Are stock return anomalies strongest when investor sentiment is highest or liquidity lowest? In the January 2015 draft version of his paper entitled “What Explains the Dynamics of 100 Anomalies?”, Heiko Jacobs addresses these questions. He first identifies, categorizes and replicates 100 well-known or recently discovered long-short stock return anomalies related to: violations of the law of one price, momentum, technical analysis, short-term and long-term reversal, calendar effects, lead-lag effects among economically linked firms, pairs trading, beta, financial distress, skewness, differences of opinion, industry effects, fundamental analysis, net stock issuance, capital investment and firm growth, innovation, accruals, dividend payments and earnings surprises. He measures the gross magnitude and direction of these anomalies via long-short extreme decile (stocks in top and bottom tenths as ranked by a specific variable) portfolios. He then examines how gross three-factor (market, size, book-to-market) alphas for these anomalies vary with:

- The Baker and Wurgler market-level investor sentiment index, adjusted for economic conditions.

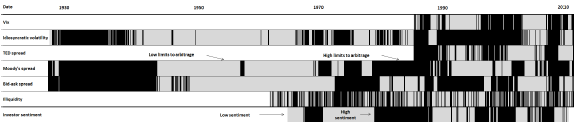

- Six measures of limits to arbitrage (cost of anomaly exploitation): VIX, average idiosyncratic volatility, TED spread, Moody’s credit spread, average bid-ask spread and market illiquidity.

Using monthly data as available for a broad sample of U.S. stocks, excluding those that are relatively small and illiquid, as available during August 1965 through December 2011 (many tests start much later and end January 2011), he finds that:

- Most anomalies produce economically large gross monthly three-factor alphas (an average of roughly 0.75% across time and anomalies),

- The Baker-Wurgler sentiment index strongly predicts anomaly returns.

- For more than 80% of the anomalies, elevated sentiment increases anomaly magnitude (significantly for 40%).

- On average across anomalies, the long-short extreme deciles spread is roughly 50% larger after months with above-median sentiment than after months with below-median sentiment.

- A one standard deviation increase in prior-month sentiment predicts an increase (decrease) in the average return for the long (short) side of about 0.03% (-0.18%) across anomalies.

- Limits to arbitrage metrics do not interact strongly with anomaly returns over time, with the partial exception of average idiosyncratic volatility (suggesting that this metric is the best measure of anomaly exploitability).

The following chart, taken from the paper, visualizes when the Baker-Wurgler sentiment index and the six metrics for limits to arbitrage are above their overall sample medians the previous month. Black (light grey) areas indicate relatively high (low) investor sentiment and relatively strong (weak) limits to arbitrage. See the paper for greater resolution.

In summary, evidence suggests that most cross-sectional stock return anomalies derive from investor irrationality such that high investor sentiment amplifies their abnormal returns.

Cautions regarding findings include:

- Determinations of whether the Baker-Wurgler sentment index and the limits to arbitrage metrics are above or below median is in-sample, requiring knowledge of the entire sample period. An investor operating in real time would have had only historical data and may have experienced different results.

- Some inputs for the fairly complex Baker-Wurgler sentiment index are available only with a substantial lag, and the publicly available series ends December 2010.

- Much research treats VIX as a measure of market-level sentiment, rather than limits to arbitrage. In this regard, the weak interaction of anomaly alphas with the simple and readily available VIX fails to corroborate findings for the more complex Baker-Wurgler sentiment index.

- Use of different sample period start dates for different anomalies may confound aggregate use.