination of broad index factor tilts to an advisor.