Are readily available crowdsourced firm earnings estimates and stock sentiment measurements exploitable? In the September 2015 revision of their paper entitled “Tweet Sentiments and Crowd-Sourced Earnings Estimates as Valuable Sources of Information Around Earnings Releases”, Jim Kyung-Soo Liew, Shenghan Guo and Tongli Zhang investigate whether earnings estimates from Estimize and sentiment measurements from iSentium usefully predict stock behavior after earnings announcements. Estimize aggregates inputs from students, independent researchers, private investors, sell-side professionals and buy-side analysts to generate earnings estimates. iSentium derives sentiment scores (ranging from -30 to +30) from real-time natural language processing of Twitter texts about stocks, market indexes and exchange-traded funds. The authors relate pre-announcement earnings estimates and sentiment to post-earnings announcement stock returns. Using Estimize and iSentium data as available, Wall Street consensus earnings estimates, actual firm quarterly earnings and associated stock returns for 16,840 earnings announcements during November 2011 through December 2014, they find that:

- Estimize earnings estimates are somewhat more accurate than Wall Street consensus earnings. Estimize (Wall Street consensus) estimates are lower than actual earnings 52%-54% (65%-68%) of the time.

- iSentium tweet sentiment measurements offer economically and statistically significant information not contained in such variables as earnings surprise, analyst coverage, analyst track record and earnings volatility.

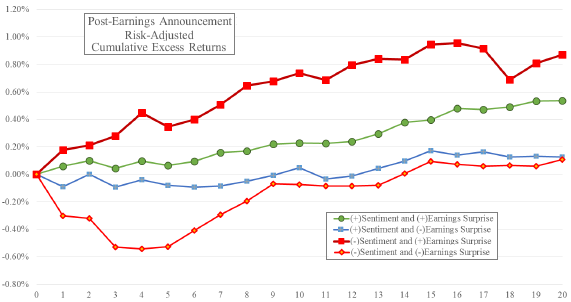

- Combining pre-announcement iSentium tweet sentiments with Estimize-based earnings surprises identifies stocks that are likely to do especially well (negative sentiment and positive earnings surprise) and especially poorly (negative sentiment and negative earnings surprise) during the days after earnings announcements. (See the chart below.)

The following chart, taken from the paper, compares average gross cumulative three-factor (market, size, book-to-market) alphas during the 20 trading days after earnings announcement for four sets of stocks sorted based on pre-announcement Estimize earnings estimate and iSentium tweet sentiment:

- Positive sentiment and positive earnings surprise.

- Positive sentiment and negative earnings surprise.

- Negative sentiment and positive earnings surprise.

- Negative sentiment and negative earnings surprise.

Day 0 is the earnings announcement date. Group 3 has the largest terminal gain (0.87%) and the strongest performance at all intra-month horizons. Group 4 has the weakest performance at all intra-month horizons and is particularly weak three to five trading days after the announcement date.

In summary, evidence suggests that crowdsourced earnings estimates and tweet sentiment predict gross post-earnings announcement stock performance.

Cautions regarding findings include:

- As noted in the paper, performance statistics are gross, not net. Accounting for trading frictions, shorting costs and costs of information/processing would reduce these returns.

- Testing multiple strategies on the same sample introduces data snooping bias, such that the best (worst) strategy tends to overstate (understate) expectations.

- Since earnings announcements tend to cluster, trading opportunities are likely also to cluster, such that: (1) capital constraints may at times limit exploitability; and, (2) there may be extended intervals of no opportunities.

- The sample period is very short in terms of variety of economic/market conditions.

- More extreme thresholds for earnings surprises and sentiment may produce stronger results.