Analyses in “Shorting VXX with Crash Protection” suggest that one-month momentum may be a useful signal for trading in and out of a short position in iPath S&P 500 VIX Short-Term Futures ETN (VXX). A subscriber inquired whether a short-term version of this signal is effective. Specifically, how useful is a strategy that goes short VXX (to cash) at the close when the same-day VXX return is negative (positive)? To test this daily momentum signal, we consider basic daily return statistics and two VXX shorting scenarios: (1) shorting an initial amount of VXX and letting this position ride indefinitely (Let It Ride); and, (2) shorting a fixed amount of VXX and resetting this fixed position daily (Fixed Reset). For tractability, we ignore shorting costs/fees, but we do consider the trading frictions associated with entering and exiting a short position in VXX based on the daily momentum signal. Using daily reverse split-adjusted closing prices for VXX from the end of January 2009 through mid-April 2013, we find that:

Ignoring all trading frictions and shorting costs/fees, the average daily return for shorting VXX continually (per the daily momentum strategy, the “Strategy”) is 0.35% (0.29%) over the available sample period, with standard deviation of daily returns 3.95% (2.85%). The corresponding gross return-risk ratio is 0.09 (0.10). In other words, the Strategy produces a slightly higher gross return-risk ratio than a continual short position by suppressing volatility more than it lowers average gross return.

What happens when we account for the frictions from trading in and out of the short position (496 switches)?

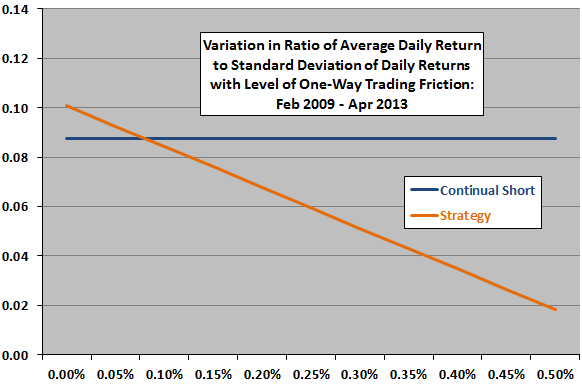

The following chart shows the variation in the return-risk ratio for the Strategy with level of one-way trading friction for entering and exiting VXX short positions over the available sample period. Results indicate that the Strategy loses its advantage over a continual short position for trading frictions above about 0.05%. The rate of degradation in Strategy performance as trading friction increases is substantial.

How do the daily statistics translate into cumulative performance?

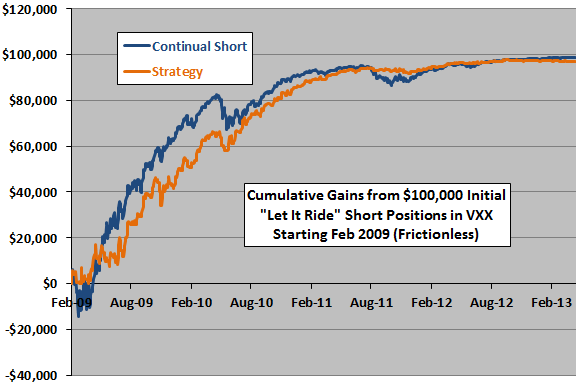

The next chart compares gross cumulative gain trajectories of two $100,000 initial “Let It Ride” short positions in VXX over the available sample period. Even for the frictionless case, results do not support belief that the Strategy is superior to a passive continual short position.

How do trading frictions affect terminal values?

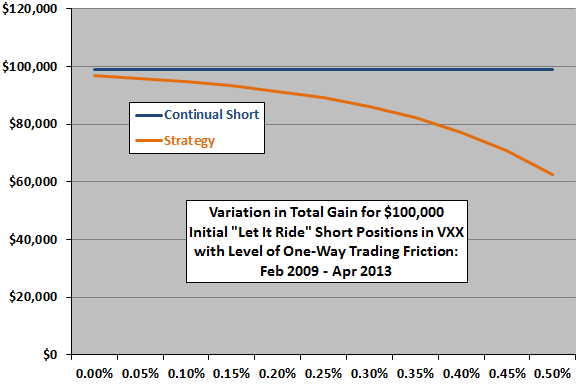

The next chart shows the variation in the “Let It Ride” terminal value for the Strategy with level of one-way trading friction for entering and exiting VXX short positions over the available sample period. Results show the effect of trading friction is material for this scenario.

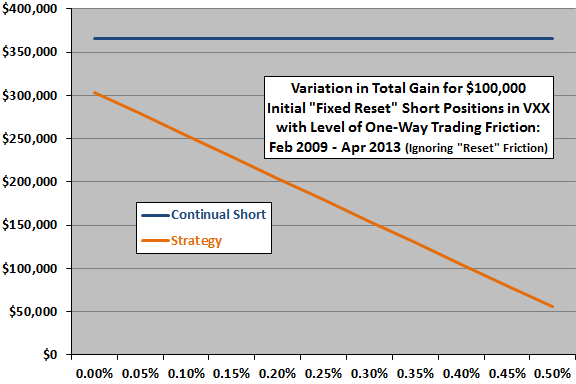

What about the “Fixed Reset” scenario?

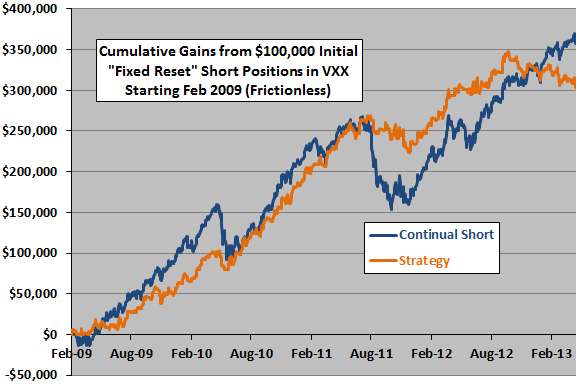

The next chart compares gross cumulative gain trajectories of two $100,000 “Fixed Reset” short positions in VXX over the available sample period. For the frictionless case, results suggest that the Strategy may sometimes be attractive compared to a continual short position due to volatility suppression.

How do trading frictions affect terminal values?

The final chart shows the variation in the “Fixed Reset” terminal value for the Strategy with level of one-way trading friction for entering and exiting VXX short positions over the available sample period. Results show the effect of trading friction is strong for this scenario (because the balance remains high for this scenario).

Note that this analysis ignores the trading frictions associated with daily reset of the short position to -$100,000. The cumulative effect of such frictions would be material for both the continual short position and the Strategy.

In summary, evidence from simple tests on available data does not support belief in the usefulness of a “one-day momentum” signal for entering and exiting a short position in VXX.

Cautions regarding findings include:

- As noted, all the above analyses ignore broker shorting costs/fees. Incorporation of such charges would lower all reported returns/gains.

- As noted, the “Fixed Reset” scenario ignores the daily frictions involved in adjusting the short position to the specified fixed amount. For daily adjustments, the cumulative effect of these frictions would be material.

- The sample period is short, especially with respect to number of VIX regimes. The available sample may not be representative of long-term VXX attrition and crashes. Specifically, the initiation date of VXX may represent a lucky start for one strategy as compared to another.

- Trading in the easily accessible VXX may have grown so intense that this ETN represents a substantial part of the demand for VIX futures, thereby changing the behavior of these futures.

- VXX is a financial instrument constructed from derivatives of a measurement of U.S. stock market expected volatility (not a real asset), dependent on the financial health of the offeror.