Is producing real estate (farmland, timberland, energy delivery infrastructure and commercial properties) a good investment? In his May 2013 paper entitled “The Performance of Direct Investments in Real Assets: Natural Resources, Infrastructure and Commercial Real Estate”, Martijn Cremers investigates the performance of direct investments in natural resources (farmland and timberland), energy infrastructure Master Limited Partnerships (MLP) and commercial real estate. He considers return, risk‐return trade‐off, downside risk, diversification benefits relative to U.S. stocks and U.S. Treasury bonds, exposure to stock market shocks and inflation hedging power. Data for natural resources and commercial real estate investments are voluntarily reported by members (mostly pension funds) of a U.S. trade association. These data include property management fees. Data for energy infrastructure investments are based on the Alerian MLP Infrastructure Index, reflecting the performance of 25 publicly traded MLPs. Using quarterly and annual investment performance data during 1978 through 2012 for real estate and monthly data during 1996 through 2012 for energy infrastructure, he finds that:

- During 1996 through 2012:

- Gross annualized returns for farmland, timberland, commercial real estate and energy infrastructure MLPs are 12.1%, 7.4%, 10.2% and 20.2%, respectively, compare to 8.6% for the S&P 500 Index and 8.3% for 20-year bonds.

- Gross annual Sharpe ratios for farmland, timberland, commercial real estate and energy infrastructure MLPs are 0.98, 1.55, 0.97 and 0.70, respectively, compare to 0.45 for the S&P 500 Index and 0.75 for 20-year bonds.

- Maximum peak-to-trough drawdowns for farmland, timberland, commercial real estate and energy infrastructure MLPs are 0.0%, -5.9%, -26.8% and -43%, respectively, compare to -44.9% for the S&P 500 Index and -14.0% for 20-year bonds.

- Regarding diversification benefits:

- Based on gross quarterly or annual returns during 1996 through 2012, real properties generally exhibit low correlations with stocks and bonds. The highest correlation for quarterly returns is stocks-MLPs (0.36) and for annual returns is stocks-commercial real estate (0.58). The categories of real properties are also mutually diversifying, except for farmland and timberland.

- During 1978 through 2012, adding real properties to stock-bond portfolios substantially lowers volatilities but does not affect average returns. Diversification benefits are strongest for farmland and energy infrastructure.

- However, the diversification benefits of farmland and timberland (but not energy infrastructure) are lower when stocks are weak.

- Among real property categories, only timberland effectively hedges inflation during the sample period.

- Investing in real property generally involves long holding periods and high frictions, including research costs and transaction fees.

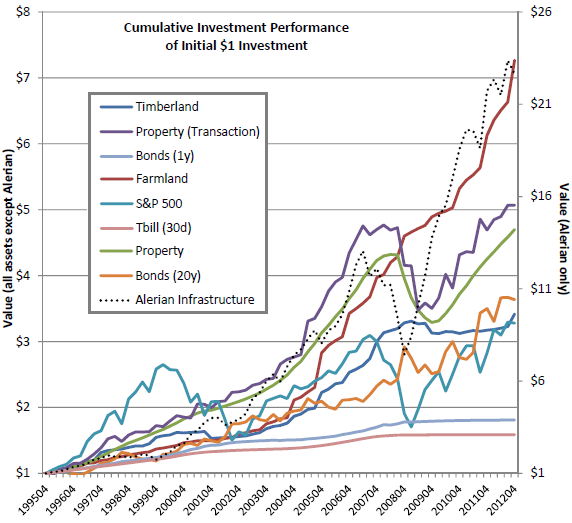

The following chart, taken from the paper, compares cumulative values of $1 initial investments during 1996 through 2012 in:

- Timberland

- Commercial real estate based on transactions [Property (Transaction)]

- 1-year U.S. Treasury notes [Bonds (1y)]

- Farmland

- S&P 500 Index [S&P 500]

- 30-day U.S. Treasury bills [Tbill (30d)]

- Commercial real estate based on appraisals [Property]

- 20-year U.S. Treasury bonds [Bonds (20y)]

- Alerian MLP Infrastructure Index [Alerian Infrastructure]

The left vertical axis applies to all investments except Alerian Infrastructure, which uses the right vertical axis. Terminal values range from $1.59 for the 30‐ day U.S. Treasury bills to $22.64 for the Alerian MLP Infrastructure Index. The figure illustrates the downside risks for the various asset classes since 1996, especially the significant losses for some classes in 2008.

In summary, evidence suggests that investments in producing real estate performed well over the past 17 years and that such investments offer substantial diversification benefits to a traditional stocks-bonds portfolio.

Cautions regarding findings include:

- The sample period is not long in terms of number of real estate boom-bust cycles.

- As noted in the paper, reported returns are gross of search costs and transaction fees, which would materially lower the performance of farmland, timberland and commercial real estate. Such frictions would likely be higher percentage-wise for small investors (if investment is feasible at all).

- As noted in the paper, many MLPs are illiquid.