Is the level of uncertainty among equity investors, as measured by the dispersion of S&P 500 Index option volume across strike prices, a useful predictor of stock market direction? In their January 2014 paper entitled “Stock Market Ambiguity and the Equity Premium”, Panayiotis Andreou, Anastasios Kagkadis, Paulo Maio and Dennis Philip investigate the ability of this dispersion in investor speculations (designated stock market “ambiguity”) to predict stock market returns. They argue that stock market ambiguity is a direct, forward-looking and readily computed indicator. They compare ambiguity to other commonly cited stock market predictors, with focus on the variance risk premium VRP). Using trading volumes for S&P 500 Index call and put options with maturities of 10 to 360 calendar days on the last trading day of each month, monthly data needed to calculate competing indicators and monthly returns for the broad U.S. stock market during 1996 through 2012, they find that:

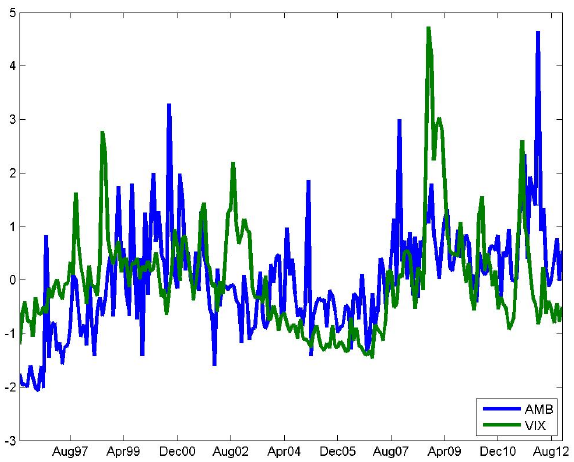

- Ambiguity is very different from market volatility (see the first chart below).

- Ambiguity relates negatively to future stock market excess return (relative to the risk-free rate) for horizons of one to 24 months. In other words, unlike other measures of disagreement, a higher (lower) ambiguity indicates lower (higher) expected stock market return.

- Ambiguity outperforms all other indicators tested, except VRP, as a stock market return predictor.

- Only ambiguity and VRP outperform the simple historical average return in out-of-sample prediction of stock market return.

- Combining ambiguity and VRP outperforms either indicator used separately.

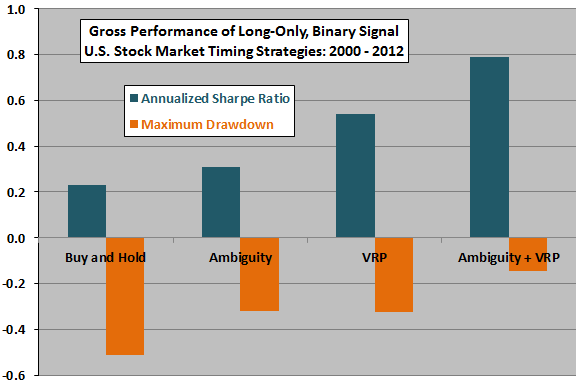

- A long-only timing strategy that each month during 2000 through 2012 holds the broad U.S. stock market (cash) according to whether a regression of past stock market return versus ambiguity indicates positive (negative) next-month return:

- Outperforms buy-and-hold based on both gross Sharpe ratio and maximum drawdown (see the second chart below).

- Generally underperforms a similar VRP-based strategy.

- Combines with VRP (via bivariate regression) to outperform ambiguity and VRP separately based on both metrics.

The following chart, taken from the paper, compares standardized behaviors of monthly ambiguity and implied S&P 500 Index volatility (VIX) during 1996 through 2012. Standardization means detrending so that sample period averages are zero and scaling so variances are one. The correlation between the two series is only 0.30, indicating that they potentially offer different kinds of information about the stock market.

The next chart, constructed from data in paper, compares gross Sharpe ratios and maximum drawdowns for three different long-only strategies that time the broad U.S. stock market:

- Ambiguity – Each month hold the stock market (cash) according to whether a regression of past monthly return versus monthly ambiguity indicates a positive (negative) next-month excess return.

- VRP – Each month hold the stock market (cash) according to whether a regression of past monthly return versus monthly VRP indicates a positive (negative) next-month excess return.

- Ambiguity + VRP – Each month hold the stock market (cash) according to whether a bivariate regression of past monthly return versus monthly ambiguity and VRP indicates a positive (negative) next-month excess return.

Buying and holding the stock market serves as a benchmark. Results indicate that both ambiguity and VRP beat the benchmark based on both performance metrics, with VRP generating a higher Sharpe ratio than ambiguity. Because the two indicators are largely unrelated, combining them improves both metrics.

The authors do not address trading frequency or trading frictions.

In summary, evidence indicates that investor ambiguity as measured by index option volume dispersion across strike prices may offer useful information about future stock market behavior (though not as much as the variance risk premium).

Cautions regarding findings include:

- Reported performance statistics for the above stock market timing strategies are gross, not net. Incorporating reasonable trading frictions would lower returns and may substantially reduce the value of ambiguity as a stock market indicator.

- Some threshold other than zero for expected return may improve stock market timing performance of the indicators tested (with data snooping bias accompanying optimization).

- Use of ambiguity and VRP as indicators involves significant data collection/processing burdens (or fees if delegated).

- It would be more direct and practical to use S&P 500 Index options or futures, rather than the broad U.S. stock market, for testing the stock market timing strategies.