How fast must attentive investors be to exploit the information in new releases of major sentiment and economic indicators? In their November 2013 paper entitled “Early Peek Advantage?”, Grace Xing Hu, Jun Pan, and Jiang Wang measure the impacts of Michigan Consumer Sentiment Index releases on E-mini S&P 500 futures volume and price with and without a small group of fee-paying, high-speed traders with early access. Early means two seconds before the 9:55:00 public release during January 2008 through June 2013 (after which the provider, Thomson Reuters, discontinues early access). To assess release impacts, they sort the sentiment releases into three subsamples according to whether the initial market response is positive, negative or neutral. Using tick-by-tick E-mini S&P 500 futures volume and price data for 9:45:00 through 10:15:00 during January 2008 through October 2013, along with semi-monthly sentiment release dates, they find that:

- When the small group of high-speed traders has early access to sentiment releases:

- Trading is very heavy during the first second after 9:54:58 (more than 12 times normal trading volume).

- Most of the price adjustment occurs during the first 15 milliseconds after 9:54:58. Specifically, for days when the initial market reaction to a release is negative (positive), the average gross return during the:

- 15 milliseconds after 9:54:58 is -0.059% (0.042%).

- Second after 9:54:58 is -0.066% (0.046%).

- Second after 9:54:59 is -0.005% (0.012%).

- Minute after 9:55:00 is insignificant.

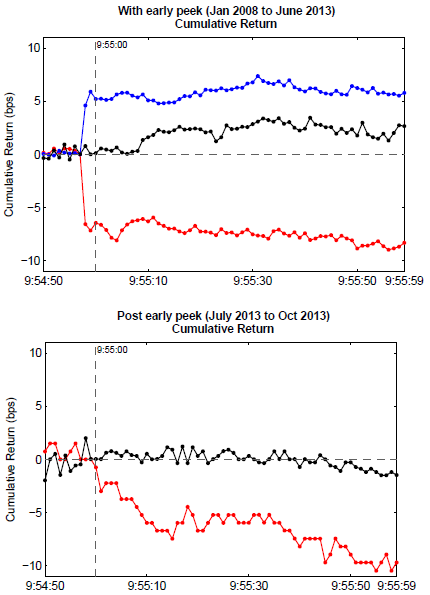

- For the very short sample after discontinuation of early release (only seven observations), volume is on average more dispersed and the speed of price discovery much slower (compare the charts below).

The following charts, taken from the paper, track average cumulative gross E-mini S&P 500 futures returns in basis points (bps) from 10 seconds before (9:54:50) to 60 seconds after (9:55:59) semi-monthly releases of the University of Michigan Consumer Sentiment Index. Public release is at 9:55:00. The charts separate price behaviors according to whether the initial market reaction to release is negative (red), positive (blue) or neutral (black). The upper chart covers a period during which a small group of high-speed traders have two seconds early access to releases. The lower chart covers a very short subsequent period after discontinuation of early access (during which there are no positive initial reactions). Cumulative returns are relative to price at the end of the second starting 9:54:57.

Results indicate that coordinated early access stimulates extremely rapid, decisive incorporation of new information. Without such access, the market incorporates new information more gradually (but still quickly).

In summary, evidence indicates that financial markets are currently capable of extremely fast adjustments to major economic/sentiment news. The sharper the focus of traders on the release, the faster the adjustment.

Turtle traders need not apply.

Cautions regarding findings include:

- Reported returns are small and gross, not net. Incorporation of trading frictions would lower potential gains.

- Sorting of releases into positive, negative and neutral market impacts is retrospective. An investor operating in real time could capture them only with foresight of the direction of initial impact.