In reaction to “Federal Reserve Holdings and the U.S. Stock Market”, a subscriber suggested analysis of market reactions to announcements (starts/ends) of major Federal Reserve System interventions, such as the series of quantitative easing (QE) initiatives. Reactions to such announcement should precede changes in actual holdings. To investigate, we look at cumulative returns of SPDR S&P 500 (SPY) and iShares Barclays 20+ Year Treasury Bond (TLT) during the 30 trading days after each of the following announcements:

- 11/25/08: QE-1 initiated

- 3/16/09: QE-1 expanded

- 3/31/10: QE-1 terminated

- 11/3/10: QE-2 initiated

- 6/29/12: QE-2 terminated

- 9/13/12: QE-3 initiated

- 12/12/12: QE-3 expanded

- 10/29/14: QE-3 terminated

- 3/23/20: “QE-4” initiated

Using daily dividend-adjusted prices for SPY and TLT spanning these dates, we find that:

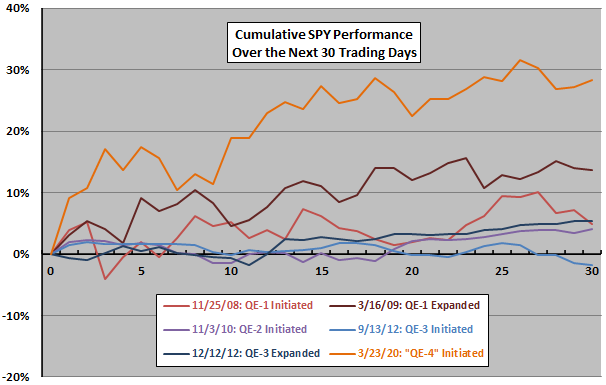

The following chart tracks cumulative SPY returns after QE initiations/expansions. Returns after QE-1 Expanded and “QE-4” Initiated are strong and persistent. Returns after the other four initiations/expansions are muted.

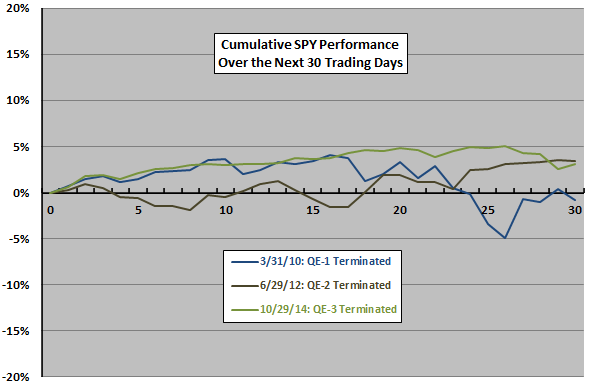

What happens to SPY after QE terminations?

The next chart tracks cumulative SPY returns after QE terminations. None of the three reactions are extreme.

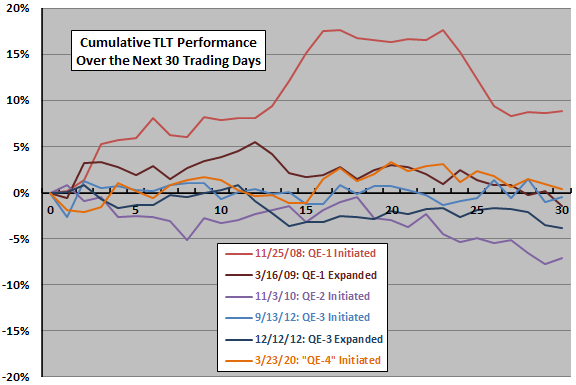

Next we look at QE effects on TLT.

The next chart tracks cumulative TLT returns after QE initiations/expansions. Return after QE-1 Initiated is strong and fairly persistent, while that after QE-2 Initiated is weak and somewhat persistent. Returns after other initiations/expansions are muted.

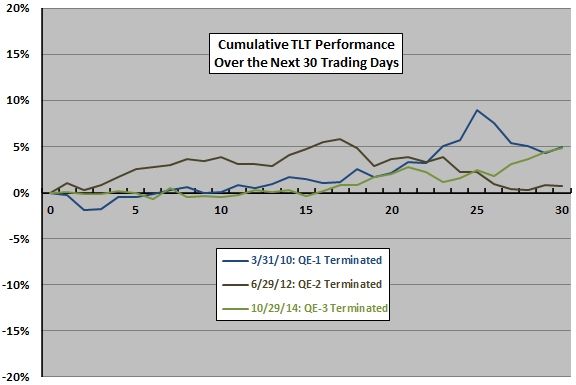

What happens to TLT after QE terminations?

The final chart tracks cumulative TLT returns after QE terminations. Returns are largely muted.

In summary, evidence from a very small sample of QE program initiations, expansions and terminations are not consistent enough to support much belief in predictability of market response.

Cautions regarding findings include:

- As noted, the sample of events is very small, such that only uniformly strong and consistent responses would support much belief in predictability.

- It may be that the market anticipates and prices in some of the announcements based on, for example, speeches and testimony of Federal Reserve Bank officials.