Do some stocks react more strongly to economic uncertainty than others? In the March 2014 draft of their paper entitled “Cross-Sectional Dispersion in Economic Forecasts and Expected Stock Returns”, Turan Bali, Stephen Brown and Yi Tang examine the role of economic uncertainty in the pricing of individual stocks. They measure economic uncertainty as disagreement (dispersion) in quarterly economic forecasts from the Survey of Professional Forecasters, focusing on forecasts for the level of and growth in U.S. real Gross Domestic Product (GDP). They also consider quarterly forecasts for nominal GDP level and growth, GDP price index level and growth (inflation rate) and unemployment rate. They then use 20-quarter (or 60-month) rolling historical regressions to estimate the time-varying dependence (beta) of returns on economic uncertainty for each NYSE, AMEX and NASDAQ stock. Finally, they rank these stocks each month into tenths (deciles) based on their economic uncertainty betas and compare average future returns of the equally weighted deciles. Using quarterly economic forecast data and monthly returns for a broad sample of U.S. common stocks from the fourth quarter of 1968 (supporting tests of predictive power commencing October 1973) through 2012, they find that:

- Using dispersion in real GDP growth forecasts to measure economic uncertainty, stocks in the lowest economic uncertainty beta decile outperform those in the highest by a gross average 6.8% per year.

- The progression of average future returns is fairly systematic across deciles, supporting belief in a reliable effect.

- Gross average annual four-factor (controlling for market, size, book-to-market and momentum) alpha for this return is 8.3%, indicating that economic uncertainty risk is distinct from other commonly considered risks.

- Findings are also robust to controlling for short-term reversal, realized market volatility, implied market volatility, co-skewness, idiosyncratic volatility and analysts earnings forecast dispersion.

- Results are also robust for:

- Economic variable forecast horizons longer than one quarter.

- Quarterly and monthly estimates of uncertainty betas.

- Exclusion of smaller stocks.

- October 1973-May 1993 and June 1993-December 2012 subperiods.

- The power of economic uncertainty beta to predict stock returns persists nine months into the future.

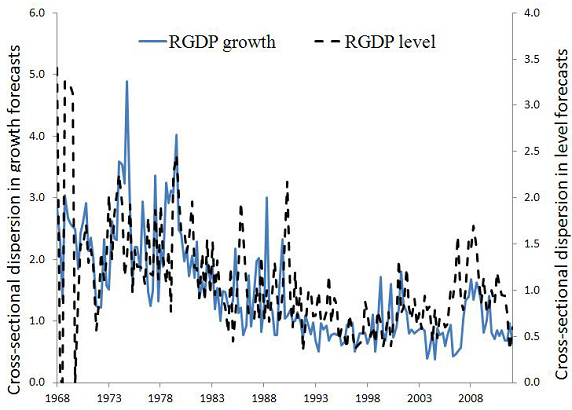

The following chart, taken from the paper, shows the dispersions of quarterly forecasts for real U.S. GDP growth and level as reported by the Survey of Professional Forecasters from the fourth quarter of 1968 through the fourth quarter of 2012. These measures of economic uncertainty track financial and economic activity. Specifically, economic uncertainty tends to be high during economic and financial market downturns.

In summary, evidence indicates that investors may be able to exploit the dependence of individual stock returns on economic uncertainty as measured by level of disagreement among expert forecasters (by identifying the safest stocks).

Cautions regarding findings include:

- Reported results are gross, not net. Accounting for the costs of periodic portfolio reformation would reduce performance. It is possible that trading frictions vary with economic uncertainty beta, such that net findings would differ from gross findings.

- Calculations required for periodic portfolio reformation may be out of reach for many investors, or costly if delegated.

- Individual investors may not be able to hold enough stocks for statistical reliability.