How uncertain are investors about cryptocurrencies, and what drives their collective uncertainty? In their March 2021 paper entitled “The Cryptocurrency Uncertainty Index”, Brian Lucey, Samuel Vigne, Larisa Yarovaya and Yizhi Wang present a Cryptocurrency Uncertainty Index (UCRY) based on news coverage, with two components defined as follows:

- UCRY Policy -weekly rate of cryptocurrency policy uncertainty news minus average weekly observed rate, divided by standard deviation of weekly observed rate, plus 100.

- UCRY Price – weekly rate of cryptocurrency price uncertainty news minus average weekly observed rate, divided by standard deviation of weekly observed rate, plus 100.

They distinguish between these two types of cryptocurrency uncertainty to understand differences in behaviors between informed (policy-sensitive) and amateur (price-sensitive) investors. Using 726.9 million relevant date/time-stamped news stories during December 2013 through February 2021, they find that:

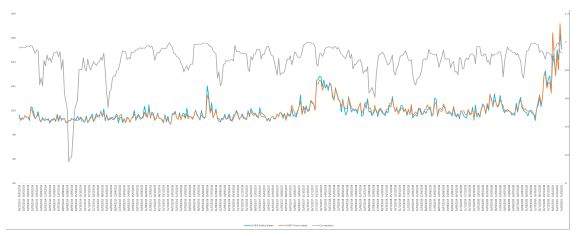

- Compared to similar indexes, UCRY is not volatile. In other words, uncertainties exist, but do not change quickly (see the chart below).

- UCRY exhibits distinct movements around major events in crypto-asset markets. For example:

- The Brexit vote, Donald Trump’s 2016 election victory, banning of Initial Coin Offerings by China, the bitcoin bubble and the decentralized finance (DeFi) take-off all increase UCRY Policy and Price.

- Some of the largest hacks of crypto-assets also affect these indexes.

- To date, fiscal policy changes contribute little to movements in UCRY Policy.

- The UCRY indexes more distinctly capture uncertainty attributable to crypto-asset news than do VIX and economic policy uncertainty (EPU) indexes. They also appear to capture uncertainty beyond that evident in bitcoin price.

The following chart, taken from the paper, tracks weekly UCRY Policy (blue) and Price (orange) indexes over the sample period. It also shows the rolling 26-week lagged correlation between the two series (gray). The two series generally track, but occasionally diverge.

In summary, Cryptocurrency Uncertainty Indexes offer a way to assess riskiness of crypto-asset investments.

Cautions regarding findings include:

- The crypto-asset market is immature, and the sample is short. Future behaviors may differ considerably from past behaviors.

- The authors make no attempt to relate uncertainty indexes to future crypto-asset price movements.

- Replication and extension of the indexes is beyond the reach of most investors, who would bear fees for delegating the work to a researcher.