Can computer software extract exploitable sentiments about individual stocks as conveyed by news articles? In their June 2016 paper entitled “News Versus Sentiment: Predicting Stock Returns from News Stories”, Steven Heston and Nitish Sinha test whether firm news sentiment as interpreted by Thomson Reuters NewScope reliably predicts stock returns. Input data include article publication time, firm mentioned, headline, relevance to the firm, staleness and sentiment as generated a trained neural network. They exclude articles that: are duplicates; mention firms that do not match ticker symbols; and, have firm relevance scores below 35%. They train the neural network with 3,000 randomly selected articles from December 2004 to January 2006. They specify firm net sentiment as average positive sentiment minus average negative sentiment during the measurement interval (one day or one week). They assess predictive power of net sentiment via a hedge portfolio that is long (short) the equally weighted returns of the fifth, or quintile, of stocks with the highest (lowest) net daily or weekly sentiment. They also run a regression that controls for neutral news to isolate the effects of positive and negative news. Using firm sentiment outputs from the Thomson-Reuters news analytics engine for 900,754 articles published during 2003 through 2010, and associated daily stock returns, they find that:

- Over the sample period:

- Large stocks (average weekly return +0.06% for the largest tenth of stocks) outperform small large stocks (average weekly return -0.14% for the smallest tenth).

- Average net sentiment is a slightly positive 2.4%.

- News frequency increases with market capitalization, such that small firms do not

dominate sentiment-based return calculations.

- The hedge portfolio formed on daily news:

- Generates positive average returns on each of the 10 trading days before article publication, indicating that articles lag events that affect stock prices (past returns predict news).

- Generates an (unexploitable) average return of 1.99% on the publication day.

- Has significantly positive returns for only one or two days after publication (0.17% on Day 1 and 0.04% on Day 2) that do not reverse within 10 days.

- The hedge portfolio formed on weekly news:

- Generates an (at least partly unexploitable) average return of 3.75% during the publication week.

- Generates positive returns in each of the subsequent 13 weeks, most of which are statistically significant.

- Performs similarly even for stocks with only one article per week.

- Performs robustly after controlling for size and momentum effects.

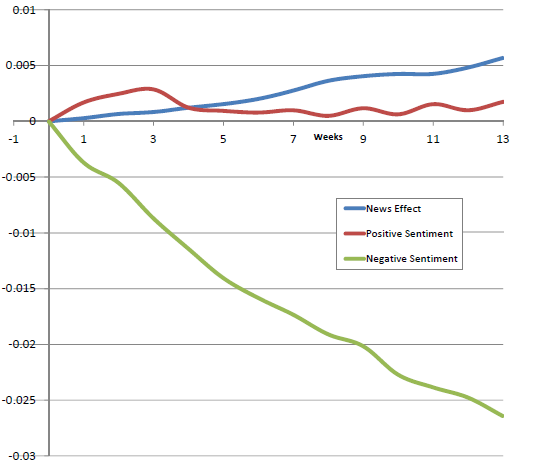

- A multivariate regression designed to detect the separate impacts of positive, neutral and negative weekly news indicates that (see the chart below):

- Neutral articles have an extended positive effect.

- Positive articles increase stock returns quickly, but outperformance does not persist.

- Negative articles have an extended negative effect, suggesting that shorting constraints slow incorporation of this news into stock prices.

The following chart, taken from the paper, compares average cumulative impacts of positive, neutral and negative weekly news over the next 13 weeks via multivariate regression. It shows that:

- Neutral articles tend to have a small, persistently positive effect throughout the next quarter. In other words, no news is not good news.

- Positive articles tend to have a positive effect over the next two or three weeks that subsequently reverses.

- Negative articles tend to have a persistently negative effect throughout the next quarter.

In summary, evidence indicates that automated interpretation of news sentiment predicts gross returns in the same direction as sentiment, with the positive (negative) sentiment effect fleeting (persistent).

Cautions regarding findings include:

- The 2008-2009 financial crisis represents a substantial portion of the sample and may strongly influence findings.

- Reported returns are gross, not net. Including costs of trading, shorting and the Thomson Reuters News Analytics service may alter findings.

- Data are stale with respect to any evolution of news sources and market adaptation to expanding availability of automated news processing since 2010.

- There may be data snooping bias in the specified 35% relevance threshold for excluding firm news articles, thereby overstating expectations.

- The study includes the data used to train the neural network software in the test sample. The authors assert that: “Given that the training sample was less than 1% of our data, the effect of data-snooping is miniscule [sic].”

Related research includes the following:

- “Predicting Stock Index Reversals with Amareos Sentiment Indicators”

- “Testing Sentdex Sentiment Trading Signals”

- “Short-term, News-driven Stock Momentum”

- “Processing News to Predict Stock Returns”

- “News, VIX and Stock Market Returns”

- “Watsonizing Financial Markets?”

- “Monthly News Sentiment Predicts Stock Market Returns?”