Does combining the wisdom of multiple stock-picking models via ensemble methods, as done in forecasting landfall of hurricanes, improve investment portfolio performance? In their September 2018 paper entitled “Ensemble Active Management”, Alexey Panchekha, Robert Tull and Matthew Bell test the application of ensemble methods to active portfolio management, looking for consensus or near-consensus among multiple, independent stock picking sources. Ensemble diversification tends to neutralize biases among individual sources when: (1) sources are independent; (2) sources employ different approaches; and, (3) most sources achieve at least 50% individual accuracies. As sources, they use the holdings and weights of 37 actively managed U.S. equity large-capitalization mutual funds, focusing on high-conviction stock selections (those with large mismatches with respect to market capitalization). Specifically, every two weeks they:

- Reform 30,000 randomly generated clusters of 10 mutual funds.

- For each cluster, reform a long-only Ensemble Active Management (EAM) portfolio consisting of the 50 stocks with the highest consensus overweights within the cluster.

- Calculate total returns for EAM portfolios, their respective clusters and the S&P 500 Index.

They debit performance of each EAM portfolio by the average contemporaneous expense ratio of the 37 mutual funds (average 0.94% across all years). To aggregate results, they calculate rolling 1-year and 3-year performances of EAM portfolios, mutual fund clusters and the index. Using daily estimated stock holdings and weights for the 37 mutual funds and associated stock prices as available during July 2007 through December 2017, they find that:

- Based on Morningstar averages for nine actively managed U.S. equity mutual fund categories (small-medium-large times value-blend-growth) during January 2008 through December 2017:

- For 1-year rolling returns, active managers beat the corresponding average index fund no more than 39% of the time (small value) .

- For 3-year rolling returns, large-capitalization funds (across value, blend and growth) beat the corresponding average index fund only 0.4% of the time.

- For 1-year (3-year) rolling returns, EAM portfolios:

- Beat the S&P 500 Index 72% (94%) of the time by an average annualized 3.4% (3.6%).

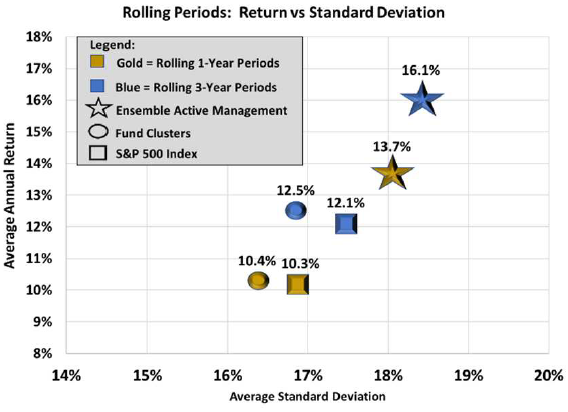

- Generate annualized Sharpe ratio 1.04 (1.07), compared to 0.89 (0.88) for the S&P 500 Index. (See the chart below.)

- Any time the S&P 500 Index has a 1-year drawdown of at least -20% (a 3-year loss), the average contemporaneous EAM portfolio beats the index.

The following chart, taken from the paper, summarizes return-risk relationships for the average EAM portfolio, the average mutual fund cluster and the S&P 500 Index based on both 1-year and 3-year rolling returns over the sample period. Aggregated EAM portfolios increase both return and risk versus the S&P 500 Index, but the former more than the latter.

In summary, evidence indicates that investors may be able to exploit consensus or near-consensus conviction stock picks among actively managed U.S. equity mutual funds.

Cautions regarding findings include:

- The study does not account for biweekly EAM portfolio reformation trading frictions. These frictions likely reduce EAM portfolio outperformance materially, making comparisons with net mutual fund performance commensurately unfair.

- As noted in the paper, daily mutual fund holdings-weights are estimated, not actual. Results may be sensitive to the estimation method.

- As noted in the paper, source mutual funds have histories of different lengths, such that 10,000 fund clusters start July 2007, 10,000 start April 2012 and 10,000 start April 2014.

- The methodology is beyond the reach of most investors, who may bear costs/fees for data collection/processing and trade execution greater than those assumed for EAM portfolios.

For more on mutual fund conviction stock picks, see “Best Ideas of Mutual Fund Managers”.