When and why do investors make changes in asset class allocations? In the March 2015 version of their paper entitled “Global Asset Allocation Shifts”, Tim Kroencke, Maik Schmeling and Andreas Schrimpf examine the asset reallocation decisions of U.S. mutual fund investors. They focus on shifts between U.S. equities and U.S. bonds (rotation) and between U.S. assets and non-U.S. assets (diversification). Specifically, they address: (1) principal factors explaining reallocations; (2) the link between monetary policy announcements and allocation shifts; and, (3) the search for bond yield and asset returns as drivers of allocation shifts. Using detailed U.S. mutual fund data on investor allocations to U.S. equities, non-U.S. equities and fixed income (comprising a total of about $6.6 trillion in assets) during January 2006 through December 2014, they find that:

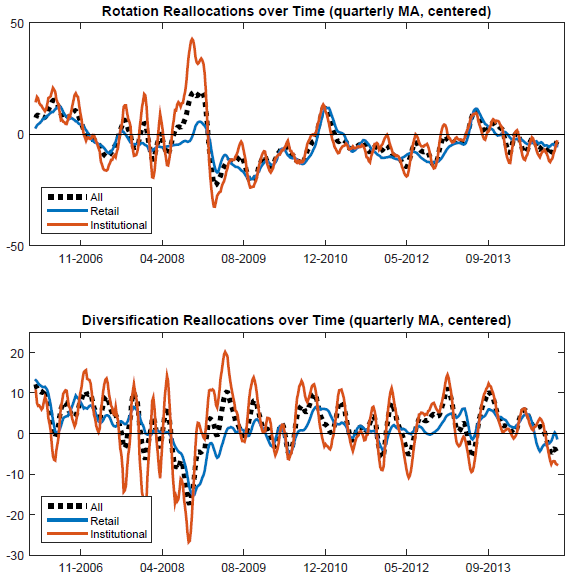

- Two factors explain more than 90% of variation in asset allocations (see the chart below).

- One factor relates to rotation between U.S. equities and U.S. bonds, accounting for 80% of variation in asset allocations.

- A second factor relates to shifts between U.S. equities and bonds and non-U.S. equities and bonds (degree of global diversification).

- Institutional investors tend to shift from all other asset classes to U.S. equities during the week before and week of Federal Reserve Open Market Committee meetings (regardless of action taken). On average, these two weeks see a 0.22% shift in allocations from U.S. bonds to U.S. equities and a 0.18% shift in allocations from non-U.S. assets to U.S. equities.

- Investors (mostly institutional) respond to U.S. monetary easing by shifting from U.S. to non-U.S. assets, consistent with the view that they are searching for higher returns abroad (especially high yield and emerging markets).

- Investors (mostly institutional) respond to a flattening of the U.S. yield curve (term premium compression) by shifting out of equities and into U.S. bonds.

- Macroeconomic news surprises have little effect on allocations.

- Investors tend to retrench from all other assets towards U.S. bonds in times of uncertainty and risk aversion (rising VIX and credit spreads).

- Both institutional and retail investors tend to chase yields and returns.

The following charts, taken from the paper, track 13-week moving averages of U.S. mutual fund investor asset reallocations during 2006 through 2014. The upper chart tracks reallocations from U.S. bonds to U.S. equities (Rotation), corresponding to the dominant explanatory factor. The lower chart tracks reallocations from U.S. assets to non-U.S. assets (Diversification), corresponding to the second explanatory factor. In both graphs, data are calibrated to an overall average of zero. Institutional investors tend to reallocate more aggressively than retail investors. Retrenchment toward U.S. assets, particularly U.S. bonds, is anomalously strong during mid-2008.

In summary, evidence indicates that the asset class reallocation decisions of U.S. mutual fund investors are in recent years sensitive to U.S. monetary policy/actions and are yield/return chasing.

Cautions regarding findings include:

- The authors do not investigate any price impacts of reallocations.

- Nor do they explore any strategies to exploit reallocations to the degree they are predictable.