Are prominent stock market bloggers in aggregate able to predict the market’s direction? The Ticker Sense Blogger Sentiment Poll “is a survey of the web’s most prominent investment bloggers, asking ‘What is your outlook on the U.S. stock market for the next 30 days?'” (bullish, bearish or neutral) on a weekly basis. The site currently lists 29 participating bloggers. Participation has varied over time. Because Ticker Sense collects data weekly, we look at weekly measurements and changes in weekly measurements. Because the poll question asks for a 30-day outlook, we test the forecasts against stock market behavior four weeks into the future. Because polling generally takes place Thursday-Sunday, we use coincident Friday stock market close to represent the state of the stock market for each poll. We use [% Bullish] minus [% Bearish] as the net sentiment statistic for each poll. Using poll results from inception in July 2006 through May 2016 (496 polls) and contemporaneous weekly closes of the S&P 500 Index as representative of the broad stock market, we find that:

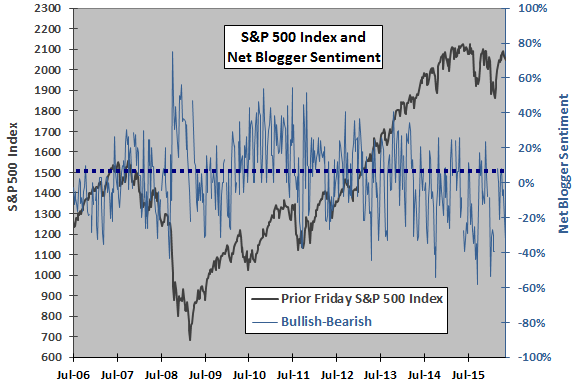

The following chart compares coincident S&P 500 Index level and net blogger sentiment over the available sample period (there are no surveys for 19 weeks during the sample period). On these visually comparable scales, blogger sentiment is generally more volatile than the stock market, suggesting either that the bloggers are very sensitive to changes in market conditions, or that participation in polling varies considerably across weeks. The average net blogger sentiment over the sample period is +3% (38.6% bullish, 35.3% bearish and 26.0% neutral).

For a more precise test of the relationship, we relate blogger sentiment statistics to both past and future stock market returns.

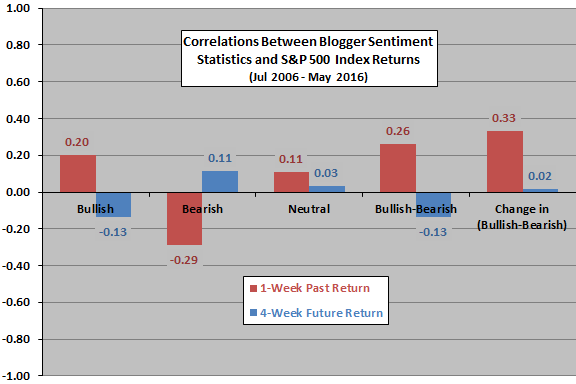

The following chart summarizes correlations between each of five blogger sentiment statistics and either 1-week past or 4-week future S&P 500 Index return over the available sample period. Results indicate that:

- Bullish and bearish respondents react to past 1-week return bullishly (bearishly) if the return is relatively high (low). The strongest effects are on weekly net bullishness and change in net bullishness.

- Bullish and bearish respondents tend to lean the wrong way with respect to future 4-week return.

- Neutral respondents are less affected by past 1-week return and tend not to lean the wrong way (or the right way) with respect to future 4-week return.

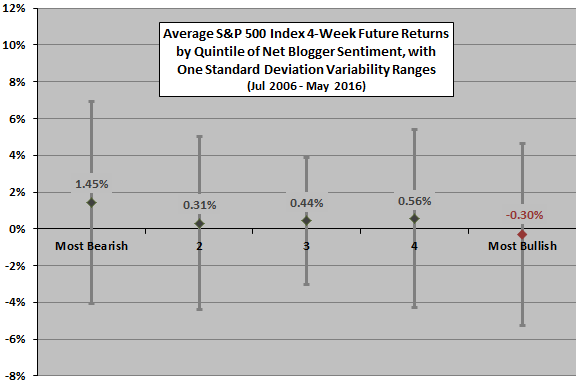

For a different perspective and a test of non-linearity, we look at future returns by range of net blogger sentiment.

The next chart shows average 4-week future S&P 500 Index return by ranked fifth (quintile) of net blogger sentiment over the entire sample period. Each quintile has 99 observations. Results generally confirm a negative correlation between the variables, but the decline across quintiles is not systematic. Extreme sentiment readings (tail effects) drive the relationship.

Do the participating bloggers learn and improve over time?

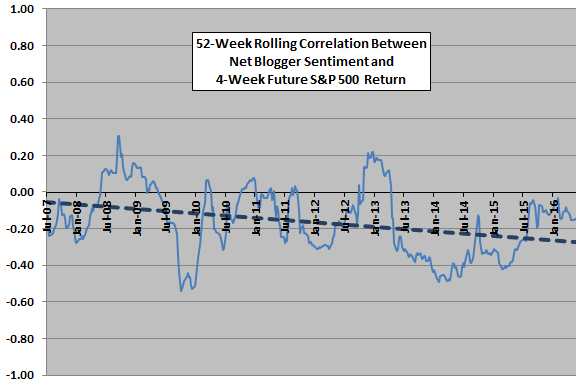

The final chart tracks past 52-week rolling correlation between net blogger sentiment and 4-week future S&P 500 Index return over the available sample period. The darker dashed line is the best-fit linear trend line for the rolling correlation series.

If the bloggers as a group lean with (against) future return, the correlation is positive (negative). The average correlation is -0.16, and the correlation is negative 78% of the time.

If the bloggers as a group learn and improve over time (assuming stable group membership), the correlation should trend up. However, the trend line slopes down, indicating that forecast performance worsens over time.

In summary, analysis of Ticker Sense Blogger Sentiment Poll results indicates that aggregate blogger sentiment, like many sentiment indicators, is somewhat contrarian with respect to future stock market behavior.

Cautions regarding findings include:

- As noted, blogger participation in polling likely varies over time. Some types of forecasters may participate more persistently than others.

- The number of independent 4-week future returns per quintile of net blogger sentiment and the number of independent 52-week correlations are not large, limiting confidence in results.