Are investors exhausting the potential of stocks? In his May 2014 presentation packages entitled “Has The Stock Market Been ‘Overgrazed’?” and “Momentum Has Not Been ‘Overgrazed'”, Claude Erb investigates the proposition that sanguine research and ever easier access to investments are exhausting U.S. stock market investment opportunities. In the first package, he focuses on trends in the overall equity risk premium, the size effect and the value premium. In the second, he focuses on momentum investing. Using U.S. stock market and equity factor premium returns and contemporaneous U.S. Treasury bill yields during 1926 through 2013, he concludes that:

- For U.S. equities from the 1920s to the end of 2013:

- The equity risk premium (relative to U.S. Treasury bills) trends from 8.4% to 4.4%, with overall average 6.4%.

- The size premium trends from 4.1% to 0.9%, with overall average 2.5%.

- The value premium trends from 6.1% to 0.5%, with overall average 3.5%.

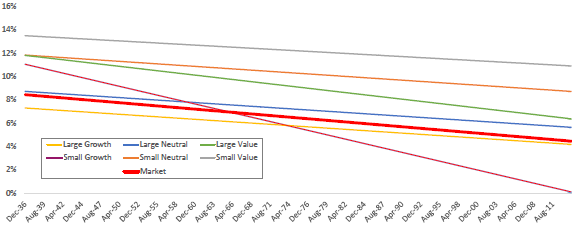

- Reasonably accessible two-factor combinations of these premiums also trend downward in varying degrees (see the first chart below).

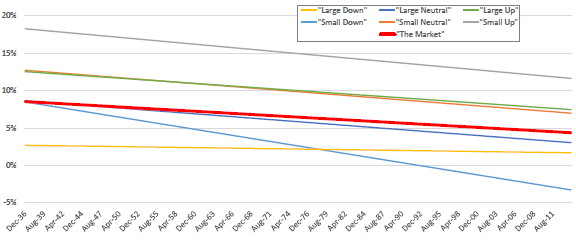

- Two-factor size-value combinations (building blocks) explain material parts of the performance of momentum and profitability factors, suggesting that performance trends for these popular factors are also downward. However, the momentum factor appears to be less overgrazed than than size and value factors (see the second chart below). For U.S. equities from the 1920s to the end of 2013:

- The premium for large stocks with upward momentum trends from 12.5% to 7.5%.

- The premium for small stocks with upward momentum trends from 18% to 12%.

- Extrapolation of trends suggests weakening prospects for equity investors, particularly those with long investment horizons.

The following chart, taken from “Has The Stock Market Been ‘Overgrazed’?”, summarizes premium trends for different long-only combinations of size and value stock factors from the 1920s to the end of 2013. All trends are downward, with small-growth and large-value especially steep.

Portfolios involving small stocks are generally more difficult to implement than those involving large stocks due to much smaller aggregate market capitalizations (carrying capacity) and higher trading frictions.

The next chart, taken from “Momentum Has Not Been ‘Overgrazed'”, summarizes premium trends for large and small stocks with up, down and neutral momentum from the 1920s to the end of 2013. All trends are downward, but premiums for small and large stocks with up momentum (implementable via long-only portfolios) remain relatively attractive.

Again, portfolios involving small stocks are generally more difficult to implement than those involving large stocks due to much smaller carrying capacity and higher trading frictions.

In summary, evidence suggests that investors should consider evidence of declining U.S. equity premiums when devising strategic allocations.

Cautions regarding conclusions include:

- Reported returns are gross, not net. Findings after incorporating reasonable portfolio maintenance (trading) frictions may differ. For example:

- Frictions vary considerably over time (see “Trading Frictions Over the Long Run”), and recent frictions are historically low, such that investors get to keep more of gross premiums now than in the past.

- Frictions for small stocks are generally higher than those for large stocks, such that investors get to keep less of premiums associated with small stocks.

- Overall size and value factor premium calculations involve unconstrained and costless shorting. Incorporating shorting constraints and costs, which vary over time, may alter findings.

Note that “overgrazed” carries the implication that investors are herd animals rather than individualistic hunters of alpha.