Are there equity styles that tend to perform relatively well during and after stock market crashes? In their April 2020 paper entitled “Equity Styles and the Spanish Flu”, Guido Baltussen and Pim van Vliet examine equity style returns around the Spanish Flu pandemic of 1918-1919 and five earlier deep U.S. stock market corrections (-20% to -25%) in 1907, 1903, 1893, 1884 and 1873. They construct three factors by:

- Separating stocks into halves based on market capitalization.

- Sorting the big half only into thirds based on dividend yield as a value proxy, 36-month past volatility or return from 12 months ago to one month ago. They focus on big stocks to avoid illiquidity concerns for the small half.

- Forming long-only, capitalization-weighted factor portfolios that hold the third of big stocks with the highest dividends (HighDiv), lowest past volatilities (Lowvol) or highest past returns (Mom).

They also test a multi-style strategy combining Lowvol, Mom and HighDiv criteria (Lowvol+) and a size factor calculated as capitalization-weighted returns for the small group (Small). Using data for all listed U.S. stocks during the selected crashes, they find that:

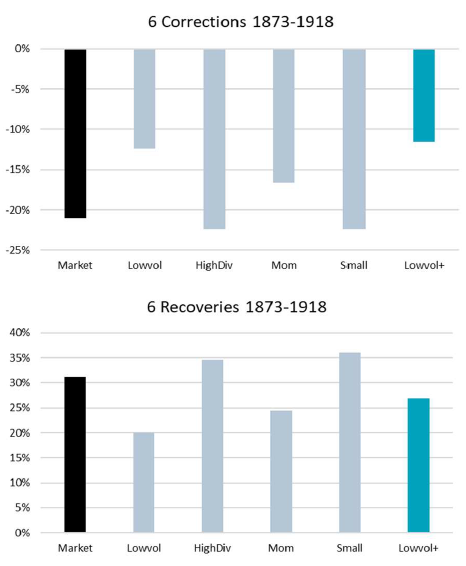

- Lowvol, Mom and Lowvol+ tend to outperform the market during crashes, while HighDiv and Small tend to underperform (see the upper chart below).

- In contrast, HighDiv and Small tend to outperform the market during recoveries, while Lowvol, Mom and Lowvol+ tend to underperform (see the lower chart below).

The following chart, taken from the article, summarizes average cumulative returns for the selected equity styles across six deep stock market corrections and across ensuing six recoveries.

In summary, evidence from six early crises suggests that equity investors should focus on low-volatility and momentum strategies during stock market crashes, and on high-dividend and small stocks during subsequent recoveries.

Cautions regarding findings include:

- Return calculations are gross, not net. Frictions involved in periodic reformation of factor portfolios during the late 1800s and early 1900s may be large and may differ across factors, such that net relative performance differs from gross relative performance.

- Efficient exploitation of findings problematically requires “calling” market bottoms.

- Broadening a portfolio to assets other than stocks may work much better than restricting investments to equity styles. See “Best Bear Market Asset Class?” and “Best Safe Haven ETF?”.